大碩 102 研究所全真模擬考試答案

advertisement

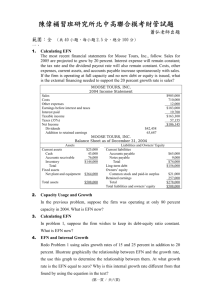

大碩 102 研究所全真模擬考試答案 科 目:財務管理(財金所) 考試日期:2012/11/24 NOTE: Answer all of the following questions. Read each question carefully, choose the most suitable answer, and write them orderly on your answer sheet. Each question has exactly one correct answer and accounts for 2% of the full score. 1 大碩 102 研究所全真模擬考試答案 1. $145. The tax rate is 34%. The firm does not have interest expenses. What is the operating cash flow? A. $93 B. $241 C. $340 D. $383 E. $485 Earnings before interest and taxes = $1,200 - $715 - $145 = $340; Tax = [$198 (1 - .34)] $198 = $102; Operating cash flow = $340 + $145 - $102 = $383 2. At the beginning of the year, a firm has current assets of $380 and current liabilities of $210. At the end of the year, the current assets are $410 and the current liabilities are $250. What is the change in net working capital? A. -$30 B. -$10 C. $0 D. $10 E. $30 Change in net working capital = ($410 - $250) - ($380 - $210) = -$10 3. Managers are encouraged to act in shareholders' interests by: A. shareholder election of a board of directors who select management. B. the threat of a takeover by another firm. C. compensation contracts that tie compensation to corporate success. D. Both A and B. E. All of the above. 4. Which form of business structure faces the greatest agency problems? A. sole proprietorship B. general partnership C. limited partnership D. corporation E. limited liability company 2 大碩 102 研究所全真模擬考試答案 5. Rosita's Resources paid $250 in interest and $130 in dividends last year. The times interest earned ratio is 3.8 and the depreciation expense is $60. What is the value of the cash coverage ratio? A. 2.40 B. 3.52 C. 3.80 D. 4.04 E. 4.28 EBIT = 3.8 $250 = $950; Cash coverage ratio = ($950 + $60) $250 = 4.04 6. Jupiter Explorers has $6,400 in sales. The profit margin is 4%. There are 6,400 shares of stock outstanding. The market price per share is $1.20. What is the price-earnings ratio? A. 13 B. 14 C. 21 D. 30 E. 48 Earnings per share = (.04 $6,400) 6,400 = .04; Price-earnings ratio = $1.20 .04 = 30 7. Katelyn's Kites has net income of $240 and total equity of $2,000. The debt-equity ratio is 1.0 and the plowback ratio is 40%. What is the internal growth rate? A. 2.46% B. 3.00% C. 4.92% D. 5.88% E. 6.00% Total assets = $2,000 + $2,000 = $4,000 (The debt-equity ratio of 1.0 means TD = TE.); Return on assets = $240 $4,000 = .06; Internal growth = [.06 .40] [1 - (.06 .40)] = 2.46% 3 大碩 102 研究所全真模擬考試答案 8. Suzette is going to receive $10,000 today as the result of an insurance settlement. In addition, she will receive $15,000 one year from today and $25,000 two years from today. She plans on saving all of this money and investing it for her retirement. If Suzette can earn an average of 11% on her investments, how much will she have in her account if she retires 25 years from today? A. $536,124.93 B. $541,414.14 C. $546,072.91 D. $570,008.77 E. $595,098.67 Future value = $135,854.64 + $183,587.35 + $275,656.68 = $595,098.67 9. You are going to loan your friend $1,000 for one year at a 5% rate of interest. How much additional interest can you earn if you compound the rate continuously rather than annually? A. $.97 B. $1.09 C. $1.27 D. $1.36 E. $1.49 Using ex on a financial calculator: EAR = 5.127% On the Texas Instruments BA II Plus, the input is: .05, 2nd, ex, -1, = .05127 = 5.127% Additional interest = $1,000 (.05127 - .05) = $1.27 4 大碩 102 研究所全真模擬考試答案 10. Aunt Clarisse has promised to leave you an annuity that will pay $60 next year and grow at an annual rate of 4%. The payments are expected to go on indefinitely and the interest rate is 9%. What is the value of the growing perpetuity? A. $667 B. $693 C. $1,200 D. $1,248 E. None of the above PVgrowing perpetuity = C/(r - g) = $60/(.09 - .04) = $1,200 11. A $25 investment produces $27.50 at the end of the year with no risk. Which of the following is true? A. NPV is positive if the required return is less than 10%. B. NPV is negative if the required return is less than 10%. C. NPV is zero if the required return is equal to 10%. D. Both A and C. E. None of the above. NPV = ($27.50/1.1) - $25.00 = $0 12. Ernie's Electrical is evaluating a project which will increase sales by $50,000 and costs by $30,000. The project will cost $150,000 and will be depreciated straight-line to a zero book value over the 10 year life of the project. The applicable tax rate is 34%. What is the operating cash flow for this project? A. $3,300 B. $5,000 C. $8,300 D. $13,300 E. $18,300 Tax = .34 [$50,000 - 30,000 - ($150,000 10)] = $1,700; OCF = $50,000 - $30,000 - $1,700 = $18,300 5 大碩 102 研究所全真模擬考試答案 13. Thornley Machines is considering a 3-year project with an initial cost of $618,000. The project will not directly produce any sales but will reduce operating costs by $265,000 a year. The equipment is depreciated straight-line to a zero book value over the life of the project. At the end of the project the equipment will be sold for an estimated $60,000. The tax rate is 34%. The project will require $23,000 in extra inventory for spare parts and accessories. Should this project be implemented if Thornley's requires a 9% rate of return? Why or why not? A. No; The NPV is -$2,646.00. B. Yes; The NPV is $27,354.00. C. Yes; The NPV is $32,593.78. D. Yes; The NPV is $43,106.54. E. Yes; The NPV is $196,884.40. CF0 = -$618,000 + (-$23,000) = -$641,000 Annual depreciation = $618,000 3 = $206,000 Taxes = ($265,000 - $206,000) .34 = $20,060 OCF = $265,000 - $20,060 = $244,940 C03 = $244,940 + [$60,000 (1 - .34)] + $23,000 = $307,540 14. Kurt Neal and Son is considering a project with a discounted payback just equal to the project's life. The projections include a sales price of $11, variable cost per unit of $8.50, and fixed costs of $4,500. The operating cash flow is $6,200. What is the break-even quantity? A. 1,800 units B. 2,480 units C. 3,057 units D. 3,750 units E. 4,280 units Financial break-even point = ($4,500 + $6,200) ($11 - $8.50) = 4,280 6 大碩 102 研究所全真模擬考試答案 15. Scenario analysis is different than sensitivity analysis: A. because no economic forecasts are changed. B. because several variables are changed together. C. because scenario analysis deals with actual data versus sensitivity analysis which deals with a forecast. D. because it is short and simple. E. because it is a "by the seat of the pants" technique. 16. A corporate bond with a face value of $1,000 matures in 4 years and has an 8% coupon paid at the end of each year. The current price of the bond is $932. What is the yield to maturity for this bond? A. 5.05% B. 6.48% C. 8.58% D. 10.15% E. 11.92% Current Price = Int(PVIFAr,4) + Face value(PVIFr,4) $932 = $80[1 - 1/(1 + r)4]/r + $1000/(1 + r)4 r = 10.152 17. A bond that makes no coupon payments and is initially priced at a deep discount is called a _____ bond. A. Treasury B. municipal C. floating-rate D. junk E. zero coupon 18. If its yield to maturity is less than its coupon rate, a bond will sell at a _____, and increases in market interest rates will _____. A. discount; decrease this discount. B. discount; increase this discount. C. premium; decrease this premium. D. premium; increase this premium. E. None of the above. 7 大碩 102 研究所全真模擬考試答案 19. Assume that you are using the dividend growth model to value stocks. If you expect the market rate of return to increase across the board on all equity securities, then you should also expect the: A. market values of all stocks to increase, all else constant. B. market values of all stocks to remain constant as the dividend growth will offset the increase in the market rate. C. market values of all stocks to decrease, all else constant. D. stocks that do not pay dividends to decrease in price while the dividend-paying stocks maintain a constant price. E. dividend growth rates to increase to offset this change. 20. B&K Enterprises will pay an annual dividend of $2.08 a share on its common stock next year. Last week, the company paid a dividend of $2.00 a share. The company adheres to a constant rate of growth dividend policy. What will one share of B&K common stock be worth ten years from now if the applicable discount rate is 8%? A. $71.16 B. $74.01 C. $76.97 D. $80.05 E. $83.25 21. The excess return you earn by moving from a relatively risk-free investment to a risky investment is called the: A. geometric average return. B. inflation premium. C. risk premium. D. time premium. E. arithmetic average return. 8 大碩 102 研究所全真模擬考試答案 22. The Zolo Co. just declared that it is increasing its annual dividend from $1.00 per share to $1.25 per share. If the stock price remains constant, then: A. the capital gains yield will decrease. B. the capital gains yield will increase. C. the dividend yield will increase. D. the dividend yield will also remain constant. E. neither the capital gains yield nor the dividend yield will change. 23. An efficient set of portfolios is: A. the complete opportunity set. B. the portion of the opportunity set below the minimum variance portfolio. C. only the minimum variance portfolio. D. the dominant portion of the opportunity set. E. only the maximum return portfolio. 24. You have a $1,000 portfolio which is invested in stocks A and B plus a risk-free asset. $400 is invested in stock A. Stock A has a beta of 1.3 and stock B has a beta of .7. How much needs to be invested in stock B if you want a portfolio beta of .90? A. $0 B. $268 C. $482 D. $543 E. $600 BetaPortfolio = .90 = ($400 $1,000 1.3) + ($x $1,000 .7) + (($600 - x) $1,000 0) = .52 + .0007x + 0; .0007x = .38; x = $542.86 = $543 25. A portfolio has 25% of its funds invested in Security C and 75% of its funds invested in Security D. Security C has an expected return of 8% and a standard deviation of 6%. Security D has an expected return of 10% and a standard deviation of 10%. The securities have a coefficient of correlation of 0.6. Which of the following values is closest to portfolio return and variance? A. .090; .0081 B. .095; .001675 C. .095; .0072 D. .100; .00849 E. Cannot calculate without the number of covariance terms. 9 大碩 102 研究所全真模擬考試答案 E(R) = .25(.08) + .75(.10) = .095 = 9.5% Variance = .252(.06)2 + .752(.10)2 + 2(.25)(.75)(.06)(.60)(.10) = .0072 26. The single factor APT model that resembles the market model uses _________ as the single factor. A. arbitrage fees B. GNP C. the inflation rate D. the market return E. the risk-free return 27. The Fama-French three factor model predicts the expected return on a portfolio increases: A. linearly with its factor loading of the size factor. B. linearly with its factor loading of the volume. C. exponentially with its factor loading of the size factor. D. exponentially with its factor loading of the volume factor. E. None of the above. 28. The asset beta of a levered firm is generally: A. equal to the equity beta. B. different from the equity beta. C. different from the debt beta. D. the simple average of the equity beta and debt beta. E. Both B and C. 29. Your best friend works in the finance office of the Delta Corporation. You are aware that this friend trades Delta stock based on information he overhears in the office. You know that this information is not known to the general public. Your friend continually brags to you about the profits he earns trading Delta stock. Based on this information, you would tend to argue that the financial markets are at best _____ form efficient. A. weak B. semiweak C. semistrong D. strong E. perfect 10 大碩 102 研究所全真模擬考試答案 30. Which of the following is true? A. A random walk for stock price changes is inconsistent with observed patterns in price changes. B. If the stock market follows a random walk, price changes should be highly correlated. C. If the stock market is weak form efficient, then stock prices follow a random walk. D. All of the above. E. Both B and C. 31. Which of the following statements is false? A. Creditors do not have voting power. B. Payment on interest on debt in considered an expense, while payment of dividends is a return on capital. C. Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm. Unpaid common stock dividends cannot force liquidation. D. One of the costs of issuing equity is the possibility of financial distress, while no financial distress is associated with debt. E. None of the above. 32. MM Proposition I without taxes is used to illustrate: A. the value of an unlevered firm equals that of a levered firm. B. that one capital structure is as good as another. C. leverage does not affect the value of the firm. D. capital structure changes have no effect on stockholders' welfare. E. All of the above. 33. The Spartan Co. has an unlevered cost of capital of 11%, a cost of debt of 8%, and a tax rate of 35%. What is the target debt-equity ratio if the targeted cost of equity is 12%? A. .44 B. .49 C. .51 D. .56 E. .62 .12 = .11 + (.11 - .08) D/E (1 - .35); .01 = .0195D/E; D/E = .51 11 大碩 102 研究所全真模擬考試答案 34. Anderson's Furniture Outlet has an unlevered cost of capital of 10%, a tax rate of 34%, and expected earnings before interest and taxes of $1,600. The company has $3,000 in bonds outstanding that have an 8% coupon and pay interest annually. The bonds are selling at par value. What is the cost of equity? A. 8.67% B. 9.34% C. 9.72% D. 9.99% E. 10.46% VU = [EBIT (1 - Tc)] RU = [$1,600 (1- .34)] .10 = $10,560 VL = VU + (Tc D) = $10,560 + (.34 $3,000) = $11,580 VL - VD = VE = $11,580 - $3,000 = $8,580 RE = RU + (RU - RD) D/E (1 - TC) = .10 + [(.10 - .08) ($3,000 $8,580) (1 - .34)] = .10 + .00462 = .10462 = 10.46% 35. Which of the following statements are correct in relation to MM Proposition II with no taxes? I. The required return on assets is equal to the weighted average cost of capital. II. Financial risk is determined by the debt-equity ratio. III. Financial risk determines the return on assets. IV. The cost of equity declines when the amount of leverage used by a firm rises. A. I and III only B. II and IV only C. I and II only D. III and IV only E. I and IV only 36. One of the indirect costs of bankruptcy is the incentive for managers to take large risks. When following this strategy: A. the firm will rank all projects and take the project which results in the highest expected value of the firm. B. bondholders expropriate value from stockholders by selecting high risk projects. C. stockholders expropriate value from bondholders by selecting high risk projects. D. the firm will always take the low risk project. E. Both A and B. 12 大碩 102 研究所全真模擬考試答案 37. Given the following information, leverage will add how much value to the unlevered firm per dollar of debt? Corporate tax rate: 34% Personal tax rate on income from bonds: 20% Personal tax rate on income from stocks: 0% A. $0.175 B. $0.472 C. $0.528 D. $0.825 E. None of the above [1 - ((1 - Tc)(1 - Ts)/(1 - Tb))]B = [1 - ((.66)(1)/(1 - .2))]B = .175B ; $0.175 38. The Felix Filter Corp. maintains a debt-equity ratio of .6. The cost of equity for Richardson Corp. is 16%, the cost of debt is 11% and the marginal tax rate is 30%. What is the weighted average cost of capital? A. 8.38% B. 11.02% C. 12.89% D. 13.00% E. 14.12% WACC = (.6/1.6)*(.11)*(1 - .3) + (1/1.6)*(.16) = .028875 + .10 = .1289 = 12.89% 39. The Telescoping Tube Company is planning to raise $2,500,000 in perpetual debt at 11% to finance part of their expansion. They have just received an offer from the Albanic County Board of Commissioners to raise the financing for them at 8% if they build in Albanic County. What is the total added value of debt financing to Telescoping Tube if their tax rate is 34% and Albanic raises it for them? A. $850,000 B. $1,200,000 C. $1,300,000 D. $1,650,000 E. There is no value to the scheme; Albanic is just conning Telescoping Tube into moving. NPVLOAN = $2,500,000 - [.08($2,500,000)(1 - .34)]/.11 = $2,500,000 - ($200,000(.66))/.11 = $2,500,000 - $1,200,000 = $1,300,000 13 大碩 102 研究所全真模擬考試答案 40. In order to value a project which is not scale enhancing you need to: A. typically calculate the equity cost of capital using the risk adjusted beta of another firm in the industry before calculating the WACC. B. typically increase the beta of another firm in the same line of business and then calculate the discount rate using the SML. C. typically you can simply apply your current cost of capital. D. discount at the market rate of return since the project will diversify the firm to the market. E. typically calculate the equity cost of capital using the risk adjusted beta of another firm in another industry before calculating the WACC. 41. In a reverse stock split: A. the number of shares outstanding increases and owners' equity decreases. B. the firm buys back existing shares of stock on the open market. C. the firm sells new shares of stock on the open market. D. the number of shares outstanding decreases but owners' equity is unchanged. E. shareholders make a cash payment to the firm. 42. Dividends are relevant and dividend policy irrelevant when: A. cash dividends are always constant and dividend policy is changed as management needs. B. cash dividends are increased for one year while others are held constant, thus causing an increase in stock price, and dividend policy establishes the trade-off between dividends at different dates. C. cash dividends are always constant and dividend policy establishes the trade-off between dividends at different dates. D. cash dividends are increased for one payment while others are held constant and dividend policy is changed as management needs. E. None of the above. 43. Under the _____ method, the underwriter buys the securities for less than the offering price and accepts the risk of not selling the issue, while under the _____ method, the underwriter does not purchase the shares but merely acts as an agent. A. best efforts; firm commitment B. firm commitment; best efforts C. general cash offer; best efforts D. competitive offer; negotiated offer E. seasoned; unseasoned 14 大碩 102 研究所全真模擬考試答案 44. Which one of the following provides the option of selling a stock anytime during the option period at a specified price even if the market price of the stock declines to zero? A. American call B. European call C. American put D. European put E. either an American or a European put 45. The Black-Scholes option pricing model is dependent on which five parameters? A. Stock price, exercise price, risk free rate, probability, and time to maturity B. Stock price, risk free rate, probability, time to maturity, and variance C. Stock price, risk free rate, probability, variance and exercise price D. Stock price, exercise price, risk free rate, variance and time to maturity E. Exercise price, probability, stock price, variance and time to maturity 46. The risk-neutral probabilities for an asset, with a current value equal to the present value of future payoffs are: A. given by the probability of each state occurring. B. given by the value of the underlying asset under good news and the risk free rate. C. given by the value of the underlying asset under good news and bad news. D. given by the value of the underlying asset under good news, bad news, and the risk free rate. E. None of the above. 47. The gain from exercising a warrant is similar to the gain from exercising a call option except: A. the gain on a warrant is greater by the fraction of warrant shares divided by total shares. B. the gain on a warrant is limited by the firm's value after being reduced by the debt of the firm. C. the gain on a warrant is decreased by the fraction of original shares divided by total post exercise shares. D. Both A and B. E. Both B and C. 48. A friendly suitor that a target firm turns to as an alternative to a hostile bidder is called a: A. golden suitor. B. poison put. C. white knight. D. shark repellent. E. crown jewel. 15 大碩 102 研究所全真模擬考試答案 49. A going-private transaction in which a large percentage of the money used to buy the outstanding stock is borrowed is called a: A. tender offer. B. proxy contest. C. merger. D. leveraged buyout. E. consolidation. 50. Financial distress can be best described by which of the following situations in which the firm is forced to take corrective action? A. Cash payments are delayed to creditors. B. The market value of the stock declines by 10%. C. The firm's operating cash flow is insufficient to pay current obligations. D. Cash distributions are eliminated because the board of directors considers the surplus account to be low. E. None of the above. 16