Modern Auditing:

advertisement

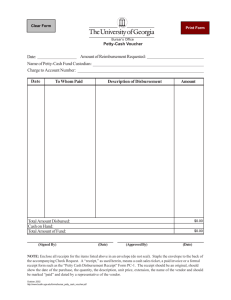

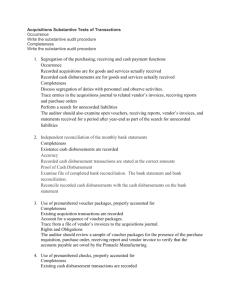

Modern Auditing: Assurance Services and the Integrity of Financial Reporting, 8th Edition William C. Boynton California Polytechnic State University at San Luis Obispo Raymond N. Johnson Portland State University Chapter 15 – Auditing the Expenditure Cycle Chapter Overview The Expenditure Cycle Develop Audit Objectives Understanding the Entity and Environment Inherent Risk, Including the Risk of Fraud • Management Misstatement of Expenditures – Understate expenses – Understate payables • Other Misstatement Factors – – – – High volume of transactions Unauthorized purchases Misappropriation Duplication of payments Analytical Procedures Consideration of Internal Control Components • Control Environment • Risk Assessment • Information and Communication • Monitoring Purchase Transactions – Documents and Records • Purchase requisition • Purchase order • Approved vendor master file • Open purchase order file • Receiving report • Receiving file • Vendor Invoice Purchase Transactions – Common Documents and Records • Voucher • Exception reports • Voucher summary • Voucher register • Purchase transactions file • Accounts payable master file • Suspense files Purchase Transactions – Functions and Control Activities • Initiating Purchases – Placing vendors on an authorized vendor list – Requisitioning goods and services – Preparing purchase orders • Receipt of Goods and Services – Receiving the goods – Storing goods received for inventory – Returning goods to vendor • Recording Liabilities Systems Flowchart – Purchase Transaction Systems Flowchart – Purchase Transaction Systems Flowchart – Purchase Transaction Cash Disbursement Transactions– Common Documents and Records • Check • Check Summary • Cash Disbursements Transaction File • Cash Disbursements Journal or Check Register Cash Disbursement TransactionsFunction and Control Activities • Computerized System – Paying the Liability – Recording the Disbursement • Manual System – Paying the Liability – Recording the Disbursement Systems Flowchart – Cash Disbursement Transactions Purchase Adjustment Transactions– Common Documents and Records • Purchase Return Authorization • Shipping Report • Debit Memo Purchase Adjustment Function and Controls • Purchase Returns and Allowances • Other Controls • Tests of Controls Substantive Tests of Accounts Payable Balances • Determining Detection Risk for Tests of Details – Existence and Occurrence – Completeness – Rights and Obligations – Valuation and Allocation – Presentation and Disclosure Designing Substantive Tests • Initial Procedures • Analytical Procedures Designing Substantive Tests • Tests of Details of Transactions – Vouch Recorded Payables to Supporting Documentation – Perform Cutoff Tests • Purchases cutoff tests • Cash disbursement cutoff tests • Purchase return cutoff tests – Perform Search for Unrecorded Payables • Subsequent payments Designing Substantive Tests • Tests of Details of Balances – Accounts Payable Confirmations – Reconcile Unconfirmed Payables to Vendor Statements • Tests of Details of Disclosures