MBAP 6061а‐аManagerial Finance Exam 1 Thursday, September

advertisement

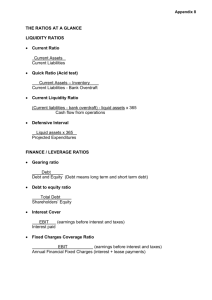

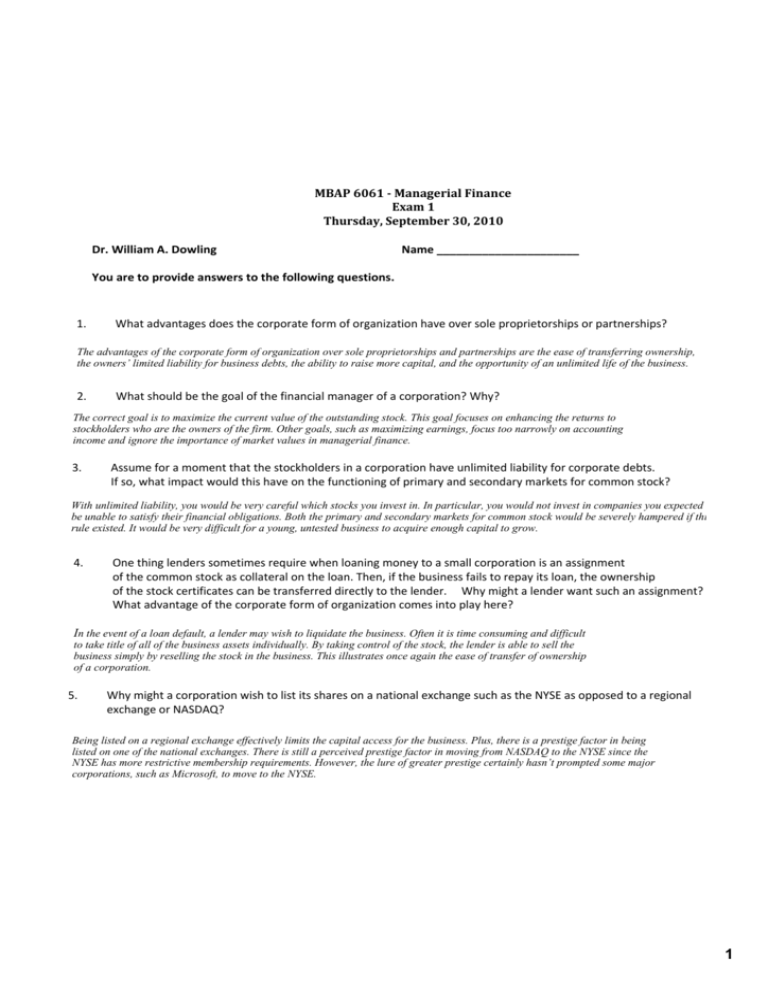

MBAP 6061 ‐ Managerial Finance Exam 1 Thursday, September 30, 2010 Dr. William A. Dowling Name ______________________ You are to provide answers to the following questions. 1. What advantages does the corporate form of organization have over sole proprietorships or partnerships? The advantages of the corporate form of organization over sole proprietorships and partnerships are the ease of transferring ownership, the owners’ limited liability for business debts, the ability to raise more capital, and the opportunity of an unlimited life of the business. 2. What should be the goal of the financial manager of a corporation? Why? The correct goal is to maximize the current value of the outstanding stock. This goal focuses on enhancing the returns to stockholders who are the owners of the firm. Other goals, such as maximizing earnings, focus too narrowly on accounting income and ignore the importance of market values in managerial finance. 3. Assume for a moment that the stockholders in a corporation have unlimited liability for corporate debts. If so, what impact would this have on the functioning of primary and secondary markets for common stock? With unlimited liability, you would be very careful which stocks you invest in. In particular, you would not invest in companies you expected to be unable to satisfy their financial obligations. Both the primary and secondary markets for common stock would be severely hampered if this rule existed. It would be very difficult for a young, untested business to acquire enough capital to grow. 4. One thing lenders sometimes require when loaning money to a small corporation is an assignment of the common stock as collateral on the loan. Then, if the business fails to repay its loan, the ownership of the stock certificates can be transferred directly to the lender. Why might a lender want such an assignment? What advantage of the corporate form of organization comes into play here? In the event of a loan default, a lender may wish to liquidate the business. Often it is time consuming and difficult to take title of all of the business assets individually. By taking control of the stock, the lender is able to sell the business simply by reselling the stock in the business. This illustrates once again the ease of transfer of ownership of a corporation. 5. Why might a corporation wish to list its shares on a national exchange such as the NYSE as opposed to a regional exchange or NASDAQ? Being listed on a regional exchange effectively limits the capital access for the business. Plus, there is a prestige factor in being listed on one of the national exchanges. There is still a perceived prestige factor in moving from NASDAQ to the NYSE since the NYSE has more restrictive membership requirements. However, the lure of greater prestige certainly hasn’t prompted some major corporations, such as Microsoft, to move to the NYSE. 1 Given the tax rates as shown, what is the average tax rate for a firm with taxable income of $126,500? 6. Taxable Income Tax Rate $0 ­ 50,000 15% 50,001 ­ 75,000 25% 75,001 ­ 100,000 34% 100,001 ­ 335,000 39% Tax = .15($50,000) + .25($25,000) + .34($25,000) +.39($126,500 ­ $100,000) = $32,585; Average tax rate = $32,585 ÷ $126,500 = .2576 = 25.76% 7. Your firm has net income of $198 on total sales of $1,200. Costs are $715 and depreciation is $145. The tax rate is 34%. The firm does not have interest expenses. What is the operating cash flow? Earnings before interest and taxes = $1,200 ­ $715 ­ $145 = $340; Tax = [$198 ÷ (1 ­.34)] ­ $198 = $102; Operating cash flow = $340 + $145 ­ $102 = $383 2 8. Teddy’s Pillows has beginning net fixed assets of $480 and ending net fixed assets of $530. Assets valued at $300 were sold during the year. Depreciation was $40. What is the amount of capital spending Net capital spending = Ending NFA ($530) ­ Beginning NFA ($480) + Depreciation ($40) = $90 9. At the beginning of the year, long‐term debt of a firm is $280 and total debt is $340. At the end of the year, long‐term debt is $260 and total debt is $350. The interest paid is $30. What is the amount of the cash flow to creditors? Cash flow to creditors = Interest ($30) ­ (Ending LTD ­ Beginning LTD ($260 ­ $280)) = $50 10. Thompson’s Jet Skis has operating cash flow of $218. Depreciation is $45 and interest paid is $35. A net total of $69 was paid on long‐term debt. The firm spent $180 on fixed assets and increased net working capital by $38. What is the amount of the cash flow to stockholders? Cash flow of the firm = [OCF ­ Change in NWC ­ Change in NFA] $218 ­ $38 ­ $180 = $0 Cash flow to creditors = [Interest ­ (­payment on LTD)] $35 ­ (­$69) = $104 Cash flow to stockholders = [Cash flow of the firm ­ Cash flow to creditors] $0 ­ $104 = ­$104 3 The following information should be used for problems #11 ‐ 17: Nabors, Inc. 2006 Income Statement ($ in millions) Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid Taxable Income Less: Taxes Net income $9,610 6,310 1,370 1,930 630 $1,300 455 $ 845 Nabors, Inc. 2005 and 2006 Balance Sheets ($ in millions) Cash Accounts rec. Inventory Total Net fixed assets Retained earnings Total assets 11. 2005 2006 $ 310 $ 405 2,640 3,055 3,275 3,850 $ 6,225 $ 7,310 10,960 10,670 1,490 2,060 $17,185 $17,980 Accounts payable Notes payable Total Long‐term debt Common stock 2005 2006 $ 2,720 $ 2,570 100 0 $ 2,820 $ 2,570 7,875 8,100 5,000 5,250 Total liab.& equity $17,185 $17,980 What is the change in the net working capital from 2005 to 2006? Change in net working capital = ($7,310 ­ $2,570) ­ ($6,225 ­ $2,820) = $1,335 12. What is the amount of the non‐cash expenses for 2006? The non­cash expense is depreciation in the amount of $1,370 13. What is the amount of the net capital spending for 2006? Net capital spending = $10,670 ­ $10,960 + $1,370 = $1,080 14. What is the operating cash flow for 2006? Operating cash flow = $1,930 + $1,370 ­ $455 = $2,845 15. What is the cash flow of the firm for 2006? Operating cash flow = $1,930 + $1,370 ­ $455 = $2,845 Change in net working capital = ($7,310 ­ $2,570) ­ ($6,225 ­ $2,820) = $1,335 Net capital spending = $10,670 ­ $10,960 + $1,370 = $1,080 Cash flow of the firm = $2,845 ­ $1,335 ­ $1,080 = $430 16. What is the amount of net new borrowing for 2006? Net new borrowing = $8,100 ­ $7,875 = $225 17. What is the cash flow to creditors for 2006? Cash flow to creditors = $630 ­ ($8,100 ­ $7,875) = $405 4 The following information should be used for problems #18 ‐ 25: Knickerdoodles, Inc. 2005 $ 740 Sales 430 COGS 33 Interest 16 Dividends 250 Depreciation 70 Cash Accounts receivables 563 390 Current liabilities 662 Inventory 340 Long‐term debt 1,680 Net fixed assets 700 Common stock 35% Tax rate 18. 2006 $ 785 460 35 17 210 75 502 405 640 410 1,413 235 35% What is the net working capital for 2006? Net working capital = $75 + $502 + $640 ­ $405 = $812 19. What is the change in net working capital from 2005 to 2006? Change in net working capital = ($75 + $502 + $640 ­ $405) ­ ($70 + $563 +$662 ­ $390) = ­$93 20. What is net capital spending for 2006? Net capital spending = $1,413 ­ $1,680 + $210 = ­$57 21. What is the operating cash flow for 2006? Earnings before interest and taxes = $785 ­ $460 ­ $210 = $115 Taxable income = $115 ­ $35 = $80 Taxes = .35($80) = $28 Operating cash flow = $115 + $210 ­ $28 = $297 22. What is the cash flow of the firm for 2006? Cash flow of the firm = $297 ­ (­$93) ­ (­$57) = $447 23. What is net new borrowing for 2006? Net new borrowing = $410 ­ $340 = $70 24. What is the cash flow to creditors for 2006? Cash flow to creditors = $35 ­ ($410 ­ $340) = ­$35 25. What is the cash flow to stockholders for 2006? Cash flow to stockholders = $447 ­ (­$35) = $482 Cash flow to stockholders = $17 ­ ($235 ­ $700) = $482 5 The following information should be used for problems #26 ‐ 28: Cost of goods sold Interest Dividends Depreciation Change in retained earnings Tax rate 26. 2006 $3,210 $215 $160 $375 $360 35% What is the taxable income for 2006? Net income = $160 + $360 = $520 Taxable income = $520 ÷ (1 ­ .35) = $800 27. What is the operating cash flow for 2006? Earnings before interest and taxes = $800 + $215 = $1,015 Operating cash flow = $1,015 + $375 ­ ($800 ­ $520) = $1,110 28. What are the sales for 2006? Sales = $1,015 + $375 + $3,210 = $4,600 29. Explain why the income statement is not a good representation of cash flow. The income statement attributes sales to the period in which they occured which is not necessarily the period in which the revenues from the sales was received. 30. Jessica’s Boutique has cash of $50, accounts receivable of $60, accounts payable of $200, and inventory of $150. What is the value of the quick ratio? Quick ratio = ($50 + $60) ÷ $200 = .55 31. A firm has sales of $3,600, costs of $2,800, interest paid of $100, and depreciation of $400. The tax rate is 34%. What is the value of the cash coverage ratio? Cash coverage ratio = ($3,600 ­ $2,800) ÷ $100 = 8 32. Syed’s Industries has accounts receivable of $700, inventory of $1,200, sales of $4,200, and cost of goods sold of $3,400. How long does it take Syed’s to both sell its inventory and then collect the payment on the sale? Inventory turnover = $3,400 ÷ $1,200 = 2.83 Days in inventory = 365 ÷ 2.83 = 128.98 Accounts receivable turnover = $4,200 ÷ $700 = 6 Days’ sales in receivables = 365 ÷ 6 = 60.83 Total days in inventory and receivables = 128.98 + 60.83 = 189.81 days = 190 days (rounded) 33. Lee Sun’s has sales of $3,000, total assets of $2,500, and a profit margin of 5%. The firm has a total debt ratio of 40%. What is the return on equity? Return on equity = (.05 × $3,000) ÷ [$2,500 × (1 ­ .40)] = $150 ÷ $1,500 = .10 = 10% 34. Patti’s has net income of $1,800, a price‐earnings ratio of 12, and earnings per share of $1.20. How many shares of stock are outstanding? Number of shares = $1,800 ÷ $1.20 = 1,500 6 35. Frederico’s has a profit margin of 6%, a return on assets of 8%, and an equity multiplier of 1.4. What is the return on equity? Return on equity = 8% × 1.4 = 11.2%, using the Du Pont Identity 36. Windswept, Inc. has 90 million shares of stock outstanding. Its price‐earnings ratio for 2006 is 12. What is the market price per share of stock? Earnings per share for 2005 = $481 million ÷ 90 million = $5.3444 Market price per share = $5.3444 × 12 = $64.13 37. Katelyn’s Kites has net income of $240 and total equity of $2,000. The debt‐equity ratio is 1.0 and the plowback ratio is 40%. What is the internal growth rate? Total assets = $2,000 + $2,000 = $4,000 (The debt­equity ratio of 1.0 means TD = TE.) Return on assets = $240 ÷ $4,000 = .06 Internal growth = [.06 × .40] ÷ [1 ­ (.06 × .40)] = 2.46% 38. You are going to loan your friend $1,000 for one year at a 5% rate of interest. How much additional interest can you earn if you compound the rate continuously rather than annually ; EAR = 5.127% EAR = 5.127% Additional interest = $1,000 × (.05127 ­ .05) = $1.27 39. Your grandmother invested one lump sum 17 years ago at 4.25% interest. Today, she gave you the proceeds of that investment which totaled $5,539.92. How much did your grandmother originally invest? Present value = $5,539.92 × [1 ÷ (1 + .0425)17] = $2,730.30 40. The common stock of Eddie’s Engines, Inc. sells for $25.71 a share. The stock is expected to pay $1.80 per share next month when the annual dividend is distributed. Eddie’s has established a pattern of increasing its dividends by 4% annually and expects to continue doing so. What is the market rate of return on this stock? ;R = 11.00% 7 41. Shares of common stock of the Samson Co. offer an expected total return of 12%. The dividend is increasing at a constant 8% per year. The dividend yield must be: Dividend yield = 4% 42. The common stock of Grady Co. had an 11.25% rate of return last year. The dividend amount was $.70 a share which equated to a dividend yield of 1.5%. What was the rate of price appreciation on the stock? g = .1125 − .015 = .0975 = 9.75% 43. The Merriweather Co. just announced that it will pay a dividend next year of $1.60 and is establishing a policy whereby the dividend will increase by 3.5% annually thereafter. How much will one share be worth five years from now if the required rate of return is 12%? ;P5 = $22.36 44. The Bell Weather Co. is a new firm in a rapidly growing industry. The company is planning on increasing its annual dividend by 20% a year for the next four years and then decreasing the growth rate to 5% per year. The company just paid its annual dividend in the amount of $1.00 per share. What is the current value of one share if the required rate of return is 9.25%? Dividends for the first 4 years are: $1.20, $1.44, $1.728, and $2.0736. P4 = $51.2301 P0 = $41.05 8 45. Nu‐Tek, Inc. is expecting a period of intense growth and has decided to retain more of its earnings to help finance that growth. As a result it is going to reduce its annual dividend by 10% a year for the next three years. After that, it will maintain a constant dividend of $.70 a share. Last month, the company paid $1.80 per share. What is the value of this stock if the required rate of return is 13%? P3 = $5.3846 46. P0 = $7.22 The Lory Company had net earnings of $127,000 this past year. Dividends were paid of $38,100 on the company's equity of $1,587,500. If Lory has 100,000 shares outstanding with a current market price of $11.625 per share, what is the required rate of return R = Div/P0 + g = (.381(1.056))/11.625)+.056 = (.40/11.625)+.056 = .0346 + .056 = .0906 = 9% 47. Doctors‐On‐Call, a newly formed medical group, just paid a dividend of $.50. The company’s dividend is expected to grow at a 20% rate for the next 5 years and at a 3% rate thereafter. What is the value of the stock if the appropriate discount rate is 12%? Years 1­5: ($.50(1.2)t/(1.12)t + (1.28/.09)/(1.12)5 = $11.17 48. Calculate the YTM on a bond priced at $1,036 which has 2 years to maturity, a 10% annual coupon rate, and a return of $1,000 at maturity. YTM = 7.98% 9