Final Exam

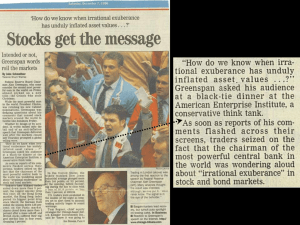

advertisement

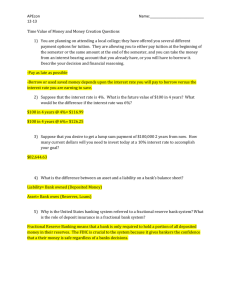

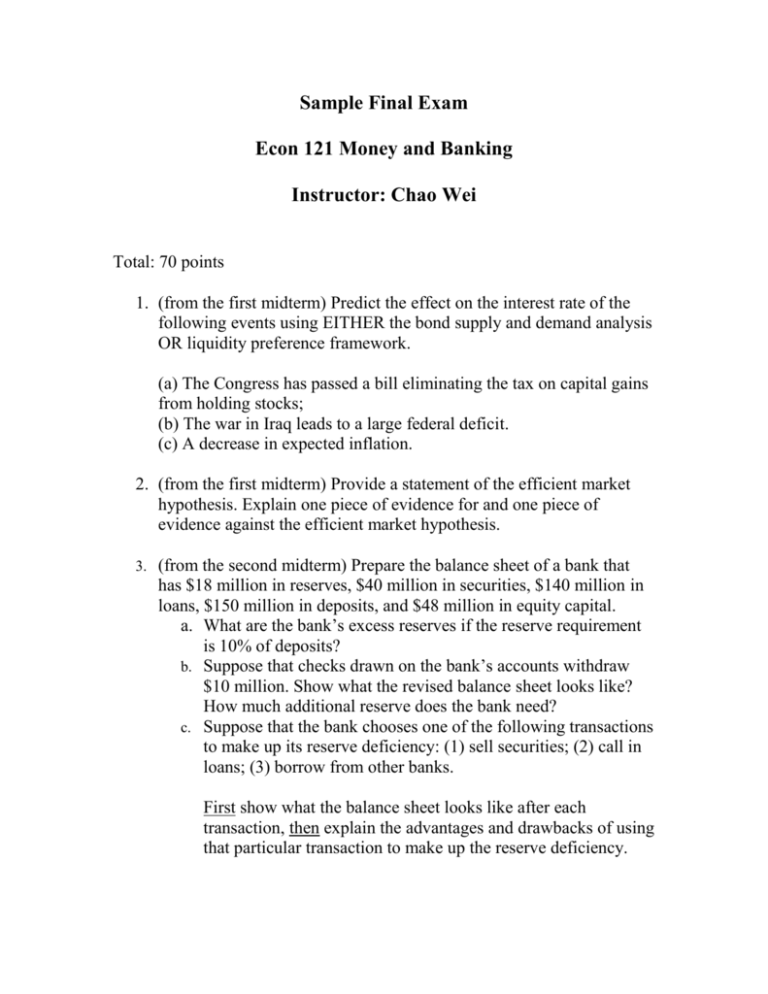

Sample Final Exam Econ 121 Money and Banking Instructor: Chao Wei Total: 70 points 1. (from the first midterm) Predict the effect on the interest rate of the following events using EITHER the bond supply and demand analysis OR liquidity preference framework. (a) The Congress has passed a bill eliminating the tax on capital gains from holding stocks; (b) The war in Iraq leads to a large federal deficit. (c) A decrease in expected inflation. 2. (from the first midterm) Provide a statement of the efficient market hypothesis. Explain one piece of evidence for and one piece of evidence against the efficient market hypothesis. 3. (from the second midterm) Prepare the balance sheet of a bank that has $18 million in reserves, $40 million in securities, $140 million in loans, $150 million in deposits, and $48 million in equity capital. a. What are the bank’s excess reserves if the reserve requirement is 10% of deposits? b. Suppose that checks drawn on the bank’s accounts withdraw $10 million. Show what the revised balance sheet looks like? How much additional reserve does the bank need? c. Suppose that the bank chooses one of the following transactions to make up its reserve deficiency: (1) sell securities; (2) call in loans; (3) borrow from other banks. First show what the balance sheet looks like after each transaction, then explain the advantages and drawbacks of using that particular transaction to make up the reserve deficiency. 4. (from the second midterm) Joe deposits $1 million dollars in a bank called Magna, which in turn makes loans to Net worth Corporation. Joe is also a shareholder of Magna. Describe all the moral hazard problems for the three parties involved, and for each moral hazard problem, propose at least one tool to deal with it. 5. Predict what will happen to the money supply if (a) the Fed abolishes the discount loan; (b) the Fed starts to pay interest on excess reserves; (c) expected inflation suddenly increased. 6. Using the GRAPHIC supply and demand analysis of the market for reserves, show what happens to the federal funds rate, holding everything else constant, if the economy is surprisingly strong, leading to a rise in the amount of checkable deposits. (Mishkin P409, Q7) 7. Mishkin P373 Q5. 8. Mishkin P409, Q15.