TXINV & Stock Pitch - Texas Investment Conference

advertisement

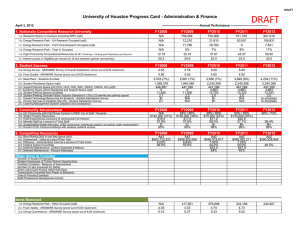

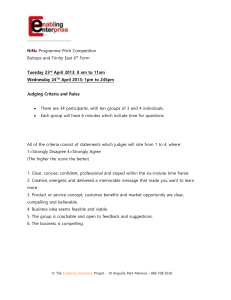

TXINV & Stock Pitch Stock Pitch Info Session Conference Overview • • • 2 Panels of Speakers Keynote – Dennis Murphree See Schedule and all relevant information at TXINV.com Competition Overview Key Points • This conference aims to educate any people interested in learning about different investment techniques and industry trends by combining industry panels with a stock pitch competition and networking lunch. • Prize Money • – 1st Place - $1000 – 2nd Place - $400 – 3rd Place - $200 REGISTER AT TXINV.COM Competition Overview Key Points • Date: Saturday, April 25 from 10:00am – 5:30pm • Location: SAC Ballroom • Sign-in Begins: 10:00 AM outside Ballroom • Team Composition: 2 – 4 students of any undergraduate classification • Breakfast & Lunch Provided Format Presentation • PowerPoint Format – 15 minutes of uninterrupted presentation time – 5 minutes of Q&A from Judges – Prelims – 10 minutes of Q&A from Judges - Finals • • Business Professional attire required PC’s for the presentation will be provided – Presentation remotes will not be provided Competition Overview Evaluation Criteria • Presentation • Industry/Market Analysis • Financial Analysis • Strategic Analysis • Balance of Risk/Return • X-Factor Event Details Pitch Specifications • U.S. Exchange Traded Equities • $1 Billion+ market capitalization • PowerPoint presentation AND one-pager should be emailed to president@usiteam.org by 8am Saturday • See example 1 pager at txinv.com Event Details Round Setup • • Preliminary Round: – 15 minute presentation – 5 minute Q&A period Final Round: – 1 Room – 15 minute presentation – 10 minute Q&A period Networking Networking Opportunities • Boxed lunches provided • Central eating location for judges and students – Networking encouraged • Resume book submitted to all judges Typical Stock Pitch • • • • • Company Overview Industry Analysis Investment Thesis Risks Overview Financial Analysis Typical Stock Pitch Industry Analysis • • • • Major competitors in the industry Trends in the overall industry Porter’s Five Forces Expectations of industry trends Typical Stock Pitch Investment Thesis • Why did you pick this as an investment? • Support your argument Typical Stock Pitch Risk Overview • • • • Major Macroeconomic Risks Major Industry Risks Major Company-specific Risks Mitigating Factors Typical Stock Pitch Company Overview • • • • • How the company makes money What the company sells Who the company sells to and buys from Competitive advantages of the company Growth Opportunities Investment Thesis China’s Real Estate Bubble Where do you look to invest? Global Economic Blue Instability chip value stocks that consistently outperform in both bull and bear markets Eurozone Crisis Student Loan Bubble Investment Thesis Global Tech Services Global Business Services Software Systems and Technology Global Financing Industry Analysis First to Market 1) Consultants define needs 2) Meet demand in real time 3) Industries are digitally dependent Digitization Cloud Computing Industry Analysis Bargaining Power of Buyers Current Industry Competition Threats of Substitutes Bargaining Power of Suppliers 400,000 employees vs. 100,000 employees Vs. Threats of New Entrants Competitive Advantages Emerging Market Dominance Innovative Expansion Blue Chip Protection Emerging Market Dominance The Energy and Utilities Solution Lab in China In 2011, IBM openedKey100 new offices Takeaway Emerging Markets will drive 60+% of Natural Resource Solution Centers in Brazil IBM is building out infrastructurethe and developing beyond BRIC countries strategic industries by responding to massive Banking Singapore demographic shiftsCenter such asinrapid urbanization. global GDP growth in the next four years Latin American Micro-Financing Center in Peru Growth Market Initiatives Innovative Expansion Key Takeaway IBM spends more IBM than is the forerunner in technological advancement and will continue to redefine the way we interact with technology and data $6 billion a year on R&D Blue Chip Protection Brand Name 126 Acquisitions since 2000 Key Takeaway IBM is strategically poised to command markets for decades to come Industry Experience Customer Loyalty Financial Highlights Dividends Paid Out (Millions) $4,000 $3,500 $3,000 $2,500 $2,585 $2,860 $3,177 EBIT Margin $3,473 20.0% $2,147 15.0% $2,000 $1,000 FY2007 FY2008 FY2009 FY2010 FY2011 19.0 17.0 14.3 15.1 16.3 0.0% 16.6 FY2010 $6.00 9.0 $4.00 7.0 $2.00 FY2009 FY2010 FY2011 $13.25 $12.00 $8.00 FY2008 FY2008 $11.69 $9.07 $10.00 12.4 FY2007 FY2007 $14.00 11.0 5.0 FY2009 20.2% Earnings Per Share Free Cash Flow (Billions) 13.0 16.2% 18.7% 5.0% $500 15.0 14.5% 18.5% 10.0% $1,500 $0 25.0% FY2011 $0.00 $10.12 $7.32 FY2007 FY2008 FY2009 FY2010 FY2011 USD Billions Balance Sheet Health 6 5 4 3 2 1 Key Takeaways 1.30 1.10 1.20 1.19 1.15 1.21 0.90 0.70 0.50 0.30 FY2007 FY2008 FY2009 FY2010 FY2011 USD Billions 1.50 IBM’s liquidity, cash flow Current Ratio generation, and access to lowcost debt financing all equate to 1.36 a strong balance sheet. Growth Opportunities The Cloud $100B Key Takeaways “By the end of the IBM is uniquely positioned Developing are decade, IDCmarkets expects at to takeexpected advantage toofdouble least 80% ofgrowth the in in the The Cloud cloud through its meshing their share of global industry’s growth will of knowledgeable consultants cloud spending by 2016. be driven byITcloud and comprehensive services” product portfolio. 150% $40B 2012 2016 Public Cloud Spending Software’s Effect on Income Intrinsic Valuation Projected 2013 2014 2015 $118,997.5 $126,732.3 $133,069.0 $59,999.7 $61,799.7 $63,035.7 $58,997.8 $64,932.6 $70,033.3 49.6% 51.2% 52.6% 2016 $138,391.7 $63,666.1 $74,725.7 54.0% R&D Expense SG&A Expenses EBIT EBIT Margin $5,990.0 $6,049.9 $6,110.4 $6,171.5 $6,233.2 $23,553.0 $25,201.71 $26,587.80 $27,651.32 $28,757.37 $21,578.0 $22,983.4 $26,299.6 $31,109.8 $35,042.7 20.2% 20.5% 22.1% 24.5% 26.3% $6,295.6 $29,620.09 $38,810.0 28.0% NOPAT D&A Change in NWC CapEx FCF Present Value of Cash Flows $16,399.3 $4,815.0 ($1,251.0) $4,108.0 $18,357.3 Revenue Cost of Sales Gross Profit Gross Margin Terminal Value Enterprise Value 2011 2012 $106,916.0 $112,261.8 $55,795.0 $58,026.8 $51,121.0 $54,235.0 47.8% 48.3% $17,467.4 $5,007.6 ($3,145.0) $4,417.0 $21,203.0 $20,002.8 $19,987.7 $5,207.9 ($1,966.0) $4,637.9 $22,523.7 $20,046.1 $23,643.5 $5,416.2 $3,516.0 $4,823.4 $20,720.3 $17,397.2 $26,632.4 $5,578.7 $1,191.0 $4,968.1 $26,052.1 $20,635.7 $29,495.6 $5,746.1 $1,191.0 $5,067.4 $28,983.3 $21,658.0 $ 293,020.79 $ 318,701.89 Assumptions WACC Tax Rate Exit Multiple Share Price $ 6% 24.0% 10.11x 205.91 Calculations Enterprise Value $ 318,701.9 Less Net Debt $ 31,320.0 Equity Value $ 287,381.9 Shares Outstanding 1158.67 Value Per Share $ 248.03 Implied Discount 20.45% Industry and Internal Risks Hardware revenues slowing down BRICS growth market stagnation Consolidation of the Chairman and CEO positions Competitors Key Takeaway IBM is on the forefront of cyber security IBM features unmatched diversity in its portfolio’s products and services Exit Strategy Key Takeaway Implement a trailing stop-loss strategy with a 9% retracement as the sell point Ideal method to capitalize on growth and account for unlikely losses Q&A