BE3201

ENTREPRENEURIAL FINANCE

_________________________________________________________________________

Course Description and Scope

The course is not only relevant for would-be entrepreneurs, but also for those considering a career in

commercial banks, investment banks, private equity firms, venture capital firms, as well as in

corporate venture investments. This course differs from a typical corporate finance course in that it

highlights the special and unique considerations when planning the financial needs of new ventures

and young companies. Many typical avenues of funding (such as bank borrowing, issuing of bonds or

issuing of liquid equities) for established or public listed companies are not accessible to small and

young companies due to the lack of business track record. The analyses and requirements of

investors who are considering providing finances to small and young companies may also be different

from that of public equity investments. This course will provide students with the understanding of

various aspects and processes in financial planning and financial management of new ventures or

young companies, as well as investment analyses and considerations for investors providing funding

to such companies.

Teaching Pedagogy

The course will be conducted through weekly three-hour seminar sessions. Students will be

introduced to the different financing tools and aspects of managing entrepreneurial ventures, as well

the investment considerations of private equity or venture capital investors. A hands-on session will

also be conducted to allow students to acquire Microsoft Excel spreadsheet intermediate skills, which

will be useful in financial forecasting.

Course Learning Objective

Acquisition of knowledge:

Students should demonstrate knowledge and application ability of core curriculum.

Problem solving & decision making:

Students should develop abilities to identify, analyze, solve financial problems for small companies or

new ventures, and effectively negotiate for external funding.

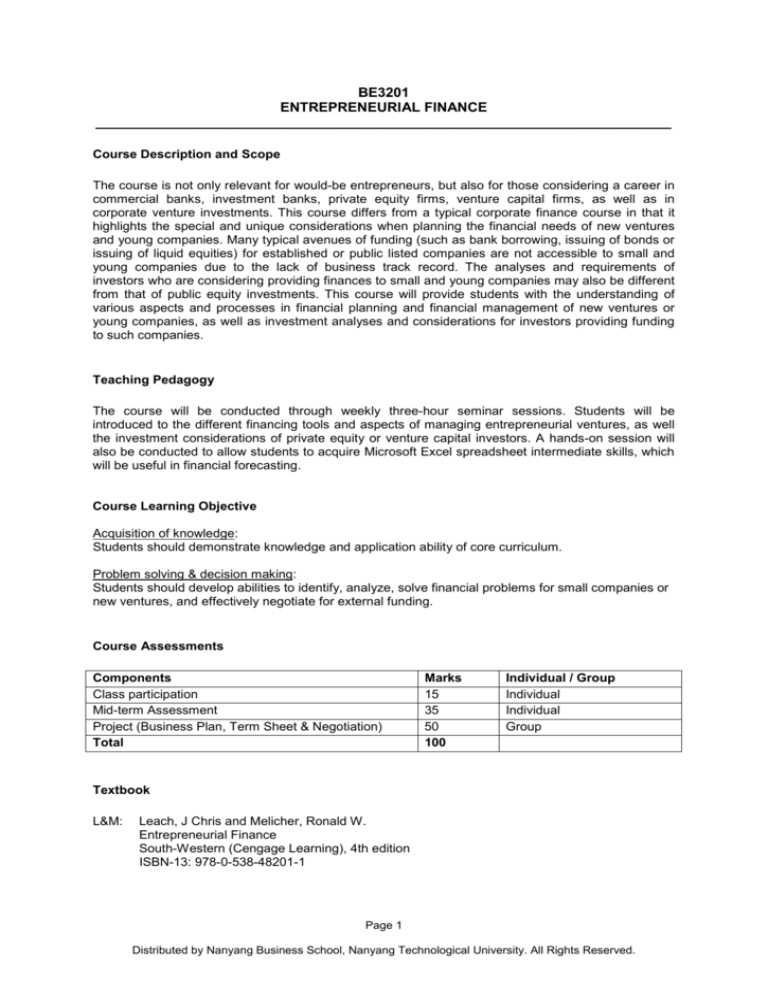

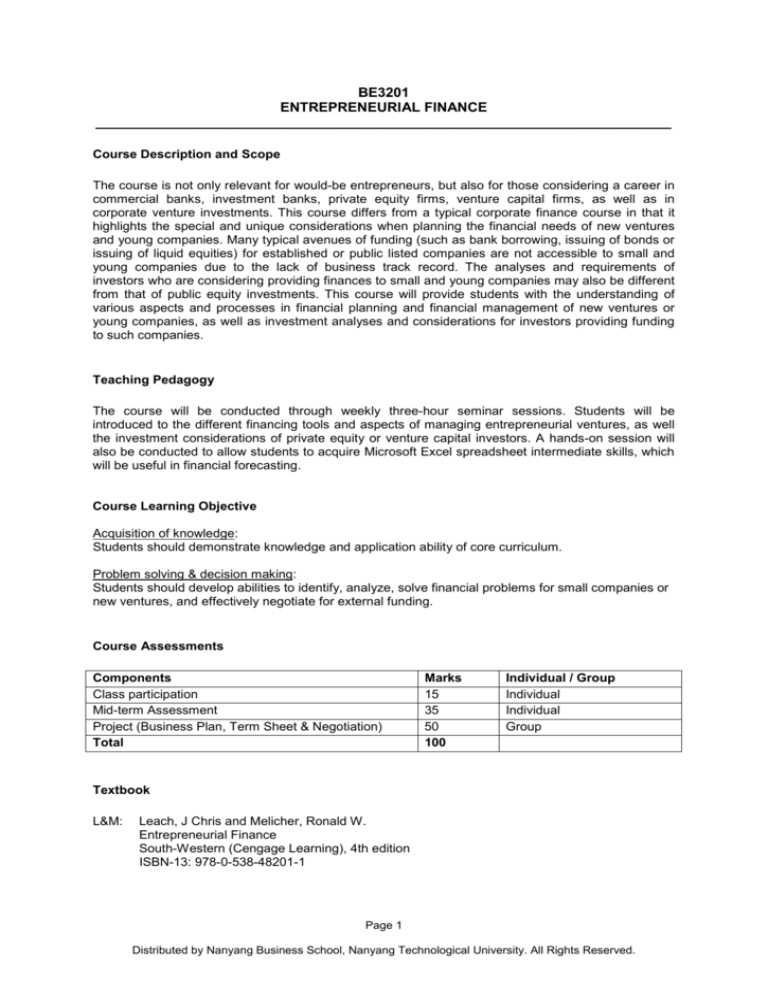

Course Assessments

Components

Class participation

Mid-term Assessment

Project (Business Plan, Term Sheet & Negotiation)

Total

Marks

15

35

50

100

Individual / Group

Individual

Individual

Group

Textbook

L&M:

Leach, J Chris and Melicher, Ronald W.

Entrepreneurial Finance

South-Western (Cengage Learning), 4th edition

ISBN-13: 978-0-538-48201-1

Page 1

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.

Proposed Weekly Schedule

Week

Topic

1

Introduction – Overview

From Idea to the Business Plan

Organizing and Financing a New Venture

Measuring and Evaluating Financial Performance

Short-Term Financial Planning

Long-Term Financial Planning

(Microsoft Excel practice)

Types and Costs of Financial Capital

Valuing Early-Stage Ventures

Venture Capital Valuation Methods

Recess week

Professional Venture Capital

(Project – Presentation of Business Plan)

Other Financing Alternatives

(Project – Presentation of Term Sheet)

Security Structures and Determining Enterprise Values

(Project –Discussion and Investment Negotiation on Term Sheet)

Harvesting the Business Venture Investment Financially Troubled Ventures: Turnaround

Opportunities

(Project – Deal closing and final presentation)

2

3

4

5

6

7

8

9

10

11

12

13

14

Page 2

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.