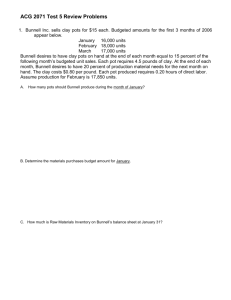

Question 1 - CMA 693 3-26 H1 - Manufacturing Input Variances

advertisement

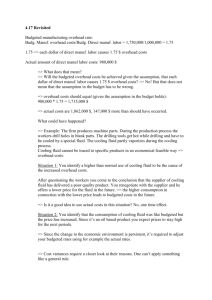

Part 1 : 07/28/10 08:42:13 Question 1 - CMA 693 3-26 H1 - Manufacturing Input Variances - Overhead Which one of the following variances is of least significance from a behavioral control perspective? A. Fixed overhead volume variance resulting from management's decision midway through the fiscal year to reduce its budgeted output by 20%. B. Favorable labor rate variance resulting from an inability to hire experienced workers to replace retiring workers. C. Unfavorable labor efficiency variance amounting to 10% more than the budgeted hours for the output attained. D. Unfavorable material quantity variance amounting to 20% of the quantity allowed for the output attained. A. The fixed overhead volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). It is not very much involved with performance of employees, as in most cases top management is responsible for this variance. This variance could be caused by different reasons: the economic situation, weather or change in planned output as it is in this question. So this variance is least significant from a behavioral control perspective. B. The result of the favorable labor rate variance caused by an inability to hire experienced workers to replace retiring workers could be an unfavorable labor efficiency variance or even unfavorable material quantity variance (if waste occurs). So this variance is quite significant from a behavioral control perspective. C. An unfavorable labor efficiency variance means that workers spent more time to perform work than was budgeted. There could be many reasons to this: work was performed by new unskilled workers, poor usage of materials or technology, etc. So this variance is quite significant from a behavioral control perspective. D. An unfavorable material quantity variance means that workers used more material than was budgeted. Variance analysis is supposed to give an answer to the question 'who is responsible for the variance'. In this situation the excessive use of material could come from either unskilled workers who could spoil some of material or from purchase of poor quality material, or both. So this variance is quite significant from a behavioral control perspective. Question 2 - CMA 687 4-17 - Manufacturing Input Variances - Overhead Selo Imports uses flexible budgeting for the control of costs. The company's annual master budget includes $324,000 for fixed production supervisory salaries at a volume of 180,000 units. Supervisory salaries are expected to be incurred uniformly throughout the year. During the month of September 15,750 units were produced, and production supervisory salaries incurred were $28,000. A performance report for September would reflect a budget variance of A. $350 favorable. B. $1,000 favorable. C. $350 unfavorable. D. $1,000 unfavorable. A. The variance is unfavorable because the actual amount of fixed overhead is greater than the budgeted amount. B. The variance is unfavorable because the actual amount of fixed overhead is greater than the budgeted amount. C. In this solution the salaries are treated as variable costs instead of fixed costs. See the correct answer for a complete explanation. D. The fixed (or spending) overhead budget variance is equal to the difference between the actual and budgeted amounts of fixed overhead. The budgeted (static budget) amount of fixed overhead was $27,000 ($325,000 ÷ 12). Thus, the fixed overhead budget variance is $1,000 unfavorable ($28,000 $27,000). (c) HOCK international, page 1 Part 1 : 07/28/10 08:42:13 Question 3 - CMA 1294 3-26 - Manufacturing Input Variances - Overhead Water Control Inc. manufactures water pumps and uses a standard cost system. The standard factory overhead costs per water pump are based on direct labor hours and are as follows: Variable overhead (4 hours at $8/hour) - $32 Fixed overhead (4 hours at $5/hour*) - $20 Total overhead cost per unit - $52 * Based on a capacity of 100,000 direct labor hours per month. The following additional information is available for the month of November: 22,000 pumps were produced although 25,000 had been scheduled for production. 94,000 direct labor hours were worked at a total cost of $940,000. The standard direct labor rate is $9 per hour. The standard direct labor time per unit is 4 hours. Variable overhead costs were $740,000. Fixed overhead costs were $540,000. The fixed overhead spending variance for November was A. $240,000 unfavorable. B. $40,000 unfavorable. C. $460,000 unfavorable. D. $70,000 unfavorable. A. This amount is the difference between the actual variable overhead and the budgeted fixed overhead. See the correct answer for a complete explanation. B. The fixed overhead budget/spending variance is the difference between the actual fixed overhead amount and the budgeted fixed overhead costs. The actual amount of fixed overhead costs was $540,000. The budgeted amount of fixed overhead was $500,000 ($5 of fixed overhead per labor hour multiplied by 100,000 budgeted labor hours). We use the budgeted amount of labor hours (100,000) because fixed costs do not vary with the level of production, and we need to calculate what the total budgeted fixed overhead amount was that the company used in its calculation of the cost per direct labor hour. Thus, the amount of fixed cost budgeted is the same for any level of production. The fixed overhead budget/spending variance is $40,000 unfavorable ($540,000 $500,000). The actual fixed overhead costs incurred were higher than the budgeted amount, so the variance is unfavorable. C. This answer is incorrect. See the correct answer for a complete explanation. D. This answer results from using the actual amount of labor hours (94,000) to calculate the budgeted fixed overhead costs instead of the budgeted labor hours (100,000). We use the budgeted amount of labor hours (100,000) because fixed costs do not vary with the level of production, and we need to calculate what the total budgeted fixed overhead amount was that the company used in its calculation of the cost per direct labor hour. Question 4 - IMA 08-P2-246 - Manufacturing Input Variances - Overhead Harper Company's performance report indicated the following information for the past month. Actual total overhead $1,600,000 Budgeted fixed overhead 1,500,000 Applied fixed overhead at $3 per labor hour 1,200,000 Applied variable overhead at $.50 per labor hour 200,000 Actual labor hours 430,000 Harper's total overhead spending variance for the month was (c) HOCK international, page 2 Part 1 : 07/28/10 08:42:13 A. $200,000 unfavorable. B. $100,000 favorable. C. $115,000 favorable D. $185,000 unfavorable. A. This is actual total overhead minus applied total overhead (fixed and variable). It correctly indicates an unfavorable variance, but the calculation is missing the budgeted element. See correct answer for a full explanation. B. This is the actual total overhead minus budgeted fixed overhead. It is incorrect for two reasons. First, if the calculation were correct, the variance would be an unfavorable one, not a favorable one, because the actual was higher than the budgeted amount and this is a cost variance. And second, variable overhead is included in the total actual overhead amount but is not included in the amount that is subtracted from total actual overhead. C. The total overhead spending variance (fixed and variable) is calculated as follows: Actual Total Overhead Incurred Minus: Budgeted Fixed Overhead Minus: Standard Variable Overhead Rate × Actual Application Base —————————————————————————————— Equals: Total Overhead Spending Variance Actual Total Overhead = $1,600,000 Budgeted Fixed Overhead = $1,500,000 Standard Variable OH Rate × Actual Application Base = $.50 × 430,000 = $215,000 Therefore, the total overhead spending variance = $1,600,000 $1,500,000 overhead is a cost, a negative variance is a favorable variance. $215,000 = $(115,000). Since D. This is actual total overhead minus applied fixed overhead minus (Standard Variable OH Rate × Actual Application Base). The fixed overhead amount subtracted should be the budgeted fixed overhead, not the applied fixed overhead. Question 5 - CMA 1294 3-27 - Manufacturing Input Variances - Overhead Water Control Inc. manufactures water pumps and uses a standard cost system. The standard factory overhead costs per water pump are based on direct labor hours and are as follows: Variable overhead (4 hours at $8/hour) - $32 Fixed overhead (4 hours at $5*/hour) - $20 Total overhead cost per unit - $52 * Based on a capacity of 100,000 direct labor hours per month. The following additional information is available for the month of November: 22,000 pumps were produced although 25,000 had been scheduled for production. 94,000 direct labor hours were worked at a total cost of $940,000. The standard direct labor rate is $9 per hour. The standard direct labor time per unit is 4 hours. Variable overhead costs were $740,000. (c) HOCK international, page 3 Part 1 : 07/28/10 08:42:13 Fixed overhead costs were $540,000. The variable overhead spending variance for November was A. $60,000 favorable. B. $48,000 unfavorable. C. $12,000 favorable. D. $40,000 unfavorable. A. The variable overhead spending variance is calculated as follows: (Actual VOH Cost/Unit of allocation base actually used Standard Application Rate) × Actual Quantity of variable overhead allocation base used for the actual output. This answer results from using the budgeted hours (100,000), not the actual hours (94,000) to calculate the actual variable overhead cost/unit of the allocation base actually used; and also to multiply by the actual quantity of the variable overhead allocation base used for the actual output. B. This is the variable overhead efficiency variance. See the correct answer for a complete explanation. C. The variable overhead spending variance is calculated as follows: (Actual VOH Cost/Unit of allocation base actually used Standard Application Rate) × Actual Quantity of variable overhead allocation base used for the actual output. The actual VOH cost/unit of the allocation base actually used was the total actual variable overhead cost of $740,000 divided by the actual number of direct labor hours worked of 94,000, or $7.8723 per direct labor hour. The standard application rate of variable overhead was $8 per direct labor hour. The actual quantity of the variable overhead allocation base used for the actual output was 94,000. Therefore, the variable overhead spending variance was ($7.8723 favorable. $8) × 94,000, which equals ($12,000) D. This is the fixed overhead spending variance. See the correct answer for a complete explanation. Question 6 - CMA 1295 3-4 - Manufacturing Input Variances - Overhead Variable overhead is applied on the basis of standard direct labor hours. If, for a given period, the direct labor efficiency variance is unfavorable, the variable overhead efficiency variance will be A. Favorable. B. Zero. C. The same amount as the labor efficiency variance. D. Unfavorable. A. This answer is incorrect. See the correct answer for a complete explanation. B. This answer is incorrect. See the correct answer for a complete explanation. C. This answer is incorrect. See the correct answer for a complete explanation. D. An unfavorable direct labor efficiency variance means that more direct labor hours were used for production than were budgeted. The variable overhead efficiency variance is calculated as follows: (Actual Activity Level of VOH allocation base used for Actual Output Standard Activity Level of VOH allocation base allowed for Actual Output) × Standard Application Rate. (c) HOCK international, page 4 Part 1 : 07/28/10 08:42:13 In this case, the actual activity level is actual direct labor hours since that is the allocation base. We know that actual labor hours exceeded the standard since the direct labor efficiency variance is unfavorable. This gives us an unfavorable variable overhead efficiency variance. Question 7 - CMA 1290 3-8 - Manufacturing Input Variances - Overhead Franklin Glass Works' production budget for the year ended November 30 was based on 200,000 units. Each unit requires two standard hours of labor for completion. Total overhead was budgeted at $900,000 for the year, and the fixed overhead rate was estimated to be $3.00 per unit. Both fixed and variable overhead are assigned to the product on the basis of direct labor hours. The actual data for the year ended November 30 are presented as follows. Actual production in units 198,000 Actual direct labor hours 440,000 Actual variable overhead $352,000 Actual fixed overhead $575,000 Franklin's fixed overhead spending variance for the year is A. $25,000 favorable. B. $5,750 favorable. C. $25,000 unfavorable. D. $19,000 favorable. A. The fixed overhead budget/spending variance is the difference between the actual fixed overhead amount and the budgeted fixed overhead costs. The fixed overhead rate was estimated to be $3.00 per unit and 200,000 units were scheduled for production, thus, the total budgeted fixed overhead was $600,000 ($3.00 × 200,000). Actual fixed overhead was $575,000. The fixed overhead spending variance was $25,000 favorable ($575,000 $600,000). B. The fixed overhead budget/spending variance is the difference between the actual fixed overhead amount and the budgeted fixed overhead costs. See the correct answer for a complete explanation. C. The fixed overhead budget/spending variance is the difference between the actual fixed overhead amount and the budgeted fixed overhead costs. See the correct answer for a complete explanation. D. The fixed overhead budget/spending variance is the difference between the actual fixed overhead amount and the budgeted fixed overhead costs. See the correct answer for a complete explanation. Question 8 - CMA 692 3-16 - Manufacturing Input Variances - Overhead An organization that specializes in reviewing and editing technical magazine articles sets the following standards for evaluating the performance of the professional staff: Annual budgeted fixed costs for normal capacity level of 10,000 articles reviewed and edited: $600,000 Standard professional hours per 10 articles: 200 hours Flexible budget of standard labor costs to process 10,000 articles: $10,000,000 The following data apply to the 9,500 articles that were actually reviewed and edited during the current year: Total hours used by professional staff: 192,000 hours Flexible costs: $9,120,000 Total cost: $9,738,000 The fixed cost spending variance for the year is (c) HOCK international, page 5 Part 1 : 07/28/10 08:42:13 A. $18,000 unfavorable. B. $18,000 favorable. C. $48,000 unfavorable. D. $30,000 favorable. A. The fixed overhead spending variance is the actual fixed overhead incurred minus the budgeted fixed overhead costs. Actual fixed overhead costs are $618,000 ($9,738,000 total cost incurred $9,120,000 flexible (variable) costs). The budgeted fixed overhead costs are $600,000. The fixed overhead spending variance is $18,000 unfavorable ($618,000 actual fixed costs $600,000 budgeted fixed costs). The actual costs exceed the budgeted costs, so the variance is unfavorable. B. The variance is unfavorable. This answer results from subtracting actual fixed overhead incurred from budgeted fixed overhead instead of the reverse. See the correct answer for a complete explanation. C. The fixed overhead spending variance is the actual fixed overhead incurred minus the budgeted fixed overhead costs. This incorrect result is the consequence of the wrong assumption that the budgeted amount of fixed overhead should be adjusted to the level of production the way variable costs are in the flexible budget. In the calculation, we have to use $600,000 of budgeted fixed costs, not $570,000 adjusted for the level of production of 9,500 articles. Again, fixed costs do not vary with the level of output. D. The variance is unfavorable. See the correct answer for a complete explanation. Question 9 - CMA 1290 3-10 - Manufacturing Input Variances - Overhead Franklin Glass Works' production budget for the year ended November 30 was based on 200,000 units. Each unit requires two standard hours of labor for completion. Total overhead was budgeted at $900,000 for the year, and the fixed overhead rate was estimated to be $3.00 per unit. Both fixed and variable overhead are assigned to the product on the basis of direct labor hours. The actual data for the year ended November 30 are presented as follows. Actual production in units 198,000 Actual direct labor hours 440,000 Actual variable overhead $352,000 Actual fixed overhead $575,000 Franklin's fixed overhead volume variance for the year is A. $6,000 unfavorable. B. $55,000 unfavorable. C. $25,000 favorable. D. $19,000 favorable. A. The fixed overhead volume variance (also called the fixed overhead production-volume variance) is the budgeted amount of fixed overhead minus the amount of fixed overhead applied (standard rate × standard quantity of application base allowed for the actual level of output). The fixed overhead rate was estimated to be $3.00 per unit and 200,000 units were scheduled for production. The total budgeted fixed overhead was $600,000 ($3.00 × 200,000). Two hours of labor are the standard required to produce one unit. Thus, the application rate is $1.50 per direct labor hour ($3.00 ÷ 2). The standard direct labor hours allowed for the actual output were 396,000 (2 × 198,000 actual production in units). The applied overhead equals $594,000 ($1.50 × 396,000). We also could calculate the amount of applied overhead using actual units produced and the unit fixed overhead application rate ($3.00 × 198,000) which gives the same answer: $594,000. Thus, the fixed overhead volume variance is $6,000 unfavorable ($600,000 $594,000). The applied amount was less than the budgeted amount which means that some amount of overhead wasn't applied to the final (c) HOCK international, page 6 Part 1 : 07/28/10 08:42:13 product i.e. it was underapplied. The variance is caused by the fact that production was planned to be 200,000 units but only 198,000 units were actually produced. The facilities were not used at the level that was planned. B. The fixed overhead volume variance (also called the fixed overhead production-volume variance) is the budgeted amount of fixed overhead minus the amount of fixed overhead applied (standard rate × standard quantity of application base allowed for the actual level of output). See the correct answer for a complete explanation. C. The fixed overhead volume variance (also called the fixed overhead production-volume variance) is the budgeted amount of fixed overhead minus the amount of fixed overhead applied (standard rate × standard quantity of application base allowed for the actual level of output). See the correct answer for a complete explanation. D. The fixed overhead volume variance (also called the fixed overhead production-volume variance) is the budgeted amount of fixed overhead minus the amount of fixed overhead applied (standard rate × standard quantity of application base allowed for the actual level of output). See the correct answer for a complete explanation. Question 10 - CMA 696 3-25 - Manufacturing Input Variances - Overhead Ardmore Enterprises uses a standard cost system in its small appliance division. The standard cost of manufacturing one unit of Zeb is as follows: Materials - 60 pounds at $1.50 per pound $90 Labor - 3 hours at $12 per hour 36 Factory overhead - 3 hours at $8 per hour 24 Total standard cost per unit $150 The budgeted variable factory overhead rate is $3 per labor hour, and the budgeted fixed factory overhead is $27,000 per month. During May, Ardmore produced 1,650 units of Zeb compared with a normal capacity of 1,800 units. The actual cost per unit was as follows: Materials (purchased and used) - 58 pounds at $1.65 per pound $95.70 Labor - 3.1 hours at $12 per hour 37.20 Factory overhead - $39,930 per 1,650 units 24.20 Total actual cost per unit $157.10 The flexible budget overhead variance for May is A. $3,270 unfavorable. B. $1,920 favorable. C. $3,270 favorable. D. $1,920 unfavorable. A. The flexible budget overhead variance is favorable. The budgeted overhead is greater than the actual, which means the variance is favorable. See the correct answer for a complete explanation. B. The flexible budget overhead variance equals the difference between the total actual overhead incurred and the flexible budget total overhead (variable and fixed). The flexible budget fixed overhead equals the master budget amount of $27,000. The budgeted variable factory overhead rate is $3 per labor hour, the standard hours to produce one unit of product is 3 hours, and 1,650 units were produced. Thus, the flexible budget variable factory overhead was $14,850. The actual overhead costs were $39,930. The total flexible budget variable factory overhead is $41,850 ($14,850 + $27,000). Therefore, the flexible budget overhead variance is ($1,920) favorable ($39,930 $41,850). Since the actual overhead is less than the budgeted overhead, the variance is favorable. (c) HOCK international, page 7 Part 1 : 07/28/10 08:42:13 C. This is the flexible budget variance based on the master budget level of output of 1,800 units. Actual factory overhead of $39,930 ([$3 × 3 × 1,800] + $27,000) budgeted fixed overhead = ($3,270) favorable. However, the actual level of production of 1,650 units should be used to calculate flexible budget amounts for variable costs, not the master budget level. See the correct answer for a complete explanation. D. The flexible budget overhead variance is favorable. The budgeted overhead is greater than actual which means the variance is favorable. See the correct answer for a complete explanation. Question 11 - CMA 1294 3-28 - Manufacturing Input Variances - Overhead Water Control Inc. manufactures water pumps and uses a standard cost system. The standard factory overhead costs per water pump are based on direct labor hours and are as follows: Variable overhead (4 hours at $8/hour) - $32 Fixed overhead (4 hours at $5*/hour) - $20 Total overhead cost per unit - $52 * Based on a capacity of 100,000 direct labor hours per month. The following additional information is available for the month of November: 22,000 pumps were produced although 25,000 had been scheduled for production. 94,000 direct labor hours were worked at a total cost of $940,000. The standard direct labor rate is $9 per hour. The standard direct labor time per unit is 4 hours. Variable overhead costs were $740,000. Fixed overhead costs were $540,000. The variable overhead efficiency variance for November was A. $200,000 unfavorable. B. $48,000 unfavorable. C. $96,000 unfavorable. D. $60,000 favorable. A. This is the difference between the actual direct labor costs of $940,000 and the actual variable overhead costs of $740,000, which does not mean anything. See the correct answer for a complete explanation. B. The variable overhead efficiency variance is calculated as follows: (Actual Activity Level of VOH allocation base used for Actual Output Standard Activity Level of VOH allocation base allowed for Actual Output) × Standard Application Rate. The actual activity level is 94,000 direct labor hours. The standard activity level is calculated as the standard of 4 hours of direct labor per unit multiplied by the 22,000 units produced during the period, or 88,000 direct labor hours. The standard application rate is $8/hour. Therefore, the variable overhead efficiency variance is (94,000 88,000) × $8 = $48,000 Unfavorable. The variance is unfavorable because the actual activity level was greater than the standard activity level. C. This is the difference between the capacity hours (100,000) and the standard hours allowed for the actual output (88,000) multiplied by the standard application rate ($8). See the correct answer for a complete explanation. D. This answer uses capacity, not actual hours. See the correct answer for a complete explanation. (c) HOCK international, page 8 Part 1 : 07/28/10 08:42:13 Question 12 - CMA 1292 3-19 - Manufacturing Input Variances - Overhead Nanjones Company manufactures a line of products distributed nationally through wholesalers. Presented below are planned manufacturing data for the year and actual data for November of the current year. The company applies overhead based on planned machine hours using a predetermined annual rate. Planning Data Annual November Fixed manufacturing overhead $1,200,000 $100,000 Variable manufacturing overhead 2,400,000 220,000 Direct labor hours 48,000 4,000 Machine hours 240,000 22,000 Data for November Direct labor hours (actual) 4,200 Direct labor hours (plan based on output) 4,000 Machine hours (actual) 21,600 Machine hours (plan based on output) 21,000 Fixed manufacturing overhead $101,200 Variable manufacturing overhead $214,000 The fixed overhead volume variance for November was A. $5,000 unfavorable. B. $10,000 favorable. C. $5,000 favorable. D. $1,200 unfavorable. A. The fixed overhead production-volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). It is Budgeted Fixed Overhead minus Applied Fixed Overhead. This is the only time for an expense variance calculation that a budgeted cost amount comes before an actual cost amount, and yet a negative amount (budget is lower than actual) is a favorable variance. The budgeted amount of fixed manufacturing overhead is the static budget amount planned for November of $100,000. The amount of applied fixed manufacturing overhead is $105,000 . Therefore, the fixed overhead volume variance is: $100,000 $105,000 = ($5,000) favorable. See the answer to the correct answer choice for a full explanation and information on interpreting this variance. B. The fixed overhead production-volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). If in the calculation of fixed manufacturing overhead applied the static budget amount of machine hours (22,000) were used, we would come up with an amount of $110,000 FOH applied. And the fixed overhead volume variance would be $10,000 ($110,000 $100,000) favorable; which is incorrect. In the calculation of fixed overhead applied, we should use the number of standard machine hours for the actual level of output (21,000 hours). See the correct answer for a complete explanation and information on interpreting this variance. C. The fixed overhead production-volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). It is Budgeted Fixed Overhead minus Applied Fixed Overhead. This is the only time for an expense variance calculation that a budgeted cost amount comes before an actual cost amount, and yet a negative amount (actual is higher than budget) is a favorable variance. Nanjones applies overhead based on planned machine hours using a predetermined annual rate. The amount of the planned fixed manufacturing overhead was $1,200,000 and the amount of planned machine hours were 240,000. Thus, the standard application rate for fixed manufacturing overhead was $5 (c) HOCK international, page 9 Part 1 : 07/28/10 08:42:13 ($1,200,000 ÷ 240,000). The number of planned machine hours for the actual level of output in November was 21,000. Now we can calculate the amount of applied fixed manufacturing overheads as $105,000 ($5 × 21,000). The budgeted amount of fixed manufacturing overhead is the static budget amount planned for November of $100,000. Therefore, the fixed overhead volume variance is: $100,000 $105,000 = ($5,000) favorable. The fixed overhead production-volume variance is caused by the actual production level being different from the production level used to calculate the budgeted fixed overhead rate. It measures usage of facilities, and so it is not a comparison of actual incurred cost with budgeted cost the way other variances are. When production facilities are used more than was planned (actual is greater than budget), the variance will be favorable because the company has gotten more use from its capacity than it thought it would. When production facilities are used less than was planned (actual is less than budget), the variance is unfavorable because it means the company had unused capacity. The amount of the variance is a rough measure of the cost of the unused capacity. When the company has unused capacity, the cost for that unused capacity should not be passed on to customers in higher prices. Instead, the company should find other uses for the capacity. Management may consider developing a new product to make use of the unused capacity, renting out part of the factory to another company, taking contract work that other companies are outsourcing, or even selling the unused facilities. This variance helps management to see the cost of the unused capacity. Fortunately for Nanjones, it is not in that situation. Its production-volume variance is favorable. D. This answer is incorrect. See the correct answer for a complete explanation and information on interpreting this variance. Question 13 - IMA 08-P2-243 - Manufacturing Input Variances - Overhead Lee Manufacturing uses a standard cost system with overhead applied based on direct labor hours. The manufacturing budget for the production of 5,000 units for the month of June included 10,000 hours of direct labor at $15 per hour, or $150,000. During June, 4,500 units were produced, using 9,600 direct labor hours, incurring $39,360 of variable overhead, and showing a variable overhead efficiency variance of $2,400 unfavorable. The standard variable overhead rate per direct labor hour was A. $6.00 B. $3.85 C. $4.00 D. $4.10 A. This answer is incorrect. See correct answer for an explanation. B. This answer is incorrect. See correct answer for an explanation. C. We can use the variable overhead efficiency variance formula, (AQ SQ) × SP, to find the answer to this. The unknown in that formula that we are looking for is SP, the standard rate. The question tells us that 9,600 direct labor hours were used, so that is the AQ in the formula. We can calculate the SQ, as follows: The standard is 10,000 hours of direct labor for the production of 5,000 units. Therefore, the standard for direct labor hours per unit is 10,000 ÷ 5,000, or 2 hours of DL per unit manufactured. Since 4,500 units were produced during June, the direct labor standard for those 4,500 units (SQ) was 4,500 × 2 = 9,000. The question also tells us that the variable overhead efficiency variance was $2,400 Unfavorable. We can now set up the formula: (AQ SQ) × SP = Variable Overhead Efficiency Variance (c) HOCK international, page 10 Part 1 : 07/28/10 08:42:13 (9,600 9,000) × SP = 2,400 U (a positive variance is unfavorable in a cost item) Solving for SP: 600 SP = 2,400 SP = $4.00 D. This is the actual incurred variable overhead of $39,360 divided by the actual number of direct labor hours used (9,600). Question 14 - CMA 1289 4-6 - Manufacturing Input Variances - Overhead If overhead is applied on the basis of units of output, the variable overhead efficiency variance will be A. A function of the direct labor efficiency variance. B. Unfavorable, if output is less than the budgeted level. C. Favorable, if output exceeds the budgeted level. D. Zero. A. This answer is incorrect. See the correct answer for a complete explanation. B. This answer is incorrect. See the correct answer for a complete explanation. C. This answer is incorrect. See the correct answer for a complete explanation. D. The formula for the variable overhead efficiency variance is: (Actual Activity Level of VOH Application Base actually used Standard Activity Level of application base allowed for actual output) × Standard Application Rate. Overhead is usually applied on the basis of some activity such as machine hours or direct labor hours. It is usually applied on the basis of the amount of that activity (machine hours, etc.) that is allowed according to the standard for the actual output, not the actual amount of machine hours used. If overhead is applied instead on the basis of units of output, overhead will be applied on the basis of actual activity, not the standard activity allowed. Therefore, if overhead is applied on the basis of units of output, there will be no difference between the actual activity level (the first number in the parentheses in the formula) and the activity level used to apply the overhead (the second number in the parentheses in the formula), and so the variance will be equal to zero. Question 15 - CMA 1289 4-3 - Manufacturing Input Variances - Overhead A fixed overhead volume variance based on standard direct labor hours measures A. Fixed overhead efficiency. B. Fixed overhead use. C. Deviation from the normal, or denominator, level of direct labor hours. D. Deviation from standard direct labor hour capacity. A. There is no fixed overhead efficiency variance because fixed costs are not related to levels of output and therefore are unable to be used efficiently or inefficiently. (c) HOCK international, page 11 Part 1 : 07/28/10 08:42:13 B. The fixed overhead volume variance does not relate to the fixed overhead usage. C. The fixed overhead volume variance (also called the fixed overhead production-volume variance) is the the budgeted amount of fixed overhead (in the static budget) minus the amount of fixed overhead applied (standard rate × standard input for the actual level of output). The budgeted amount of fixed overhead is what was projected as the total amount of fixed overhead to be incurred during the period at the beginning of the year when the budget was developed. Traditionally, overhead is applied to individual products throughout the year using some standard allocation basis, usually direct labor hours, machine hours, materials cost, units of production, or some similar measure that can be measured and calculated. The measure used is called the activity base. A predetermined rate is calculated by dividing the budgeted amount of manufacturing overhead by the budgeted activity level. The budgeted activity level is the number of units of the activity base (labor hours, machine hours, etc.) allowed for the expected production during the coming year. As production continues throughout the year, the amount of the activity base allowed for the amount of product actually produced is multiplied by the predetermined rate to calculate the amount of overhead to be applied. The fixed overhead volume variance is caused by the actual production level being diffeent from the production level (called the denominator level) used to calculate the budgeted fixed overhead rate. If the amount of overhead applied is greater than the budgeted amount, the variance will be favorable because it means that the actual level of production was greater than the budgeted level of production. That is good because it means the facilities are being more fully utilized. If the amount of oveerhead applied is less than the budgeted overhead, the variance will be unfavorable because it means that actual production was lower than the budgeted production level. D. The fixed overhead volume variance does not relate to the capacity of standard direct labor hours. Question 16 - CMA 693 3-19 - Manufacturing Input Variances - Overhead Tiny Tykes Corporation had the following activity relating to its fixed and variable overhead for the month of July. Actual costs Fixed overhead Variable overhead $120,000 80,000 Flexible budget Variable overhead 90,000 Applied Fixed overhead 125,000 Variable overhead spending variance 2,000F Production volume variance 5,000U If the budgeted rate for applying variable manufacturing overhead was $20 per direct labor hour, how efficient or inefficient was Tiny Tykes Corporation in terms of using direct labor hours as an activity base? A. 100 direct labor hours inefficient. B. 100 direct labor hours efficient. C. 400 direct labor hours efficient. D. 400 direct labor hours inefficient. A. This answer is incorrect. See the correct answer for a complete explanation. (c) HOCK international, page 12 Part 1 : 07/28/10 08:42:13 B. This answer is incorrect. See the correct answer for a complete explanation. C. The total variable overhead variance is equal to the difference between the actual variable overhead incurred and the budgeted variable overhead. This is also called the flexible budget variance. The formula is: Actual Variable Overhead Incurred Flexible Budget Variable Overhead Amount. Hence, the total variable overhead variance is $10,000 favorable ($80,000 $90,000). This total variance may be broken down into the spending and efficiency variances. The variable overhead spending variance is given as $2,000 favorable.The variable overhead efficiency variance equals the total variable overhead variance minus the variable overhead spending variance, or $8,000 favorable ($10,000 $2,000). If the budgeted rate for applying variable manufacturing overhead was $20 per direct labor hour using direct labor hours as an activity base, this variance is equivalent to 400 direct labor hours ($8,000 ÷ $20). The number is positive which means the Tiny Tykes Corporation was 400 direct labor hours efficient. D. This answer is incorrect. See the correct answer for a complete explanation. Question 17 - CMA 1295 3-7 - Manufacturing Input Variances - Overhead The variance in an absorption costing system that measures the departure from the denominator level of activity that was used to set the fixed overhead rate is the A. Production volume variance. B. Spending variance. C. Flexible budget variance. D. Efficiency variance. A. In the budgeting process, the company must determine the level of activity to use. This level of activity is also called the denominator level. The fixed overhead production volume variance is caused by the actual production level being diffeent from the production level that was used to calculate the budgeted fixed overhead rate. B. The fixed overhead spending variance is the difference between actual fixed costs and budgeted fixed costs. C. The flexible budget variance is the difference between the actual results and the flexible budget amounts. D. This answer is incorrect. See the correct answer for a complete explanation. Question 18 - IMA 08-P2-247 - Manufacturing Input Variances - Overhead The JoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT estimated variable factory overhead of $600,000 and fixed factory overhead of $400,000. JoyT uses a standard costing system, and factory overhead is allocated to units produced on the basis of standard direct labor hours. The denominator level of activity budgeted for this year was 10,000 direct labor hours, and JoyT used 10,300 actual direct labor hours. Based on the output accomplished during this year, 9,900 standard direct labor hours should have been used. Actual variable factory overhead was $596,000, and actual fixed factory overhead was $410,000 for the year. Based on this information, the variable overhead spending variance for JoyT for this year was A. $24,000 unfavorable. B. $4,000 favorable. C. $22,000 favorable. D. $2,000 unfavorable. (c) HOCK international, page 13 Part 1 : 07/28/10 08:42:13 A. This is the standard cost per direct labor hour of $60 multiplied by the difference between 10,300 actual DLH used and 9,900 standard DLH for the actual output, i.e., (10,300 9,900) × $60. The variable overhead spending variance is the actual amount of variable overhead incurred minus the standard amount of variable overhead allowed for the actual quantity of the variable overhead allocation base used for the actual output. See the correct answer for a full explanation. B. This is the actual variable overhead of $596,000 minus estimated variable overhead of $600,000. The standard amount used should be the standard amount of variable overhead allowed for the actual quantity of the variable overhead allocation base used for the actual output, or (10,300 × $60). See the correct answer for a full explanation. C. The Variable Overhead Spending Variance is the actual amount of variable overhead incurred minus the standard amount of variable overhead allowed for the actual quantity of the variable overhead allocation base used for the actual output. The actual amount of variable overhead incurred is $596,000. The standard application rate is calculated by dividing the $600,000 estimated variable overhead by the 10,000 budgeted direct labor hours, which results in an application rate of $60 per direct labor hour. The company actually used 10,300 direct labor hours. Therefore, the standard amount of variable overhead allowed for the actual quantity of the variable overhead allocation base used for the actual output was $60 × 10,300, or $618,000. The Variable Overhead spending Variance is $596,000 a cost, a negative variance is favorable. $618,000, which equals $(22,000). Since overhead is D. This answer is the difference between the actual variable overhead cost incurred of $596,000 and (standard hours for the actual output of 9,900 × estimated overhead cost per hour of $60). The use of the actual cost is correct, but the standard amount used should be the standard amount of variable overhead allowed for the actual quantity of the variable overhead allocation base used for the actual output, or (10,300 × $60). See the correct answer for a full explanation. Question 19 - CMA 693 3-20 - Manufacturing Input Variances - Overhead Tiny Tykes Corporation had the following activity relating to its fixed and variable overhead for the month of July. Actual costs Fixed overhead $120,000 Variable overhead 80,000 Flexible budget Variable overhead 90,000 Applied Fixed overhead 125,000 Variable overhead spending variance 2,000F Production volume variance 5,000U The fixed overhead efficiency variance is A. Never a meaningful variance. B. $5,000 favorable. C. $3,000 favorable. D. $3,000 unfavorable. A. There is no such thing as a fixed overhead efficiency variance because fixed costs are not related to (c) HOCK international, page 14 Part 1 : 07/28/10 08:42:13 levels of output and therefore are unable to be used efficiently or inefficiently. B. There is no such thing as a fixed overhead efficiency variance because fixed costs are not related to levels of output and therefore are unable to be used efficiently or inefficiently. C. There is no such thing as a fixed overhead efficiency variance because fixed costs are not related to levels of output and therefore are unable to be used efficiently or inefficiently. D. There is no such thing as a fixed overhead efficiency variance because fixed costs are not related to levels of output and therefore are unable to be used efficiently or inefficiently. Question 20 - CMA 1290 3-7 - Manufacturing Input Variances - Overhead Franklin Glass Works' production budget for the year ended November 30 was based on 200,000 units. Each unit requires two standard hours of labor for completion. Total overhead was budgeted at $900,000 for the year, and the fixed overhead rate was estimated to be $3.00 per unit. Both fixed and variable overhead are assigned to the product on the basis of direct labor hours. The actual data for the year ended November 30 are presented as follows. Actual production in units 198,000 Actual direct labor hours 440,000 Actual variable overhead $352,000 Actual fixed overhead $575,000 Franklin's variable overhead spending variance for the year is A. $22,000 unfavorable. B. $20,000 favorable. C. $20,000 unfavorable. D. $19,800 favorable. A. The variable overhead spending variance is the difference between the actual variable overhead cost per unit of the allocation base actually used (the actual overhead costs divided by the actual usage of the allocation base) and the standard variable overhead application rate multiplied by the actual quantity of the application base. (Actual Application Rate Standard Application Rate) × Actual Quantity.) This variance is also the difference between the actual amount of variable overhead incurred and the standard amount of variable overhead allowed for the actual quantity of the variable overhead allocation base used for the actual output produced.The fixed overhead rate was estimated to be $3.00 per unit, thus the budgeted amount of fixed overhead for the budgeted level of production of 200,000 units was $600,000 ($3 × 200,000). Thus, the budgeted amount of variable overhead was $300,000 ($900,000 $600,000). Each unit requires two standard hours of labor, hence the labor rate per unit was $0.75 ($300,000 ÷ (200,000 × 2)). The actual variable overhead was $352,000. The actual production hours were 440,000. The standard application rate multiplied by the actual quantity is $330,000 ($0.75 × 440,000). The variable overhead spending variance is $22,000 unfavorable ($352,000 $330,000). B. This answer is incorrect. See the correct answer for a complete explanation. C. This answer is incorrect. See the correct answer for a complete explanation. D. This answer is incorrect. See the correct answer for a complete explanation. Question 21 - CMA 1273 4-13 - Manufacturing Input Variances - Overhead Which of these variances is least significant for cost control? (c) HOCK international, page 15 Part 1 : 07/28/10 08:42:13 A. Labor price variance. B. Fixed O/H volume variance. C. Variable O/H spending variance. D. Materials quantity variance. A. The labor price variance is the difference in labor rates between actual and standard used in production. It is an important area of cost control. B. The fixed overhead volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). It does not reflect any differences between actual costs and budgeted costs. This variance concerns only the level of production. If the actual level of production is lower than the budgeted level, the fixed overhead volume variance will be unfavorable. If the actual production level is higher than the budgeted level, the fixed overhead volume variance will be favorable. Because this variance arises from a variance in the level of production, it is not very significant for cost control purposes. C. The variable overhead spending variance is the difference between the actual application rate (the actual application rate is calculated as the actual overhead costs ÷ the actual usage of the allocation base) and the standard application rate multiplied by the actual quantity of the application base. Because actual variable costs are used in this variance, it is an important area of cost control. D. The materials quantity variance is the difference between the quantity of materials actually used in production and the standard quantity of materials allowed for the actual level of output. It is an important area of cost control. Question 22 - CMA 1290 3-6 - Manufacturing Input Variances - Overhead Franklin Glass Works' production budget for the year ended November 30 was based on 200,000 units. Each unit requires two standard hours of labor for completion. Total overhead was budgeted at $900,000 for the year, and the fixed overhead rate was estimated to be $3.00 per unit. Both fixed and variable overhead are assigned to the product on the basis of direct labor hours. The actual data for the year ended November 30 are presented as follows. Actual production in units 198,000 Actual direct labor hours 440,000 Actual variable overhead $352,000 Actual fixed overhead $575,000 Franklin's variable overhead efficiency variance for the year is A. $33,000 unfavorable. B. $35,520 favorable. C. $66,000 unfavorable. D. $33,000 favorable. A. The variable overhead efficiency variance determines the amount of the total variance that was caused by a different usage of the allocation base than was expected (i.e. the standard hours for the actual output). The variable overhead efficiency variance is calculated as: (Actual Activity Level of VOH application base actually used Standard Activity Level of application base allowed for Actual Output) × Standard Application Rate. Total budgeted overhead (variable and fixed) was $900,000. The fixed overhead rate was estimated to be $3.00 per unit, thus the budgeted amount of fixed overhead for the budgeted level of production of 200,000 units was $600,000 ($3 × 200,000). Therefore, the budgeted amount of variable overhead was $300,000 ($900,000 $600,000). Each unit requires two standard hours of labor, hence the labor rate per unit for (c) HOCK international, page 16 Part 1 : 07/28/10 08:42:13 variable overhead was $0.75 ($300,000 ÷ (200,000 × 2)). The standard hours were 396,000 (198,000 × 2) and the actual hours were 440,000. Now we can calculate the variable overhead efficiency variance as follows: (440,000 396,000) × $0.75 = 33,000 unfavorable variance. B. This answer is incorrect. See the correct answer for a complete explanation. C. This answer was calculated using an incorrect labor rate of $1.50. It was caused by using the wrong number of hours budgeted (200,000) for production. In fact, 400,000 hours was scheduled for production, as each unit requires two standard hours of labor and production was planned to be 200,000 units. D. The variable overhead efficiency variance is calculated as: (Actual Activity Level of VOH application base actually used Standard Activity Level of application base allowed for Actual Output) × Standard Application Rate. A positive result is an unfavorable variance, while a negative result is a favorable variance, since this is a cost item. This variance is an unfavorable variance, not a favorable one. Question 23 - CMA 1284 4-2 - Manufacturing Input Variances - Overhead Dori Castings, a job-order shop, uses a full-absorption, standard-cost system to account for its production costs. The O/H costs are applied on a direct-labor-hour basis. A production volume variance will exist for Dori in a month when A. The fixed factory O/H applied on the basis of standard allowed direct labor hours differs from the budgeted fixed factory O/H. B. Actual direct labor hours differ from standard allowed direct labor hours. C. The fixed factory O/H applied on the basis of standard allowed direct labor hours differs from actual fixed factory O/H. D. Production volume differs from sales volume. A. The fixed overhead production volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). B. The fixed overhead production volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). The difference between actual direct labor hours and the standard allowed direct labor hours does not relate to the fixed overhead volume variance. C. The fixed overhead production volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). The difference between the actual fixed factory overhead and the fixed factory overhead applied on the basis of the standard allowed direct labor hours is the total fixed overhead variance, not the fixed overhead production volume variance. D. The fixed overhead production volume variance is the difference between the budgeted amount of fixed overhead and the amount of fixed overhead applied (standard rate × standard input for the actual level of output). It does not relate to the difference between the sales and production volume. (c) HOCK international, page 17