To what extent should Canadians support social

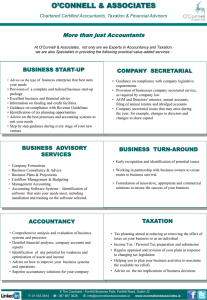

advertisement

Chapter Eight By: Kristin, Brett, and Skyler Pg. 281-285 TO WHAT EXTENT SHOULD CANADIANS SUPPORT SOCIAL PROGRAMS AND TAXATION? What’s the connection between taxation and social programs? Government collects taxes to pay for services it provides to citizens, such as social programs. Individual Canadian citizens pay two kinds of tax to the federal government and to their provincial government, these taxes are: • Sales Tax – Tax Paid at the time of buying a product or service, and based on a percentage of the price of the product or service. • Income Tax – Is based on what you earn: the more money you earn the more tax you pay. • Goods and Services Tax – Is a sales tax that everybody in Canada pays. A federal sales tax in Canada. • Median – a concept in statistics that means the middle number in a set of data organized in order of least to most. What is an example of a tax you or your family pays here in Canada? Spending By Canada's Government (2007) Recreation and Culture 2% Health 10% Enviroment 1% Education 3% Debt Charges 15% Foreign Affairs and International Assistance 3% Social Services 32% Transportation and Communincation 2% Protections of Persons and Property 12% Resource Conservation and Industry 4% Other 16% Spending By Alberta's Government (2007) Recreation and Culture 2% Health 33% Environment 2% Education 25% Debt Charges 2% Transportation and Communication 6% Social Services 15% Protections of Persons and Property 3% Resource Conservation and Industry 7% Other 5% What is a Taxation Model? A taxation model is a policy about taxation that describes, what to tax, how much to tax, and how to spend taxes. Jobs and Income Individuals Taxes Government Programs and Services for Everyone Based on the flow chart above, how may lack of taxes affect programs and services for everyone? How does paying or not paying taxes affect social programs and quality of life? • In all countries, it is against the law to avoid paying taxes. Canadians must report what they earn, so government can determine and collect the taxes they owe. • The economic activity that governments tax is called the tax base. The tax base pays for the services provided by government, such a social programs. • Tax evasion is misrepresenting what you earn to avoid taxes. • People who work without paying taxes are part of the underground economy“underground” because it functions in secret from the government. Also called the black market. • Workers can work without reporting what they are doing and the money they are collecting to avoid paying taxes, which means more money for them and less for the government. To what extent does the underground economy affect quality of life for you and others? Video http://video.google.com/videoplay?docid= 4213985495402281839# Created By: Kristin Short Skyler Keeping Brett Bauer Matt Lander

![Job Description [DOCX - 55 KB]](http://s3.studylib.net/store/data/006895349_1-819903366b2251ed50e700b744e8196f-300x300.png)