2071t5review

advertisement

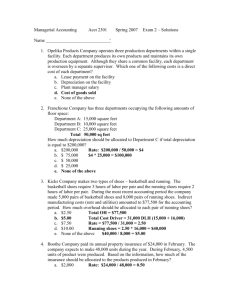

ACG 2071 Test 5 Review Problems 1. Bunnell Inc. sells clay pots for $15 each. Budgeted amounts for the first 3 months of 2006 appear below. January 16,000 units February 18,000 units March 17,000 units Bunnell desires to have clay pots on hand at the end of each month equal to 15 percent of the following month’s budgeted unit sales. Each pot requires 4.5 pounds of clay. At the end of each month, Bunnell desires to have 20 percent of production material needs for the next month on hand. The clay costs $0.80 per pound. Each pot produced requires 0.20 hours of direct labor. Assume production for February is 17,850 units. A. How many pots should Bunnell produce during the month of January? B. Determine the materials purchases budget amount for January. C. How much is Raw Materials Inventory on Bunnell’s balance sheet at January 31? 2.Larkin Company budgeted sales, all on credit, for March through July as follows: March April May June July $40,000 $50,000 $60,000 $45,000 $54,000 Larkin expects cash collections to be 30% in month of sale, 60% in following month, and 8% in the next month. Two percent of sales are uncollectible. Calculate budgeted cash receipts for May. How much is accounts receivable at May 31? Walker Inc. budgeted direct materials purchases of $220,000 in March, $210,000 in April, and $200,000 in May. Past experience indicates that the company pays for 30% of its purchases in the month of purchase and the remaining 70% in the next month. Other costs are paid 20% in the month of acquisition and the balance during the following month. Accounts payable is used only for material purchases. During April, the following items were budgeted: Wages expense $60,000 Purchase of office equipment 24,000 Selling and administrative expenses 62,000 Depreciation expense 11,000 A. How much is budgeted cash disbursements for April? 3. B. How much is Accounts Payable at April 30 on Walker’s balance sheet? 4. Siggy Inc. budgeted 12,000 and produced 11,000 tape dispensers during June. Resin used to make the dispensers is purchased by the pound. Standards and actual costs follow for May: Standards Actual Materials 2 pounds @ $5.00 a pound 20,900 pounds @ $4.90 per pound .25 hours @ $15.00 per Labor 2,700 hours @$15.30 per hour hour Variable $39,000 $36,500 Overhead Fixed Overhead $1.50 per dispenser $17,250 How much is the standard cost of one tape dispenser? 5.AT, Inc.’s static budget for production of 10,000 widgets appears below: Direct materials $88,000 Direct labor 36,000 Variable manufacturing overhead costs 100,000 Fixed manufacturing overhead costs 50,000 The company produced 11,000 units in June. How much is the flexible budget amount for production costs during June? 6. Cantave projected the following for 2006: Credit sales, $240,000 Collections from customers, $246,000 Cost of goods sold, $92,000 Loan repayments, $16,000 total of which $1,000 is interest Current period cash operating expenses, $80,000 Depreciation expense, $20,000 Loss on disposal of plant asset, $5,000 Merchandise purchase, $95,000 (10% due at year end) Year end accrued wages, $12,000 Beginning cash balance, $36,000 How much is cash to be reported on Contave’s budgeted balance sheet at the end of 2006. 7. For each case listed as items 1 through 6, select the variance(s) the case would most likely cause and write the letter of the variances in the answer space next to the case. You may use some answers more than once or not at all. Print using legible CAPITAL letters. Variances A. B. C. D. E. F. favorable materials price variance unfavorable materials price variance favorable materials quantity variance unfavorable materials quantity variance favorable labor rate variance unfavorable labor rate variance Answer G. favorable labor efficiency variance H. unfavorable labor efficiency variance J. favorable overhead controllable variance K. unfavorable overhead controllable variance L. favorable overhead volume variance M. unfavorable overhead volume variance Case 1. The company produced more units than anticipated. 2. Workers were paid more than they were worth. 3. The purchasing manager skillfully negotiated a better price. 4. The market had an unexpected oversupply of the required materials. 5. The company had a strike and unskilled workers were hired. 6. The factory janitor worked more hours than anticipated. (variable cost). 8. Markus reported the following amounts for 2006: Actual material cost $75,000 Material price variance $1,100 F Budgeted material $73.000 Material quantity $1,050 U cost variance Markus employs management by exception and has a 1.5% materiality threshold. Support with calculations. Should you investigate the material price variance? Briefly justify why or why not. Should you investigate the material quantity variance? Briefly justify why or why not. 9. Shubert manufactures machinery. The following information is available for the year ending October 31, 2009. • Produced and sold 1,000 machines at $1,100 each. • Production was budgeted at 1,200 machines. • Standard variable costs per machine were: • Direct materials: 100 pounds at $2 a pound • Direct labor: 20 hours at $9 • Variable overhead: $145,000 Fixed overhead was budgeted at $256,000. • Actual production costs were: • Direct materials purchased and used: 105,000 pounds at $1.80. • Direct labor: 19,000 hours at $9.20 • Variable overhead: $147,000 • Fixed overhead: $271,000 A Prepare a flexible budget for October. B. How does a performance report differ?