RATIOS

advertisement

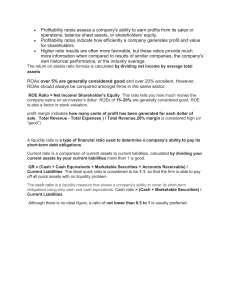

RATIOS Liquidity • Current Ratio = Total Current Assets Total Current Liabilities ***1.5 to 2 is desirable**** Measures ability to pay current liabilities with current assets Liquidity Ratios Debt/Equity Percentages Debt Ratio = Total liabilities x 100 Total Assets Shows proportion of assets that are financed with debt Low debt ratio is desirable Equity Ratio = Total Equity x 100 Total Assets Shows proportion of assets financed with shareholder’s funds **Two percentages are complementary, which means that they add up to 100** Profitability Rate of Return on Net Sales = Net Income x 100 Net Sales Measures the dollars that remain after all expenses are deducted from net sales Compare with other years. (look for trends) For example, 9.1% means 9₡ is left after all expenses are paid per dollar of sales. Profitability Gross Margin Percentage = Gross Margin Net Sales Revenue Measures the dollars that remain after cost of goods sold is deducted WitFit Letter Outline Intro – tell reason for writing Paragraph 1 – Liquidity Tell him the numbers and what they mean. Recommend what he should do. Paragraph 2 – Profitability Tell him the numbers and what they mean. Recommend what he should do. Paragraph 3 – Any other points. Final summary. **Remember to include graphs and charts as instructed in letter sample**