ECON366 - KONSTANTINOS KANELLOPOULOS

INSTRUCTOR:

Mr. Konstantinos Kanellopoulos, MSc (L.S.E.), M.B.A.

COURSE:

MBA-680-50-F12 Corporate Financial Theory

SEMESTER:

I, 2012

Coursework 2

SECTION A

INSTRUCTIONS

Students are required to complete the following 2 parts. The first part consists of self-test questions while the second part consists of two exam-type problems. Part 1 counts to 5% of the final evaluation and Part 2 to 5% of the final evaluation, i.e. the whole coursework counts towards 10% of the final evaluation. The questions are based on the syllabus and lectures.

Answers to the Parts 1-2 should be filled in the spaces provided. However, for part 2, underlying reasoning and calculations showing how you got your answers should also be attached to the answer sheet in order to make the marking easier.

The deadline for delivering the coursework is November 21 st

2012.

This is not a group project. Answers should be your own work and should not involve collaboration with other students. The policy for suspected plagiarism (copying) is very severe at the UIA and it may provoke penalties.

Konstantinos Kanellopoulos

November 7 th 2012

1.

2.

SECTION B

PART 1 SELF-TEST QUESTIONS

On a graph with common stock returns on the Y-axis and market returns on the X-axis, the slope of the regression line represents the:

a. Alpha b. Beta c. R-squared d. Adjusted beta

The company cost of capital when debt as well as equity is used for financing is: a. Cost of debt b. Cost of equity c. The weighted average cost of capital (WACC) d. None of the above

3.

4.

One way to uncover forecasting errors in NPV estimates is by looking at: I) Book values

II) Liquidating values III) Market values a. I only b. b. II only c. III only d. I and II only

A new grocery store cost $50 million in initial investment. It is estimated that the store will generate $ 5 million after-tax cash flow each year for five years. At the end of 5 years it can be sold for $60 million. What is the NPV of the project at a discount rate of 10%? a. $2.42 million b. $10 million c. $6.21 million d. None of the above

5. A rental property is providing 13% rate of return. Next year's rent is expected to be $1.0 million and is expected to grow at 3% per year forever. What is the current value of the property? a. $7.7 million b. $10 million c. $33.3 million d. None of the above

6. If the capital markets are efficient, then the sale or purchase of any security at the prevailing market price is: a. Always a positive NPV transaction b. Generally a zero NPV transaction c. Is always a negative NPV transaction d. None of the above

7. Which of the following statement(s) is/are true if the efficient market hypothesis holds? I) It implies perfect forecasting ability II) It implies market is irrational III) It implies that prices follow a particular pattern IV) It implies that prices reflect all available information a. I only b. II only c. I and III only d. IV only

8. A firm has $100 million in current liabilities, $200 million in total long-term liabilities and $300 million in stockholders' equity, total assets of $600 million. Calculate the debt ratio for the firm. a. 40% b. 20% c. 50% d. None of the above

9. The equity accounts of Bio-Tech Company is as follows:

Suppose the firm sells 2,000,000 new (additional) shares at a price of $20 per share. What is the new value of Common Shares account? a. 12,000,000 b. 10,000,000 c. 2,000,000 d. None of the above

10. Generally, the book value of the shareholders' equity is represented by: a. The total assets minus the current liabilities b. The total assets minus the net worth c. The sum of preferred stock, debt and the capital surplus d. The sum of the par value of common stock, the capital surplus and the accumulated retained earnings

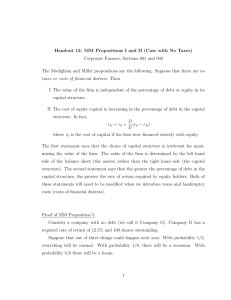

PART 2 PROBLEM 1 (Chapter 9 Risk and the Cost of Capital )

You are given the following information for Golden Fleece Financial:

Long-term debt outstanding: $300,000

Current yield to maturity (r debt

):

Number of shares of common stock:

Price per share:

Book value per share:

8%

10,000

$50

$25

Expected rate of return on stock (r equity

): 15% a.

Calculate Golden Fleece’s company cost of capital. Ignore taxes. b.

Calculate the cost of equity from the CAPM using its own beta estimate and the industry beta estimate. How different are your answers? Assume a risk-free rate of

5% and a market risk premium of 7%.

c.

Can you be confident that the company’s true beta is not the industry average? Under what circumstances might you advise the company to calculate its cost of capital based on its own beta estimate?

PROBLEM 2 – (Chapter 13 Efficient Markets and Behavioral Finance )

What does the efficient-market hypothesis have to say about these two statements? a.

“I notice that short-term interest rates are about 1% below long-term rates. We should borrow short-term”. b.

“I notice that interest rates in Japan are lower than rates in the United States. We would do better to borrow Japanese yen rather than U.S. dollars”.

(Hint: Examine whether there is a relationship between the efficient market hypothesis and the exploitation of opportunities.)

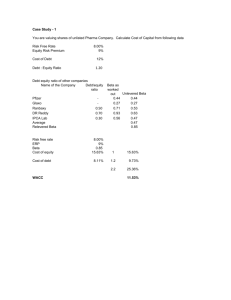

PROBLEM 3 (Chapter 14 An Overview of Corporate Financing )

In 2011 Pfizer had 12,000 million shares of common stock authorized, 8,784 million in issue, and 7,361 million outstanding (figures rounded to the nearest million). Its equity account was as follows:

Common stock $ 439

Additional paid-in capital 67,622

Retained earnings

Treasury shares

37,608

39,323

Contributions to an employee benefit trust have been deducted from retained earnings. a.

What is the par value of each share? b.

What was the average price at which shares were sold? c.

How many shares have been repurchased? d.

What was the average price at which the shares were repurchased? e.

What is the value of the net common equity?