Slide 1

advertisement

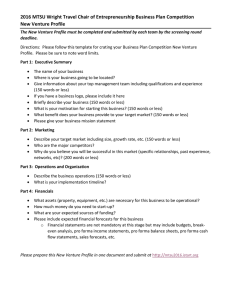

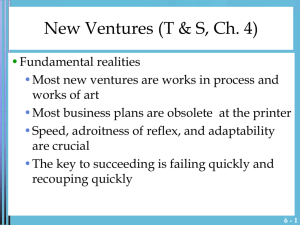

New Venture: The Opportunity Prof. Alexander Settles New Ventures • Fundamental realities – Most new ventures are works in process and works of art – Most business plans are obsolete at the printer – Speed, adroitness of reflex, and adaptability are crucial – The key to succeeding is failing quickly and recouping quickly New Ventures • Fundamental realities – Success is highly situational, depending on time, space, context, and stakeholders – The best entrepreneurs specialize in making “new mistakes” only – Starting a company is much harder than it looks, or you think it will be; but you can last a lot longer and do more than you think if you do not try to do it solo Circle of Venture Capital Ecstasy Where are Opportunities Born? • Technology sea change – Moore’s Law – “The number of transistors incorporated in a chip will approximately double every 24 months.” – Metcalf’s Law - the value of a telecommunications network is proportional to the square of the number of connected users of the system – Disruption • Market sea change – Value chain disruption/ obsolescence/vulnerability – Deregulation Where are Opportunities Born? • Societal sea change – Changes in ways we live, learn, work, etc. – Gilder’s Law – the total bandwidth of communication systems triples every twelve months • Brontosaurus factor – Arrogance – Loss of peripheral vision – Deadened reflexes – turning the tanker Window of Opportunity Evaluating • Criteria for evaluating venture opportunity – Industry and market – Economics – Harvest issues – Competitive advantage issues – Management team issues – Personal criteria – Strategic differentiation Brainstorming Rules • • • • • Define your purpose Choose participants Choose a facilitator Brainstorm spontaneously, copiously No criticisms, no negatives Screening Venture Opportunities Anchors of Superior Businesses • Create or add significant value to a customer or end user • Solve a significant problem, or meet a significant want or need, for which someone is willing to pay a premium • Are a good fit with the founder(s) and management team at the time and marketplace and with the risk-reward balance Anchors of Superior Businesses • Have robust market, margin, and moneymaking characteristics • Strong and early free cash flow (recurring revenue, low assets, and working capital) • High profit potential (10 to 15 percent + after tax) • Attractive realizable returns for investors (25 to 30 percent + IRR) Screening Methodologies • Quick Screen – Provides a broad overview of an idea’s potential – Enables the entrepreneur to conduct a preliminary review and evaluation of an idea in a short period of time • Venture Opportunity Screening Exercises (VOSE) – Segments the screening of ideas into extremely detailed but manageable pieces The Business Plan Business Plan • Objectives – Carefully articulate the merits, requirements, risks, and potential rewards of the opportunity and how it will be seized – Demonstrate how the four anchors reveal themselves to the founders and investors by converting all the research, careful thought, and creative problem solving from the Venture Opportunity Screening Exercises into a thorough business plan What Does It Reveal? • A business plan for a high potential venture reveals the business’ ability to: – Create or add significant value to a customer or end user – Solve a significant problem, or meet a significant want or need for which someone will pay a premium – Have robust market, margin, and moneymaking characteristics – Fit well with the founder(s) and management team at the time, in the marketplace, and with the risk-reward balance Business Plan • I. EXECUTIVE SUMMARY – Description of the business concept and the business opportunity and strategy – Target market and projections – Competitive advantages – Costs – Economics, profitability, and harvest potential – The team – The offering Business Plan • II. THE INDUSTRY AND THE COMPANY AND ITS PRODUCT(S) OR SERVICE(S) • • • • The industry The company and the concept The product(s) or service(s) Entry and growth strategy • III. MARKET RESEARCH AND ANALYSIS • • • • • Customers Market size and trends Competition and competitive edge Estimated market share and sales Ongoing market evaluation Business Plan • IV. THE ECONOMICS OF THE BUSINESS – – – – – Gross and operating margins Profit potential and durability Fixed, variable, and semivariable costs Months to breakeven Months to reach positive cash flow • V. MARKETING PLAN – – – – – – Overall marketing strategy Pricing Sales tactics Service and warranty policies Advertising and promotion Distribution Business Plan • VI. DESIGN AND DEVELOPMENT PLAN – Development status and tasks – Difficulties and risks – Product improvement and new products – Costs – Proprietary issues • VII. – – – – – MANUFACTURING AND OPERATIONS PLAN Operating cycle Geographical location Facilities and improvements Strategy and plans Regulatory and legal issues Business Plan • VIII. MANAGEMENT TEAM – – – – – – – – • IX. • X. Organization Key management personnel Management compensation and ownership Other investors Employment and other agreements and stock option and bonus plans Board of directors Other shareholders, rights, and restrictions Supporting professional advisors and services OVERALL SCHEDULE CRITICAL RISKS, PROBLEMS, AND ASSUMPTIONS Business Plan • XI. THE FINANCIAL PLAN – Actual income statements and balance sheets – Pro forma income statements / forma balance sheets – Pro forma cash flow analysis – Breakeven chart and calculations – Cost control – Highlights Business Plan • XII. PROPOSED COMPANY OFFERING – Desired financing – Offering – Capitalization – Use of funds – Investor’s return • XIII. APPENDICES