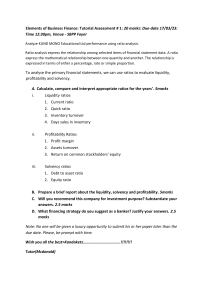

Financial Statement Analysis: Financial statement analysis is a fundamental process that allows investors, creditors, and stakeholders to evaluate a company's financial performance, profitability, solvency, and overall financial health. It involves analyzing key financial statements, including the income statement, balance sheet, and cash flow statement, to extract meaningful insights and make informed decisions. One of the primary objectives of financial statement analysis is to assess the profitability of a company. Analysts use profitability ratios such as net profit margin, return on assets (ROA), return on equity (ROE), and gross profit margin to measure how effectively a company generates profits relative to its assets, equity, and sales. Profitability analysis helps investors evaluate the company's operational efficiency, pricing strategies, cost control measures, and overall profitability trends over time. Another critical aspect of financial statement analysis is liquidity and solvency analysis. Liquidity ratios such as the current ratio and quick ratio assess the company's ability to meet short-term financial obligations and manage liquidity risks. Solvency ratios such as the debt-to-equity ratio and interest coverage ratio evaluate the company's long-term financial stability, leverage levels, debt repayment capacity, and financial risk exposure. Furthermore, financial statement analysis includes assessing the efficiency of asset utilization through turnover ratios such as inventory turnover, accounts receivable turnover, and asset turnover. These ratios measure how effectively the company manages its assets, inventory levels, receivables collection, and capital investments to generate revenue. Trend analysis, benchmarking against industry peers, and comparative analysis across periods help analysts identify financial trends, strengths, weaknesses, and areas for improvement. Qualitative factors such as industry dynamics, competitive positioning, management quality, and economic factors also inform financial statement analysis and investment decisions. In summary, financial statement analysis is a multifaceted process that combines quantitative analysis, ratio analysis, trend analysis, and qualitative assessment to provide a comprehensive evaluation of a company's financial performance and prospects.