Advanced Accounting Course No.:02833670 Program

advertisement

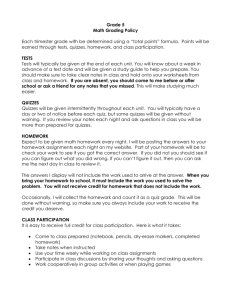

Advanced Accounting Course No.:02833670 Program: Undergraduate Credit: 2 Time: Mon.2-4 Instructor: YueHeng Location: 112#1 Prerequisite: Financial Accounting Semester: 2012 Fall Contact Information: Office: Rm322, Guanghua New Building Email:yueheng@gsm.pku.edu.cn Office Hour: 12:30-15:30 Thursday, or by appointment Program Learning Goals and Objectives Learning Goal 1: Graduates will possess a solid understanding of business and management and will be able to translate this knowledge into practice. 1.1 Objective 1 Our students will have a good command of fundamental theories and knowledge. 1.2 Objective 2 Our students will have a good command of analytical methods and decision-making tools. 1.3 Objective 3 Our students will be able to apply theories and methodologies in key business functions. Learning Goal 2: Our students will be able to think critically. 2.1 Objective 1 Our students will be able to identify and summarize problems 2.2 Objective 2 Our students will be able to collect data and analyze problems in a critical manner 2.3 Objective 3 Our students will be able to put forward effective solutions to business problems Learning Goal 3:Our students will have a sense of social responsibility. 3.1 Objective 1 Our students will be aware of the importance of ethics. 3.2 Objective2 Our students will be able to provide solutions that take account of contrasting ethical standpoints. Learning Goal 4: Our students will be effective communicators. 4.1 Objective 1 Our students will be proficient in oral and written communication. 4.2 Objective 2 Our students will possess good interpersonal skills. 4.3 Objective 3 Our students will be able to adapt to diverse learning environments. Learning Goal 5: Our students will have global perspectives. 5.1 Objective 1 Our students will be aware of social and cultural differences. 5.2 Objective2 Our students will be aware of the impact of globalization on business operations, opportunities, and challenges. 5.3 Objective 3 Our students will be proficient in English. 1 Course Overview The course covers accounting issues that have not been discussed in fundamental and intermediate accounting courses. Main contents include accounting method for financial assets, equity method for investments, consolidated financial statements, variable interest entity, inter‐company transactions and other complex issues in financial accounting. Course Objectives The main objectives of the course are as follows: first, teach students the accounting techniques in dealing with specific accounting issues, such as investments, consolidated financial statements, financial assets. Second, stimulate student deeper thoughts about the accounting policy making, and firms’ choices of accounting rules. Accounting rules in China and U.S. will be compared and discussed to help students widen their international perspective. Detailed Course Plan The following contents will be covered in the course. I reserve the right to change according to the actual progress of the class. Introduction to advanced accounting Merger and Acquisition Accounting for passive investments Equity method for investment Consolidation of financial information at the date of acquisition Consolidation of financial information subsequent to the date of acquisition Consolidated financial statements and outside ownership Consolidated financial statements‐intercompany assets transactions Variable interest entities, intercompany debt Consolidated financial statements‐Ownership patterns Foreign currency transactions and statements Final Exam:close-book exam Teaching Methods Classes will be conducted in a lecture‐discussion format. The lectures will introduce topics and provide theory and examples, following the conceptual structure of the materials. Articles from financial press and short cases will be discussed to develop the understanding of the environment in which accounting standards are set, and the implications for different accounting methods. Students will also be exposed to current accounting research frontier. Student participation is expected. In order to get the most from this class, students must prepare for each lecture in advance. IT tools to be used in the classroom PPT and video clips Textbooks Advanced Accounting, by Hoyle, Schaefer, &Doupnik, McGraw‐Hill Irwin References & Readings Advanced accounting by Fischer, Taylor and Cheng. Advanced accounting by Jeter and Chaney 2 Rules students must follow Class Attendance and Participation: Regular class attendance is essential and required. The attendance will be randomly checked in class. You can contribute to class by asking or answering questions, attending discussion, or making comments. If circumstances prevent attendance at a class meeting, please send me email for permission. Remember that you are responsible for all materials discussed, handouts distributed, assignments covered, and announcements made. Homework: There are a few homework assignments during the semester. Students need to submit homework at the beginning of the class as indicated in tentative schedule below. Homework will be graded based on efforts not accuracy. Late assignments will not be accepted. Homework should be done individually. Students who found plagiarism will fail the course. Quizzes: There will be one or two quizzes during the class. Each quiz will be around 15‐20 minutes long. The quizzes aim to encourage students to keep the pace with the course. Group Project: Students are required to complete a group project. Each group consists of 5‐6 students. The project requires students to collect materials and to discuss a specific issue related to our course. Selected groups will need to do a presentation for about 20 minutes. The score for the group project will depend on the quality of the project and contribution of each person in the group. Exams: There will be a final exam. The exam will be a mixture of objective questions (i.e. multiple choice), essay questions or/and case analysis. Missing exams without legitimate reasons will result in a score of 0. Course Assessment Class attendance and participation Homework Quizzes Group Project Exam 50 Total: 100 5 15 15 15 (The above only gives a raw score. Due to the requirements of the university, the final grade will be adjusted to an appropriate distribution.) How does this course serve the Assurance of Learning Assessment? The aim of this course is to help students to learn accounting knowledge about complexbusiness activities and to develop a global perspective of business situation and institutions. This course will serve the learning goals of the program in the following way: Students will study cases about accounting fraud and realize the importance of business 3 Students will learn the knowledge of accounting policy and accounting treatment about complex business activities. Students will understand the differences in accounting policies around the world and develop more effective inter‐cultural communication skills. Students will work on team project and develop team‐working spirit and leadership capability. 4