Solultion to Case Study Cost of Capital 040513.xlsx

advertisement

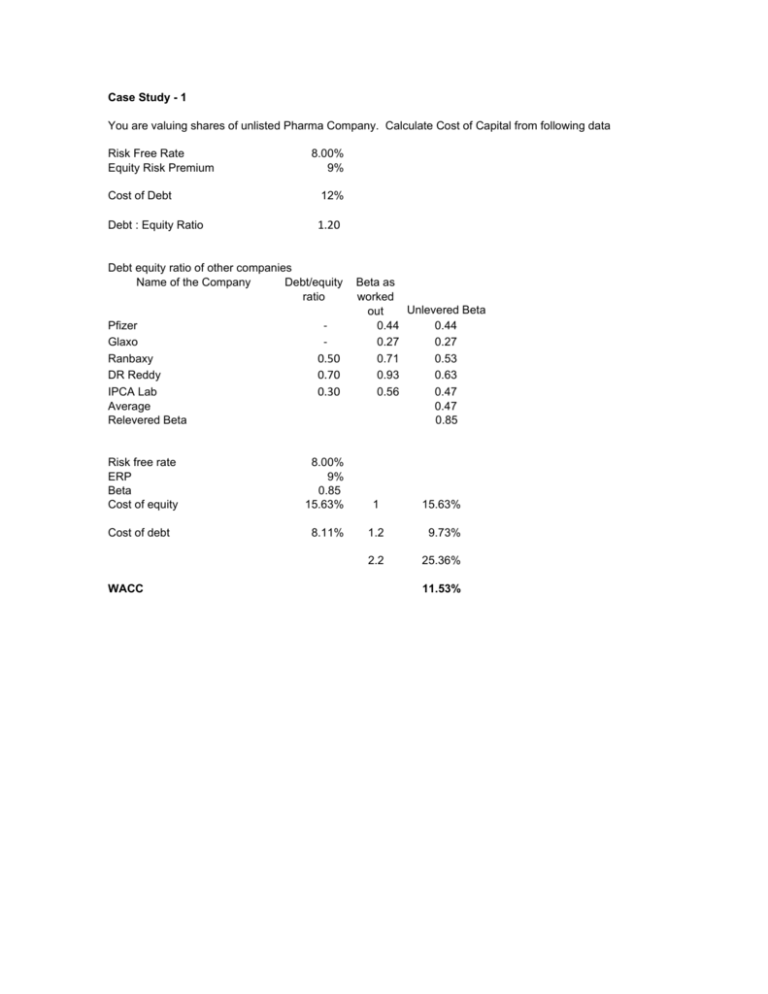

Case Study - 1 You are valuing shares of unlisted Pharma Company. Calculate Cost of Capital from following data Risk Free Rate Equity Risk Premium Cost of Debt Debt : Equity Ratio 8.00% 9% 12% 1.20 Debt equity ratio of other companies Name of the Company Debt/equity ratio Pfizer Glaxo Ranbaxy DR Reddy IPCA Lab Average Relevered Beta Risk free rate ERP Beta Cost of equity Cost of debt WACC ‐ ‐ 0.50 0.70 0.30 Beta as worked Unlevered Beta out 0.44 0.44 0.27 0.27 0.71 0.53 0.93 0.63 0.56 0.47 0.47 0.85 8.00% 9% 0.85 15.63% 1 15.63% 8.11% 1.2 9.73% 2.2 25.36% 11.53% Case Study - 2 You are valuing shares Tata Steel Limited. Calculate Cost of Equity using Gordon Dividend Model Current Market Price Expected Dividend Expected Growth Rate of Dividend Dividend Yield cost of equity 390.00 8.00 15% 2.05% 17.05% Case Study - 3 You are valuing shares of Dabur India. Calculate WACC from following data Risk Free Rate Equity Risk Premium Beta Cost of Debt Debt : Equity Ratio 8.00% 9% 0.7 10% 0.50 Other Info Company has some of its manufacturing facilities in tax free zone. 30% of its profit for next 5 years is exempt from tax. WACC for First 5 years cost of equity 14.30% 1 14.30% Cost of debt 7.73% 0.5 3.86% 1.5 18.16% WACC 12.11% WACC for subsequent Years cost of equity 14.30% 1 14.30% Cost of debt 6.76% 0.5 3.38% 1.5 17.68% WACC 11.79% Case Study - 4 You are valuing shares of XYZ Limited. Following is the data Risk Free Rate Equity Risk Premium Beta Cost of Term Loan Coupon on FCCB 8.00% 9% 1.3 12% 2% Additional info 1) FCCB are convertible into equity shares at fixed conversion price of Rs.180 per share 2) Premium payable to FCCB holders upon redemption after 5 years from date of issue will be such amount which gives them Yield to Maturity of 7.5% 3) Business of the Company is financed as follows Equity Debt FCCB 40% 40% 20% Calculate cost of capital under following scenarios a) current market price of the Company is Rs.105 b) current market price of the Company is Rs.200 c) current market price of the Company is Rs.280

![Question 2 [15 points]](http://s3.studylib.net/store/data/008612667_1-3c6e0662f7bbfa111ea1fe6b58f8cdef-300x300.png)