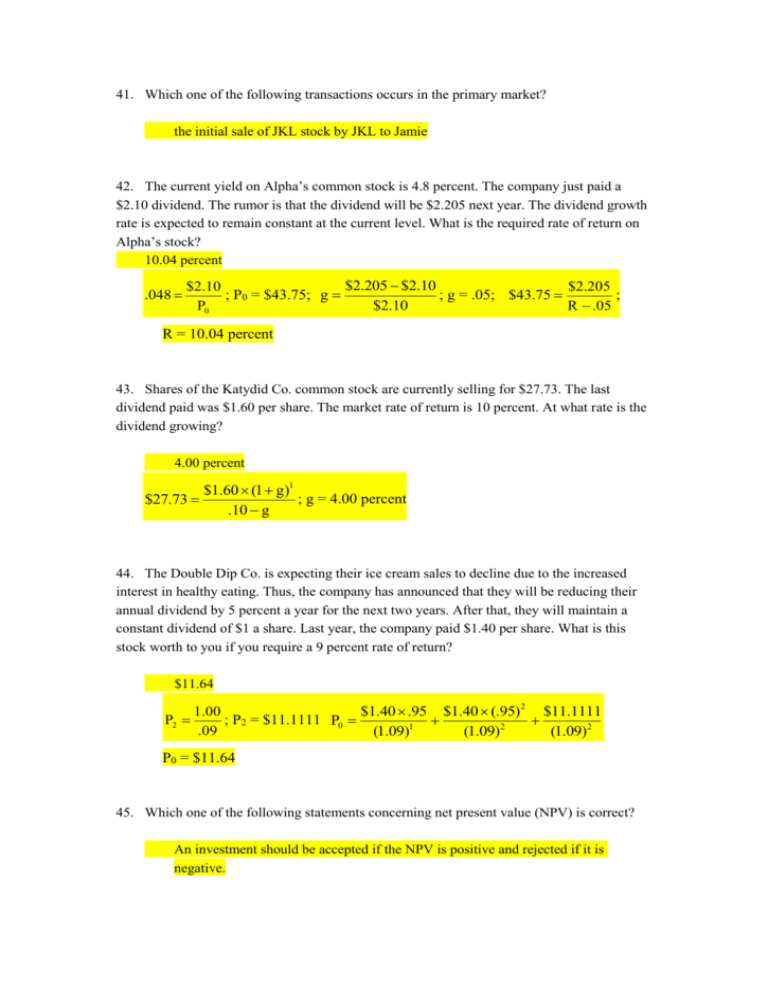

41. Which one of the following transactions occurs in the primary

advertisement

41. Which one of the following transactions occurs in the primary market? the initial sale of JKL stock by JKL to Jamie 42. The current yield on Alpha’s common stock is 4.8 percent. The company just paid a $2.10 dividend. The rumor is that the dividend will be $2.205 next year. The dividend growth rate is expected to remain constant at the current level. What is the required rate of return on Alpha’s stock? 10.04 percent .048 $2.205 $2.10 $2.205 $2.10 ; P0 = $43.75; g ; g = .05; $43.75 ; R .05 P0 $2.10 R = 10.04 percent 43. Shares of the Katydid Co. common stock are currently selling for $27.73. The last dividend paid was $1.60 per share. The market rate of return is 10 percent. At what rate is the dividend growing? 4.00 percent $27.73 $1.60 (1 g)1 ; g = 4.00 percent .10 g 44. The Double Dip Co. is expecting their ice cream sales to decline due to the increased interest in healthy eating. Thus, the company has announced that they will be reducing their annual dividend by 5 percent a year for the next two years. After that, they will maintain a constant dividend of $1 a share. Last year, the company paid $1.40 per share. What is this stock worth to you if you require a 9 percent rate of return? $11.64 P2 $1.40 .95 $1.40 (.95)2 $11.1111 1.00 ; P2 = $11.1111 P0 .09 (1.09)1 (1.09)2 (1.09)2 P0 = $11.64 45. Which one of the following statements concerning net present value (NPV) is correct? An investment should be accepted if the NPV is positive and rejected if it is negative. 46. Which of the following are capital budgeting decisions? I. determining whether to sell bonds or issue stock II. deciding which product markets to enter III. deciding whether or not to purchase a new piece of equipment IV. determining which, if any, new products should be produced II, III, and IV only 47. The average accounting rate of return: is similar to the return on assets ratio. 48. Analysis using the profitability index: is useful as a decision tool when investment funds are limited. 49. You are considering a project with the following data: Internal rate of return 8.7 percent Profitability ratio .98 Net present value -$393 Payback period 2.44 years Required return 9.5 percent Which one of the following is correct given this information? This project should be rejected based on the internal rate of return. 50. What is the profitability index for an investment with the following cash flows given a 9 percent required return? Year 0 1 2 3 Cash Flow -$21,500 $ 7,400 $ 9,800 $ 8,900 1.02 PVinf lows $7,400 $9,800 $8,900 ; PVinflows = $21,909.89 (1.09)1 (1.09) 2 (1.09)3 CF0 $ 0 C01 $7,400 F01 1 C02 $9,800 F02 1 C03 $8,900 F03 1 I=9 NPV CPT $21,909.89 PI $21,909.89 = 1.02 $21,500