陳偉補習班研究所北中高聯合模考財管試題 陳偉補習班研究所北中高

advertisement

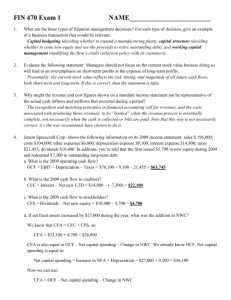

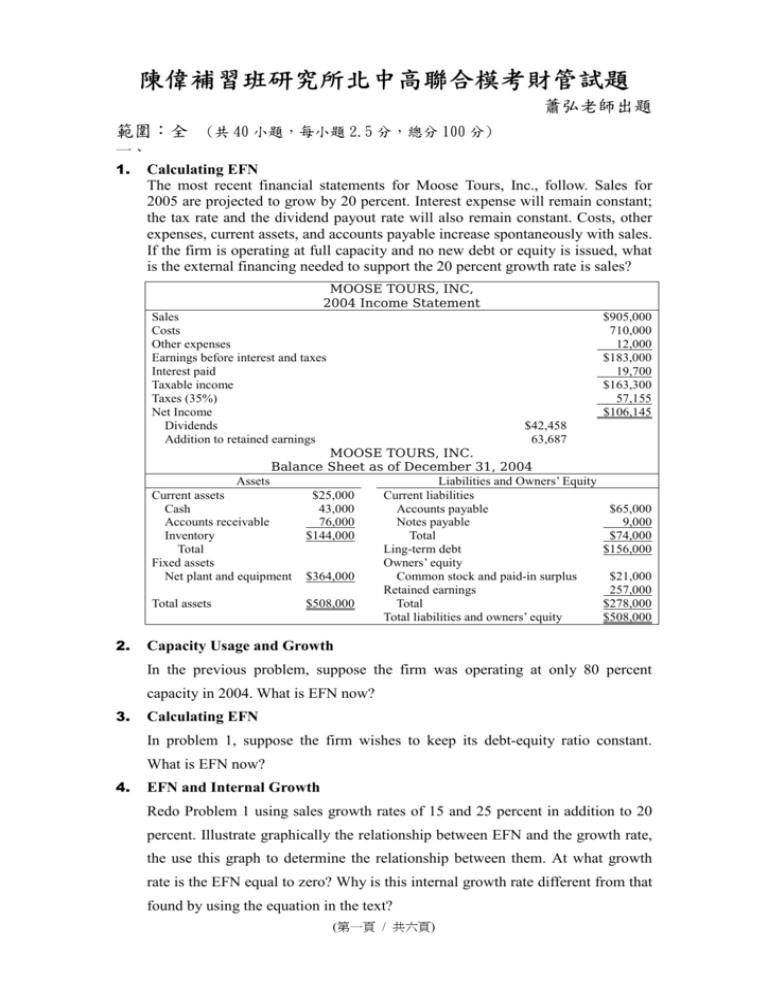

陳偉補習班研究所北中高聯合模考財管試題 蕭弘老師出題 範圍:全 (共 40 小題,每小題 2.5 分,總分 100 分) 一、 1. Calculating EFN The most recent financial statements for Moose Tours, Inc., follow. Sales for 2005 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued, what is the external financing needed to support the 20 percent growth rate is sales? MOOSE TOURS, INC, 2004 Income Statement Sales Costs Other expenses Earnings before interest and taxes Interest paid Taxable income Taxes (35%) Net Income Dividends Addition to retained earnings $905,000 710,000 12,000 $183,000 19,700 $163,300 57,155 $106,145 $42,458 63,687 MOOSE TOURS, INC. Balance Sheet as of December 31, 2004 Assets Liabilities and Owners’ Equity Current assets $25,000 Current liabilities Cash 43,000 Accounts payable Accounts receivable 76,000 Notes payable Inventory $144,000 Total Total Ling-term debt Fixed assets Owners’ equity Net plant and equipment $364,000 Common stock and paid-in surplus Retained earnings Total assets $508,000 Total Total liabilities and owners’ equity 2. $65,000 9,000 $74,000 $156,000 $21,000 257,000 $278,000 $508,000 Capacity Usage and Growth In the previous problem, suppose the firm was operating at only 80 percent capacity in 2004. What is EFN now? 3. Calculating EFN In problem 1, suppose the firm wishes to keep its debt-equity ratio constant. What is EFN now? 4. EFN and Internal Growth Redo Problem 1 using sales growth rates of 15 and 25 percent in addition to 20 percent. Illustrate graphically the relationship between EFN and the growth rate, the use this graph to determine the relationship between them. At what growth rate is the EFN equal to zero? Why is this internal growth rate different from that found by using the equation in the text? (第一頁 / 共六頁) 5. EFN and Sustainable Growth Redo Problem 3 using sales growth rates of 30 and 35 percent in addition to 20 percent. Illustrate graphically the relationship between EFN and the growth rate, and use this graph to determine the relationship between them. At what growth rate is the EFN equal to zero? Why is this sustainable growth rate different from that found by using the equation in the text? 二、Interest Rate Risk Both Bond Sam and Bond Dave have 10 percent coupons, make semiannual payments, and are priced at par value. Bond Sam has 2 years to maturity, whereas Bond Dave has 15 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Sam? Of Bond Dave? If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Same be then? Of Bond Dave? Illustrate your answers by graphing bond prices versus YTM. What does this problem tell you about the interest rate risk of longer-term bonds? 三、Stock Valuation Most corporations pay quarterly dividends on their common stock rather than annual dividends. Barring any unusual circumstances during the year, the board raises, lowers, or maintains the current dividend once a year and then pays this dividend out in equal quarterly installments to its shareholders. (a) Suppose a company currently pays a $3.00 annual dividend on its common stock in a single annual installment, and management plans on raising this dividend by 6 percent per year, indefinitely. If the required return on this stock is 14 percent, what is the current share price? (b) Now suppose that the company in (a) actually pays its annual dividend in equal quarterly installments; thus, this company has just paid a $.75 dividend per share, as it has for the previous three quarters. What is your value for the current share price now? (Hint: Find the equivalent annual end-of-year dividend for each year.) Comment on whether or not you think that this model of stock valuation is appropriate. 四、 1. Comparing Mutually Exclusive Projects Hagar Industrial Systems Company (HISC) is trying to decide between two different conveyor belt systems. System A costs $430,000, has a four-year life, and requires $120,000 in pretax annual operating costs. System B cost $540,000, has a six-year life, and requires $80,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever project is chosen, it will not be replaced when it wears out. If the tax rate is 34 percent and the discount rate is 20 percent, which project should the firm choose? 2. Comparing Mutually Exclusive Projects Suppose in the previous problem that HISC always needs a conveyor belt system; when one wears out, it must be replaced. Which project should the firm choose now? (第二頁 / 共六頁) 五、Calculating a Bid Price Your company has been approached to bid on a contract to sell 10,000 voice recognition (VR) computer keyboards a year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $2.4 million and will be depreciated on a straight-line basis to a zero salvage value. Production will require an investment in net working capital of $75,000 to be returned at the end of the project and the equipment can be sold for $200,000 at the end of production. Fixed costs are $500,000 per year, and variable costs are $165 per unit. In addition to the contract, you feel your company can sell 3,000, 6,000 8,000 and 5,000 additional units to companies in other countries over the next four years, respectively, at a price of $275. This price is fixed. The tax rate is 40 percent, and the required return is 13 percent. Additionally, the president of the company will only undertake the project if it has an NPV of $100,000. What bid price should you set for the contract? 六、Systematic versus Unsystematic Risk Consider the following information on Stocks I and II: State of Economy Recession Normal Irrational exuberance Probability of State of Economy .15 .70 .15 Rate of Return If State Occurs Stock I Stock II -.30 .09 .42 .12 .26 .44 The market risk premium is 10 percent, and the risk-free rate is 4 percent. Which stock has the most systematic risk? Which one has the most unsystematic risk? Which stock is “riskier”? Explain. 七、SML Suppose you observe the following situation: Security Pete Corp. Repete Co. Beta 1.3 .6 Expected Return .23 .13 Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? 八、Abandonment Value We are examining a new project. We expect to sell 7,000 units per year at $60 net cash flow apiece for the next 10 years. In other words, the annual operating cash flow is projected to be $60×7,000 = $420,000. The relevant discount rate is 16 percent, and the initial investment required is $1,800,000. (a) What is the base-case NPV? (b) After the first year, the project can be dismantled and sold for $1,400,000. If expected sales are revised based on the first year’s performance, when would it make sense to abandon the investment? In other words, at what level of expected sales would it make sense to abandon the project? (c) Explain how the $1,400,000 abandonment value can be viewed as the opportunity cost of keeping the project in one year. (第三頁 / 共六頁) 九、Pricing Convertibles You have been hired to value a new 25-year callable, convertible bond. The bond has 6.80 percent coupon, payable annually. The conversion price is $150, and the stock currently sells for $44.75. The stock price is expected to grow at 12 percent per year. The bond is callable at $1,200, but, based on prior experience, it won’t be called unless the conversion value is $1,300. The required return on this bond is 10 percent. What value would you assign? 十、Flotation Costs and NPV Photochronograph Corporation (PC) manufactures time series photographic equipment, It is currently at its target debt-equity ratio of 1.3. It’s considering building a new $45 million manufacturing facility. This new plant is expected to generate aftertax cash flows of $5.7 million in perpetuity. There are three financing options: (1) A new issue of common stock. The flotation costs of the new common stock would be 8 percent of the amount raised. The required return on the company’s new equity is 17 percent. (2) A new issue of 20-year bonds. The flotation costs of the new bonds would be 4 percent of the proceeds. If the company issues these new bonds at an annual coupon rate of 9 percent, they will sell at par. (3) Increased use of counts payable financing. Because this financing is part of the company’s ongoing daily business, it has no flotation costs and the company assigns it a cost that is the same as the overall firm WACC. Management has a target ratio of accounts payable to long-term debt of .20. (Assume there is no difference between the pretax and aftertax accounts payable costs.) What is the NPV of the new plant? Assume that PC has a 35 percent tax rate. 十一、Rights Offerings The Clifford Corporation has announced a rights offer to raise $50 million for a new journal, the Journal of financial Excess. This journal will review potential articles after the author pays a nonrefundable reviewing fee of $5,000 per page. The stock current sells for $40 per share, and there are 5.2 million shares outstanding. (a) What is the maximum possible subscription price? What is the minimum? (b) If the subscription price is set at $35 per share, how many shares must be sold? How many rights will it take to buy one share? (c) What is the ex-rights price? What is the value of a right? (d) Show how a shareholder with 1,000 shares before the offering and no desire (or money) to buy additional shares is not harmed by the rights offer. 十二、M&M Tool Manufacturing has an expected EBIT of $35,000 in perpetuity and a tax rate of 35 percent. The firm has $70,000 in outstanding debt at an interest rate of 9 percent, and its unlevered cost of capital is 14 percent. What is the value of the firm according to M&M Proposition I with taxes? Should Tool change its debt-equity ratio if the goal is to maximize the value of the firm? Explain. 十三、Firm Value Old School Corporation expects an EBIT of $9,000 every year forever. Old School currently has no debt, and its cost of equity is 17 percent. The firm can borrow at 10 percent. If the corporate tax rate is 35 percent, what is the value of the firm? What will the value be if Old School converts to 50 percent debt? To 100 percent debt? (第四頁 / 共六頁) 十四、Homemade Dividends You own 1,000 shares of stock in Avondale Corporation. You will receive a 70-cent per share dividend in one year. In two years, Avondale will pay a liquidating dividend of $40 per share. The required return on Avondale stock is 15 percent. What is the current share price of your stock (ignoring taxes)? If you would rather have equal dividends in each of the next two years, show how you can accomplish this by creating homemade dividends. Hint: Dividends will be in the form of an annuity. 十五、Stock Repurchases Flychucker Corporation is evaluating an extra dividend versus a share repurchase. In either case, $5,000 would be spent. Current earnings are $0.95 per share, and the stock currently sells for $40 per share. There are 200 shares outstanding. Ignore taxes and other imperfections in answering the first two questions. (a) Evaluate the two alternatives in terms of the effect on the price per share of the stock and shareholder wealth. (b) What will be the effect on Flychucker’s EPS and PE ratio under the two different scenarios? (c) In the real world, which of these actions would you recommend? Why? 十六、Hedging with Futures Refer to Table 23.1 in the text to answer this question. Suppose today is July 7, 2004, and your firm produces breakfast cereal and needs 75,000 bushels of corn in December 2004 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and December. (a) How could you use corn futures contracts to hedge your risk exposure? What price would you effectively be locking in based on the closing price of the day? (b) Suppose corn prices are $2.64 per pound in December. What is the profit or loss on your futures position? Explain how your futures position has eliminated your exposure to price risk in the corn market. 十七、Equity as an Option and NPV Suppose the firm in the previous problem is considering two mutually exclusive investments. Project A has an NPV of $700, and Project B has an NPV of $1,000. As the result of taking Project A, the standard deviation of the return on the firms’ assets will increase to 55 percent per year. If Project B is taken, the standard deviation will fall to 34 percent per year. (a) What is the value of the firm’s equity and debt if Project A is undertaken? If Project B is undertaken? (b) Which project would the stockholders prefer? Can you reconcile your answer with the NPV rule? (c) Suppose the stockholders and bondholders are in fact the same group of invertors. Would this affect your answer to (b)? (d) What does this problem suggest to you about stockholder incentives? (第五頁 / 共六頁) 十八、Effects of a Stock Exchange Consider the following premerger information about Firm A and Firm B: Total earnings Shares outstanding Price per share Firm A $900 550 $ 40 Firm B $600 220 $ 15 Assume that Firm A acquires Firm B via an exchange of stock at a price of $20 for each share of B’s stock. Both A and B have no debt outstanding. (a) What will the earnings per share, EPS, of Firm A be after the merger? (b) What will Firm A’s price per share be after the merger if the market incorrectly analyzes this reported earnings growth (that is, the price-earnings ratio does not change)? (c) What will the price-earnings ratio of the postmerger firm be if the market correctly analyzes the transaction? (d) If there are no synergy gains, what will the share price of A be after the merger? What will the price-earnings ratio be? What does your answer for the share price tell you about the amount A bid for B? Was it too high? Too low? Explain. (第六頁 / 共六頁) 陳偉補習班研究所北中高聯合模考財管試題解答 蕭弘老師解題 範圍:全 一、 1. Dividend payout ratio = 0.40 2005 Pro Forma Income Statement Sales $ Costs Assets 1,086,000 Current assets 852,000 Other expenses EBIT Interest expense Taxable income $ Taxes 30,000 Accounts payable Accounts receivable 51,600 Notes payable 219,600 Inventory 91,200 19,700 Total $ Net income $ 129,935 Dividends $ 51,974 Total $ 78,000 9,000 $ $ 172,800 Long-term debt 199,900 Fixed assets 69,965 Add. To RE Current liabilities Cash 14,400 $ Liabilities and owners’ equity 87,000 156,000 Owners’ equity Net plant and equipment 436,800 Common stock and $ 21,000 paid-in surplus Retained earnings 77,961 Total 334,961 $ 355,961 Total liabilities and $ 609,600 owners’ equity Total assets External financing = $ 10,639 2. EFN=172,800+364,000-598,961=(62,161) 3. 2004 Debt/equity ratio= New total debt= $ 0.82734 294,500.11 External financing needed= $ (40,861.11) 4. b ROA Internal growth rate 0.60 20.89% 14.33% b ROE Internal growth rate 0.60 38.18% 29.72% 5. (第七頁 / 共六頁) $ $598,961 二、 Price of Bond Bob= $ 965.35 Price of Bond Tom= $ 862.35 % change in Bond Bob= -3.47% % change in Bond Tom= -13.76% All else same, the longer the maturity of a bond, the greater is its price sensitivity to changes in interest rates. 三、 (a) Price= (b) Next four dividends = Effective quarterly rate = Effective first dividend = Share price = $ 39.75 $ $ 0.7950 3.33% 3.34 $ 41.78 四、 1. System A: OCF NPN System B: OCF NPV $ $ (42,650) (540,409.53) $ $ (22,200) (613,826.32) If the system will not be replaced when it wears out, then System A should be chosen, because it has the more positive NPV. 2. System A: EAC System B: EAC If the system is replaced, System B should be chosen because it has the lower EAC. (第八頁 / 共六頁) $ (208,754.32) $ (184,581.10) 五、 Market sales Sales $ Variable costs 1 825,000 $ 495,000 2 1,650,000 $ 990,000 3 2,200,000 $ 1,320,000 4 1,375,000 825,000 EBT Tax $ 330,000 132,000 $ 660,000 $ 264,000 880,000 $ 352,000 550,000 220,000 Net income (and OCF) $ 198,000 $ 396,000 $ 528,000 $ 330,000 NPV of market sales $ 1,053,672.99 Initial investment Aftertax salvage value $ $ 2,475,000 120,000 NPV of OCF $ 1,401,729.86 OCF $ 471,253.44 Bid price $ 253.54 (第九頁 / 共六頁) 六、 Stock I Recession Normal Boom Probability 0.15 0.70 0.15 Return 0.09 0.42 0.26 E(R) = Standard Deviation = 12.15% Stock I beta = 3.07 Stock II Probability Recession 0.15 Normal 0.70 Boom 0.15 Return -0.30 0.12 0.44 E(R) = Product 0.0135 0.2940 0.0390 0.3465 Product (0.0450) 0.0840 0.0660 0.1050 Standard Deviation = 20.39% Stock II beta = 0.65 Return Deviation (0.2565) 0.0735 (0.0865) Squared Deviation Product 0.06579 0.009868837 0.00540 0.003781575 0.00748 0.001122338 Variance = 0.01477 Return Deviation (0.4050) 0.0150 0.3350 Squared Deviation Product 0.16403 0.02460375 0.00023 0.0001575 0.11223 0.01683375 Variance= 0.04160 Although Stock II has more total risk than Stock I, it has much less systematic risk, since its beta is smaller than I’s. Thus I has more systematic risk, and II has more unsystematic and total risk. Since unsystematic risk can be diversified away, I is actually the “riskier” stock despite the lack of volatility in its returns. Stock I will have a higher risk premium and a greater expected return. 七、 Risk-free rate 4.43% Market return With Pete With Repete 18.71% 18.71% (第一○頁 / 共六頁) 八、 (a) NPV $ (b) Q Abandon the project if Q < because NPV (abandonment) > NPV (project CF’s) 229,955.54 5,065 5,065 (c) The abandonment value is the market value of the project. If you continue with the project in one year, you forego this cash that could have been used for something else. 九、 Straight bond value Conversion value # of years The bond will be called in years, forcing conversion. Bond value $ #NAME? 298.33 12.99 12.99 $ 859.80 十、 WACC Floatation costs Project cost NPV 十一、 $ $ 11.32% 5.29% 47,511,935 2,860,617 (a) Maximum subscription price = current share price $ 40 Minimum is anything > 0 (b) Number of new shares 1,428,571 Number of rights needed 3.64 (c) P(X) Value of a right (d) Before offer: After offer: (第一一頁 / 共六頁) $ 38.92 $ 1.08 $ 40,000 $ 40,000 十二、 VU $ 162,500.00 VL $ 187,000.00 Applying M&M Proposition I with taxes, the firm has increased its value by issuing debt. As long as M&M Proposition I holds, that is, there are no bankruptcy costs and so forth, then the company should continue to increase its debt/equity ratio to maximze the value of the firm. 十三、 No debt: VU $ 34,411.76 Debt 50% $ 40,433.82 Debt 100% $ 46,455.88 十四、 Stock price today $ 30.85 Equal dividend amount $ 18.98 Stock price in one year $ 34.783 You want in one year but you will only get $ 18,979.07 $ 700.00 You need to sell shares at time 1. Cash flow at time 1 Cash flow at time 2 525.52 $ $ 18,979.07 18,979.07 (第一二頁 / 共六頁) 十五、 (a) Cash Dividend: DPS $ 25.00 Price per share $ 15.00 The wealth of a shareholder who is holding one share is $ 40.00 Repurchase: Shares repurchased 125.00 If you choose to let your shares be repurchased, you have $ 40.00 in cash. If you keep your shares they are still worth $ 40.00 $ 0.95 (b) Cash Dividend EPS P/E 15.79 Repurchase: EPS $ P/E 2.53 15.79 (c) A share repurchase would seem to be the preferred course of action. Only those shareholders who wish to sell will do so, giving the shareholder a tax timing option that he or she doesn’t get with a dividend payment. (第一三頁 / 共六頁) 十六、 You’re concerned about a rise in corn prices so you would buy: Buy 4 December corn futures contracts. By doing so, you’re effectively locking in a settle price on July 7, 2004 of $ per bushel of corn, or $ 15 2.5850 193,875 Final contract value $ 198,000 Gain $ 4,125 While the price of corn your firm needs has become $ 4,125 more expensive since July, your profit from the futures position has netted out this higher cost. (第一四頁 / 共六頁) 十七、 (a) Project A: d1 0.5720 d2 0.0220 N(d1) 0.7163 N(d2) 0.5088 Equity value $ 3,183.37 Debt value $ 8,016.63 Project B: d1 0.7281 d2 0.3881 N(d1) 0.7667 N(d2) 0.6510 Equity value $ 2,624.54 Debt value $ 8,875.46 (b) Although the NPV of project B is higher, the equity value with project A is higher. While NPV represents the increase in the value of the assets of the firm, in this case, the increase in the value of the firm’s assets resulting from the project B is mostly allocated to the debtholders, resulting in smaller increase in the value of the equity. Stockholders would, therefore, prefer project A even though it has a lower NPV. (c) Yes. If the same group of investors have equal stakes in the firm as bondholders and stockholders, then total firm value matters and project B should be chosen, since it increases the value of the firm $11,500 instead of $11,200. (d) Stockholders may have an incentive to take on more risky, less profitable projects if the firm is leveraged; the higher the firm’s debt load, all else the same, the greater is this incentive. (第一五頁 / 共六頁) 十八、 Cost Shares given up by A $ 4,400 110 a. EPS $ 2.27 b. Old P/E New Price 24.44 $ c. P/E d. Price 55.56 17.60 $ P/E 38.33 16.87 At the current acquisition price, this is a negative NPV acquisition (第一六頁 / 共六頁)