Chapter 14 - ORU Accounting

advertisement

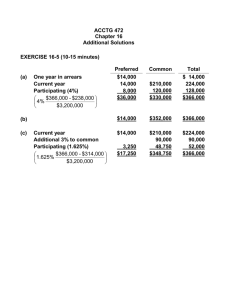

ANSWERS TO QUESTIONS 1. (a) A dividend is a distribution of cash or stock by a corporation to its stockholders on a pro rata (proportional) basis. (b) Disagree. Dividends may take four forms: cash, property, scrip (promissory note to pay cash), or stock. 2. Sue DeVine is not correct. Adequate cash is only one of the conditions. In order for a cash dividend to occur, a corporation must also have retained earnings and the dividend must be declared by the board of directors. 3. (a) The three dates are: Declaration date is the date when the board of directors formally declares the cash dividend and announces it to stockholders. The declaration commits the corporation to a binding legal obligation that cannot be rescinded. Record date is the date that marks the time when ownership of the outstanding shares is determined from the stockholder records maintained by the corporation. The purpose of this date is to identify the persons or entities that will receive the dividend. Payment date is the date on which the dividend checks are mailed to the stockholders. (b) The accounting entries and their dates are: Declaration date—Debit Cash Dividends and Credit Dividends Payable. No entry is made on the record date. Payment date—Debit Dividends Payable and Credit Cash. 4. The allocation of the cash dividend is as follows: Total dividend............................................................................................... Allocated to preferred stock Dividends in arrears—one year....................................................... Current year dividend ........................................................................ Remainder allocated to common stock................................................... $45,000 $10,000 10,000 20,000 $25,000 5. A cash dividend decreases assets, retained earnings, and total stockholders’ equity. A stock dividend decreases retained earnings, increases paid-in capital, and has no effect on total assets and total stockholders’ equity. 6. A corporation generally issues stock dividends for one of the following reasons: (a) To satisfy stockholders’ dividend expectations without spending cash. (b) To increase the marketability of its stock by increasing the number of shares outstanding and thereby decreasing the market price per share. Decreasing the market price of the stock makes the shares easier to purchase for smaller investors. (c) To emphasize that a portion of stockholders’ equity that had been reported as retained earnings has been permanently reinvested in the business and therefore is unavailable for cash dividends. 7. In a stock split, the number of shares is increased in the same proportion that par value is decreased. Thus, in the Meenen Corporation the number of shares will increase to 60,000 = (30,000 X 2) and the par value will decrease to $5 = ($10 ÷ 2). The effect of a split on market value is generally inversely proportional to the size of the split. In this case, the market price would fall to approximately $60 per share ($120 ÷ 2). 14-6 Copyright © 2011 John Wiley & Sons, Inc. Weygandt, Accounting Principles, 10/e, Solutions Manual (For Instructor Use Only) Questions Chapter 14 (Continued) 8. The different effects of a stock split versus a stock dividend are: Item Total paid-in capital Total retained earnings Total par value (common stock) Par value per share Stock Split No change No change No change Decrease Stock Dividend Increase Decrease Increase No Change 9. A prior period adjustment is a correction of an error in previously issued financial statements. The correction is reported in the current year’s retained earnings statement as an adjustment of the beginning balance of retained earnings. 10. The understatement of depreciation in a prior year overstates the beginning retained earnings balance. The retained earnings statement presentation is: Balance, January 1, as reported................................................................................... Correction for understatement of prior year’s depreciation ..................................... Balance, January 1, as adjusted................................................................................... $210,000 (50,000) $160,000 11. The purpose of a retained earnings restriction is to indicate that a portion of retained earnings is currently unavailable for dividends. Restrictions may result from the following causes: legal, contractual, or voluntary. 12. Retained earnings restrictions are generally disclosed in the notes to the financial statements. 13. The debits and credits to retained earnings are: Debits 1. 2. 3. 4. Credits Net loss Prior period adjustments for overstatement of net income Cash and stock dividends Some disposals of treasury stock 1. Net income 2. Prior period adjustments for understatement of net income 14. Juan is incorrect. Only the ending balance of retained earnings is reported in the stockholders’ equity section. 15. Gene should be told that although many factors affect the market price of a stock at a given time, the reported net income is one of the most significant factors. When companies announce increases or decreases in net income, the market price of their stock usually increases or decreases immediately. Net income also provides an indication of the amount of dividends that a company can distribute. In addition, net income leads to a growth in retained earnings, which is often reflected in a stock’s market price. Copyright © 2011 John Wiley & Sons, Inc. Weygandt, Accounting Principles, 10/e, Solutions Manual (For Instructor Use Only) 14-7 Questions Chapter 14 (Continued) 16. The unique feature of a corporation income statement is a separate section that shows income taxes or income tax expense. The presentation is as follows: Income before income taxes.................................................................................................. Income tax expense................................................................................................................. Net income................................................................................................................................. $500,000 150,000 $350,000 17. Earnings per share means earnings per share of common stock. Preferred stock dividends are subtracted from net income in computing EPS in order to obtain income available to common stockholders. 18. PepsiCo declared the following dividends per share amounts in 2005 to 2009: $1.01, $1.16, $1.425, $1.65, and $1.775. PepsiCo’s dividends per share is somewhat consistent with its net income trend during this 5 year period. 14-8 Copyright © 2011 John Wiley & Sons, Inc. Weygandt, Accounting Principles, 10/e, Solutions Manual (For Instructor Use Only)