View - Jordan Ahli Bank

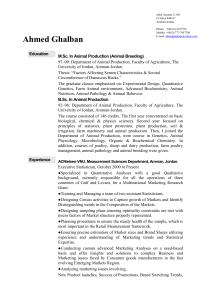

advertisement