International Financial Management Spring, 2016 Homework

advertisement

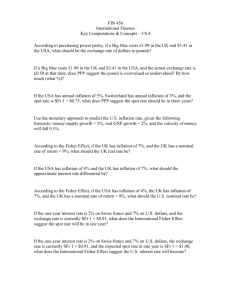

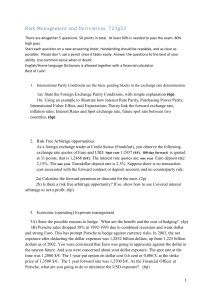

International Financial Management Spring, 2016 Homework Questions 1: Due date–Tuesday, Feb 23, 2016 Name: Instructions: • Read the questions carefully, write all your steps where necessary. • You don’t have to computer-type the solution. However, the hand-written version has to be reader-friendly. • Hard copies of the solutions must be dropped in the TA’s box by 6PM on the due date. No later submission will be accepted. • You may work in groups of four or less, and only one solution set will be turned in by each group. The grade on the problems turned by the group will be given to each member of the group. 1. If the $/£ bid and ask prices are $1.50 and $1.51, respectively, the corresponding £/$ bid and ask prices are: (a) £0.6667 and £0.6623 (b) $1.51 and $1.50 (c) £0.6623 and £0.6667 (d) cannot be determined with the information given 2. The $/CAD spot bid-ask rates are $0.7560-$0.7625. The 3-month forward points are 12-16. Determine the $/CAD 3-month forward bid-ask rates. (a) $0.7548-$0.7609 (b) $0.7572-$0.7641 (c) $0.7512-$0.7616 (d) cannot be determined with the information given 3. The SF/$ spot exchange rate is SF1.25/$ and the annual forward premium is 8 percent. What is the 180 day forward exchange rate? (a) SF1.30/$ (b) SF1.20/$ (c) SF6.25/$ – 1– International Financial Management Spring, 2016 (d) None of the above 4. A formal statement of IRP is (a) (b) (c) 1+i$ 1+i£ 1+i$ 1+i£ 1+i$ 1+i£ = = = F ($/£) S($/£) S($/£) F ($/£) F ($/£)−S($/£) S($/£) (d) F ($/£) − S($/£) = i$ − i£ 5. Suppose that the one-year interest rate is 5.0 percent in the Hong Kong, the spot exchange rate is $1.20/e, and the one-year forward exchange rate is $1.16/e. What must be the one-year interest rate in the euro zone? (a) (b) (c) (d) 5.0% 1.09% 8.62% None of the above. 6. Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting e0.7627/$1.00 and Credit Suisse is offering SF1.1806/$1.00. You learn that UBS is making a direct market between the Swiss franc and the euro, with a current e/SF quote of e0.6395/SF1.00. Show how you can make a triangular arbitrage profit by trading at these prices (ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What happens if you initially sell dollars for Swiss francs? What e/SF price will eliminate triangular arbitrage? 7. The current spot exchange rate is $1.95/£ and the three-month forward rate is $1.90/£. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be $1.92/£ in three months. Assume that you would like to buy or sell £1,000,000. (a) What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculations? (b) What would be your speculative profits in dollar terms if the spot exchange rate actually turns out to be $1.86/£? 8. Suppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The interest rate is 8 percent per annum in the United States and 7 percent per annum in Germany. Currently, the spot exchange rate is e1.01 per dollar and the six-month forward exchange rate is e0.99 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should he/she invest to maximize the return? 9. Do you have any comments or questions regarding our class so far? – 2–