Money and Banking (econ 121)

advertisement

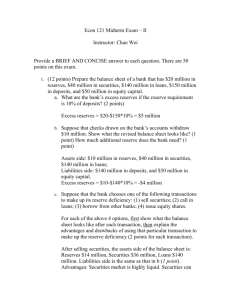

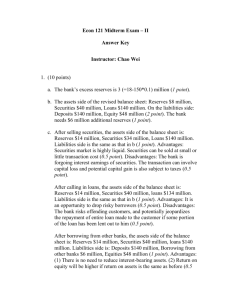

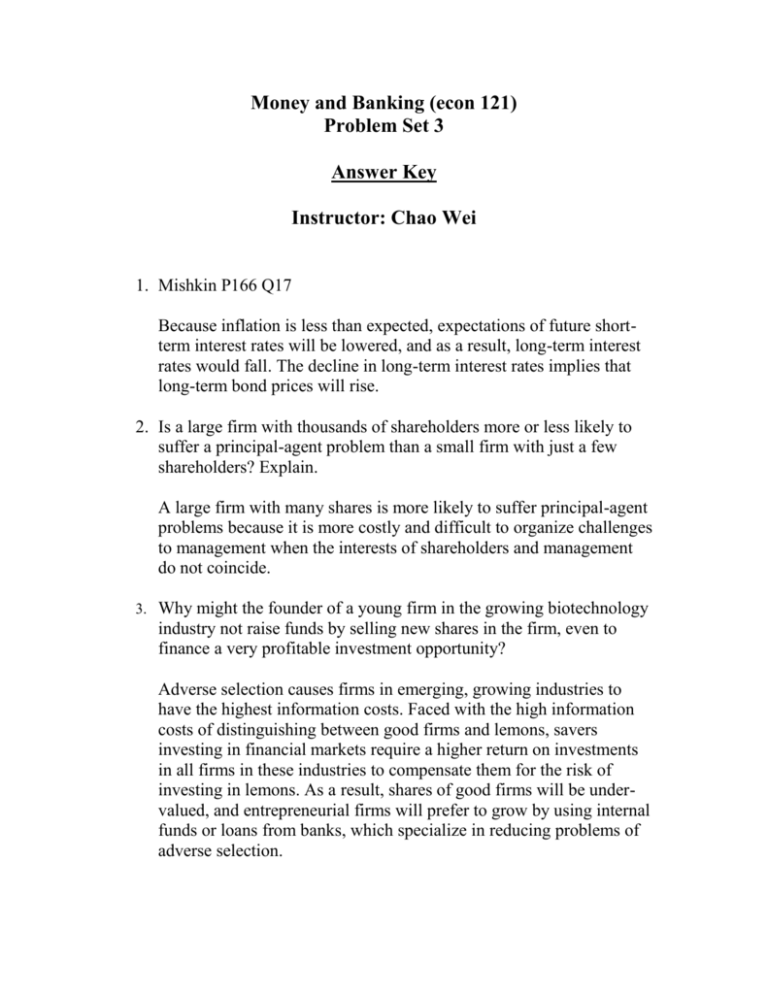

Money and Banking (econ 121) Problem Set 3 Answer Key Instructor: Chao Wei 1. Mishkin P166 Q17 Because inflation is less than expected, expectations of future shortterm interest rates will be lowered, and as a result, long-term interest rates would fall. The decline in long-term interest rates implies that long-term bond prices will rise. 2. Is a large firm with thousands of shareholders more or less likely to suffer a principal-agent problem than a small firm with just a few shareholders? Explain. A large firm with many shares is more likely to suffer principal-agent problems because it is more costly and difficult to organize challenges to management when the interests of shareholders and management do not coincide. 3. Why might the founder of a young firm in the growing biotechnology industry not raise funds by selling new shares in the firm, even to finance a very profitable investment opportunity? Adverse selection causes firms in emerging, growing industries to have the highest information costs. Faced with the high information costs of distinguishing between good firms and lemons, savers investing in financial markets require a higher return on investments in all firms in these industries to compensate them for the risk of investing in lemons. As a result, shares of good firms will be undervalued, and entrepreneurial firms will prefer to grow by using internal funds or loans from banks, which specialize in reducing problems of adverse selection. 4. Prepare the balance sheet of a bank that has $20 million in reserves, $40 million in securities, $140 million in loans, $150 million in deposits, and $50 million in equity capital. a. What are the bank’s excess reserves if the reserve requirement is 10% of deposits? Excess Reserves = 20 – 0.1*150 = 5 million. b. Suppose that checks drawn on the bank’s accounts withdraw $10 million. Show what the revised balance sheet looks like. What are the bank’s excess reserves? Assets side: reserves $10 million, securities $40 million, loans $140 million; Liabilities side: deposits $140 million, capital $50 million. Excess Reserves = 10 – 0.1*140 = -$4 million. As a result, the bank needs to raise its reserves by $4 million to satisfy the reserve requirement. c. Suppose that the bank borrows half of its reserve deficiency from other banks and sell securities to make up the other half of its reserve deficiency. Now what does its balance sheet look like? Assets side: reserves $14 million, securities $38 million, loans $140 million; Liabilities side: deposits $140 million, borrowing from other banks $2 million, capital $50 million. d. Asset side: Reserves 14m, Securities 40m, Loans 140m; Liabilities side: Deposits 140m, bank capital(or equity, net worth) 54m. 5. Mishkin P228, Q15. The gap is $10 million ($30 million of rate-sensitive assets minus $20 million of rate-sensitive liabilities). The change in bank profits from the interest rise is +0.5 million (5%*10 million). The interest risk can be reduced by increasing the rate-sensitive liabilities to $30 million or by reducing the rate-sensitive assets to $20 million. Transactions in financial derivatives, like interest rate swap, can also reduce the interest rate risk.