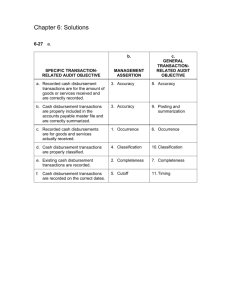

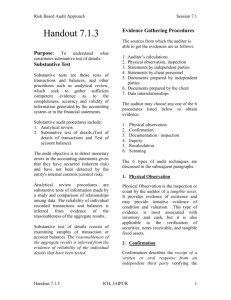

Acquisitions Substantive Tests of Transactions

advertisement

Acquisitions Substantive Tests of Transactions Occurrence Write the substantive audit procedure Completeness Write the substantive audit procedure 1. Segregation of the purchasing, receiving and cash payment functions Occurrence Recorded acquisitions are for goods and services actually received Recorded cash disbursements are for goods and services actually received Completeness Discuss segregation of duties with personnel and observe activities. Trace entries in the acquisitions journal to related vendor’s invoices, receiving reports and purchase orders Perform a search for unrecorded liabilities The auditor should also examine open vouchers, receiving reports, vendor’s invoices, and statements received for a period after year-end as part of the search for unrecorded liabilities 2. Independent reconciliation of the monthly bank statements Completeness Existence cash disbursements are recorded Accuracy Recorded cash disbursement transactions are stated at the correct amounts Proof of Cash Disbursement Examine file of completed bank reconciliation. The bank statement and bank reconciliation. Reconcile recorded cash disbursements with the cash disbursements on the bank statement 3. Use of prenumbered voucher packages, properly accounted for Completeness Existing acquisition transactions are recorded Account for a sequence of voucher packages. Trace from a file of vendor’s invoices to the acquisitions journal. Rights and Obligations The auditor should review a sample of voucher packages for the presence of the purchase requisition, purchase order, receiving report and vendor invoice to verify that the accounts payable are owed by the Pinnacle Manufacturing. 4. Use of prenumbered checks, properly accounted for Completeness Existing cash disbursement transactions are recorded Proof of Cash Disbursement Account for chronological sequence of checks. Reconcile recorded cash disbursement with the cash disbursements on the bank statement 5. Use of prenumbered receiving reports, properly accounted for Completeness Existing acquisition transactions are recorded Account for a sequence of receiving reports. Trace from a file of receiving reports to the acquisitions journal. 6. Internal verification of document package before check preparation Valuation, Allocation and Accuracy The auditor should perform the following procedures: (1) Obtain the accounts payable listing, foot the listing, and agree the listing to the general ledger. (2) Obtain a sample of vendor statements and agree the amounts to the vendor accounts. (3) Review the results of accounts payable confirmations Existence and Occurrence (1) Accounts Payable Confirmations (not required) Accounts payable confirmations are not required because good external evidence to support accounts payable may be sent when internal control is weak, when there are disputed amounts, or when monthly vendor statements are not available. Typically, vendors with small or zero balances would be selected for confirmation. 7. Review of supporting documents and signing of checks by an independent, authorized person The following substantive tests may also be performed as tests of controls or dualpurpose tests. a. Completeness The auditor should trace a sample of vouchers to the purchase journal b. Cut-off The auditor should compare dates on a sample of vouchers with the dates the transactions were recorded in the purchase journal. The auditor should also examine purchases before and after year-end to determine if they were recorded in the proper period. c. Valuation, Allocation and Accuracy The auditor should recomputed the mathematical accuracy of a sample of vendor invoices. d. Existence and Occurrence The auditor should test a sample of vouchers for authorization and the presence of the receiving report. e. Understandability and Classification The auditor should verify the account classification of a sample of purchases. 8. Cancellation of documents prior to signing of the check Substantive Procedures Related to the Expenditure cycle a. Completeness The receiving report and vendor’s invoice should be stamped as “Paid” as a way of canceling the document so that the voucher package will not be presented again for payment. This procedure will prevent double payment of an invoice. 9. Monthly reconciliation of the accounts payable master file with the general ledger Completeness, Valuation and Allocation, Existence The primary audit procedures performed to test the existence, completeness and valuation of the ending cash balance are the bank confirmation and the audit of the year-end bank reconciliation.