ACCT223 Tax Accounting II - Raritan Valley Community College

advertisement

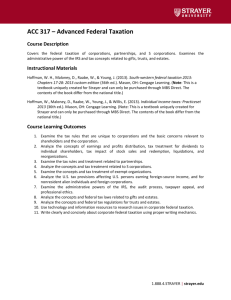

RARITAN VALLEY COMMUNITY COLLEGE Tax Accounting II ACCT- 223 I. II. Basic Course Information A. Course Number and Title: ACCT 223 Tax Accounting II B. Date of Proposal: May 2004 C. Sponsoring Department: Business & Public Service D. Semester Credit Hours: 3 E. Weekly Contact Hours: 3 F. Prerequisites: ACCT 221 Tax Accounting I G. Laboratory Fees: None Lecture: 3 Laboratory: 0 Catalog Description Prerequisite: ACCT 221 Tax Accounting I. This course continues the study of Tax Accounting I with the primary emphasis on Federal Income Tax Laws and Regulations relating to Corporations, S Corporations and Partnerships. In addition, the course will cover various federal tax issues concerning Trusts, Estates, Gifts, Generation-Skipping Transfer Tax and Retirement Planning. The course will specifically focus on tax research, planning and familiarization with tax forms and their preparation. III. Statement of Course Need This course is necessary to support students in the CPA Certificate Program as well as the AAS program and covers course material relevant to the Uniform CPA Examination per April 2004 Examination Content Specifications. It continues the study of Tax Accounting I with the emphasis on Federal Income Tax Laws and Regulations as applied to Corporations, Partnerships, Trusts, Estates and Gift Taxation. The study of Federal Income Tax is complex, and cannot be covered in one course. Currently, only three N J Community Colleges offer more than one course in Federal Taxation. Developing a second course in Federal Taxation may not only help provide additional learning opportunities for students at RVCC, but will also attract more students and further facilitate the development of RVCC’s CPA Education Requirement Certificate Program. In addition, it provides a significant opportunity to bridge course offerings between the academic (credit side) and continuing education (non-credit side). IV. Place of Course in College Curriculum V. Certificate Program: CPA Elective Outline of Course Content Taxation of Corporations o Basic Concepts Entity Choice Corporate Capital Structure Determination of Corporate Taxable Income and Tax Liability o Distributions and Reorganizations Partnerships: o Formation and Operation o Distributions, Sales and Exchanges S Corporations o Selecting the Subchapter S Form o S Corporation Taxation o Treatment of: Income, Deductions, Credits and Corporate Distributions o Termination of Election o Operational Rules Federal Estate and Gift Taxation o Legal Terms Common to Estates and Trusts o Computation and Payment of Estate Tax o Federal Gift Tax Exclusions o Generation-Skipping Transfer (GST) Tax Income Taxation of Trusts and Estates o Taxation of Trusts and Estates o Special Rules regarding taxation of Trusts Retirement and Estate Planning o Types of Retirement Plans o Qualified Pension Plans o Self-Employed Plans o Individual Retirement Plans (IRA’s) o Distributions to Employees and Beneficiaries o NonQualified Deferred Compensation Plans o Estate Planning Techniques Tax Research, Practice and Procedure o Tax Reference Materials o Primary and Secondary Sources o Research Methodology VI. Educational Goals and Learning Outcomes General Education Goals Students will: Identify issues related to federal income tax planning and compliance. (G.E. 1;G.E. 2) Apply tax related technological tools for research, information analysis, and problem solving. (G.E. 3) Evaluate ethical issues relating to federal income tax practice, compliance and planning. (G.E. 5) Apply quantitative reasoning to interpret data and solve problems relating to federal income tax practice, compliance and planning through written (tax research papers) and numeric form (tax return preparation). (G.E. 7) Learning Outcomes Students will be able to: VII. Modes of Teaching and Learning VIII. Apply basic tax concepts to various circumstances relating to the following: Corporations, Partnerships, S-Corporations, Trusts, Estates and Gift Taxation. Interpret relevant facts relating to a variety of federal income tax practice, compliance and planning scenarios using online and manual research tools. Apply theory and knowledge gained to communicate and solve problems in areas relating to federal income tax practice, compliance and planning matters. Identify the appropriate federal tax forms and supporting schedules, including Corporate Forms 1120 and 1120S, Partnership Form 1065, Estate Form 706 as well as Gift and Generation-Skipping Tax Return Form 709. Lecture/Discussion Small-group work Computer- assisted instruction Student collaboration Independent Study Papers, Examinations, and other Assessment Instruments Interim Examinations and Final Exam Individual Tax Return Projects and Research Papers Demonstrations including: o Homework Assignments o Class participation o In class and small group projects IX. Grade Determinants Projects, exams, homework, and class participation will be used to assess the students according to the learning outcomes and general education goals listed above. X. Suggested Material Textbook: Smith, Harmelink & Hasselback. 2004 CCH Federal Taxation Comprehensive Topics, Irwin McGraw-Hill, 2003. ISBN 0808009605. Note: New Text, latest edition to be released May 2004. Student Study Manual: Foth. 2004 CCH Federal Tax Study Manual, CCH, 2003. ISBN 0808009818. Note: Optional, New Text, latest edition to be released May 2004. Supplemental Publisher Resources including: o Web research using CCH’s Online Tax Research Network o Tax Return Practice Sets o US Master Tax Guide. Web Resources including IRS, www.irs.gov/ Tax Return Software – Optional (Please Note: The course outline is intended only as a guide to course content and resources. Do not purchase textbooks based on this outline. The RVCC Bookstore is the sole resource for the most up-to-date information about textbooks.) XI. Resources Course will require use of a CATT room or Overhead Projection.