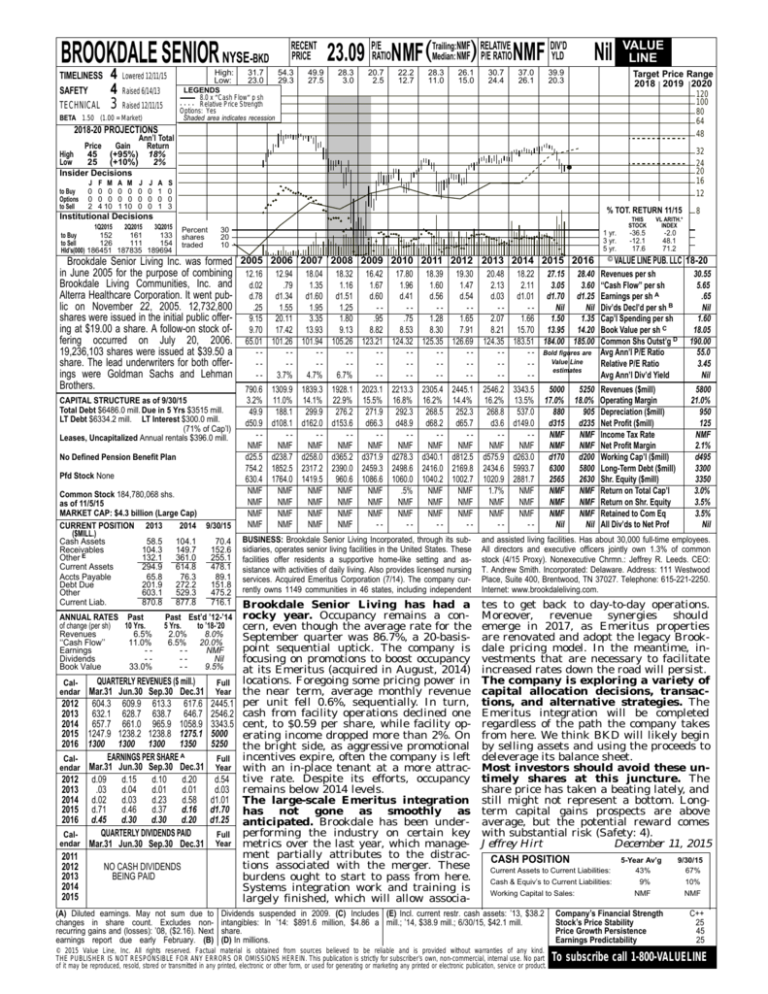

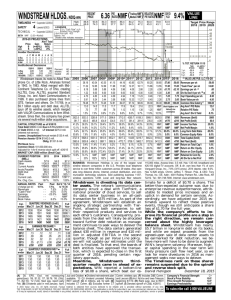

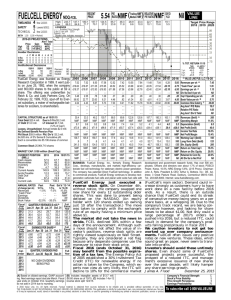

BROOKDALE SENIOR NYSE-BKD

TIMELINESS

SAFETY

TECHNICAL

4

4

3

High:

Low:

Lowered 12/11/15

RECENT

PRICE

31.7

23.0

54.3

29.3

49.9

27.5

NMF RELATIVE

DIV’D

Median: NMF) P/E RATIO NMF YLD

23.09 P/ERATIONMF(Trailing:

28.3

3.0

20.7

2.5

22.2

12.7

28.3

11.0

26.1

15.0

30.7

24.4

37.0

26.1

Nil

39.9

20.3

Target Price Range

2018 2019 2020

LEGENDS

8.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Raised 6/14/13

Raised 12/11/15

BETA 1.50 (1.00 = Market)

VALUE

LINE

120

100

80

64

48

2018-20 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

45 (+95%) 18%

Low

25 (+10%)

2%

Insider Decisions

to Buy

Options

to Sell

J

0

0

2

F M

0 0

0 0

4 10

A M

0 0

0 0

1 10

J

0

0

0

J

0

0

0

A

1

0

1

32

24

20

16

12

S

0

0

3

% TOT. RETURN 11/15

Institutional Decisions

1Q2015

2Q2015

3Q2015

152

161

133

to Buy

to Sell

126

111

154

Hld’s(000) 186451 187835 189694

Percent

shares

traded

30

20

10

1 yr.

3 yr.

5 yr.

Brookdale Senior Living Inc. was formed 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

in June 2005 for the purpose of combining 12.16 12.94 18.04 18.32 16.42 17.80 18.39 19.30 20.48 18.22 27.15 28.40

Brookdale Living Communities, Inc. and d.02

.79

1.35

1.16

1.67

1.96

1.60

1.47

2.13

2.11

3.05

3.60

Alterra Healthcare Corporation. It went pub- d.78 d1.34 d1.60 d1.51 d.60 d.41 d.56 d.54

d.03 d1.01 d1.70 d1.25

lic on November 22, 2005. 12,732,800

.25

1.55

1.95

1.25

------Nil

Nil

shares were issued in the initial public offer- 9.15 20.11 3.35 1.80

.95

.75

1.28

1.65

2.07

1.66

1.50

1.35

ing at $19.00 a share. A follow-on stock of- 9.70 17.42 13.93 9.13 8.82 8.53 8.30 7.91

8.21 15.70 13.95 14.20

fering occurred on July 20, 2006. 65.01 101.26 101.94 105.26 123.21 124.32 125.35 126.69 124.35 183.51 184.00 185.00

19,236,103 shares were issued at $39.50 a

---------- - Bold figures are

Value Line

share. The lead underwriters for both offer----------estimates

ings were Goldman Sachs and Lehman

-3.7%

4.7%

6.7%

------Brothers.

790.6 1309.9 1839.3 1928.1 2023.1 2213.3 2305.4 2445.1 2546.2 3343.5

5000

5250

CAPITAL STRUCTURE as of 9/30/15

Total Debt $6486.0 mill. Due in 5 Yrs $3515 mill.

LT Debt $6334.2 mill. LT Interest $300.0 mill.

(71% of Cap’l)

Leases, Uncapitalized Annual rentals $396.0 mill.

No Defined Pension Benefit Plan

Pfd Stock None

Common Stock 184,780,068 shs.

as of 11/5/15

MARKET CAP: $4.3 billion (Large Cap)

CURRENT POSITION 2013

2014

($MILL.)

Cash Assets

58.5

104.1

Receivables

104.3

149.7

132.1

361.0

Other E

Current Assets

294.9

614.8

Accts Payable

65.8

76.3

Debt Due

201.9

272.2

Other

603.1

529.3

Current Liab.

870.8

877.8

2012

2013

2014

2015

2016

Calendar

2012

2013

2014

2015

2016

Calendar

2011

2012

2013

2014

2015

11.0%

188.1

d108.1

-NMF

d238.7

1852.5

1764.0

NMF

NMF

NMF

NMF

14.1% 22.9% 15.5% 16.8% 16.2% 14.4%

299.9 276.2 271.9 292.3 268.5 252.3

d162.0 d153.6 d66.3 d48.9 d68.2 d65.7

------NMF

NMF

NMF

NMF

NMF

NMF

d258.0 d365.2 d371.9 d278.3 d340.1 d812.5

2317.2 2390.0 2459.3 2498.6 2416.0 2169.8

1419.5 960.6 1086.6 1060.0 1040.2 1002.7

NMF

NMF

NMF

.5%

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

NMF

-----

16.2%

268.8

d3.6

-NMF

d575.9

2434.6

1020.9

1.7%

NMF

NMF

--

13.5%

537.0

d149.0

-NMF

d263.0

5993.7

2881.7

NMF

NMF

NMF

--

17.0%

880

d315

NMF

NMF

d170

6300

2565

NMF

NMF

NMF

Nil

18.0%

905

d235

NMF

NMF

d200

5800

2630

NMF

NMF

NMF

Nil

VL ARITH.*

INDEX

-36.5

-12.1

17.6

-2.0

48.1

71.2

© VALUE LINE PUB. LLC

8

18-20

Revenues per sh

‘‘Cash Flow’’ per sh

Earnings per sh A

Div’ds Decl’d per sh B

Cap’l Spending per sh

Book Value per sh C

Common Shs Outst’g D

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

30.55

5.65

.65

Nil

1.60

18.05

190.00

55.0

3.45

Nil

Revenues ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

5800

21.0%

950

125

NMF

2.1%

d495

3300

3350

3.0%

3.5%

3.5%

Nil

BUSINESS: Brookdale Senior Living Incorporated, through its subsidiaries, operates senior living facilities in the United States. These

facilities offer residents a supportive home-like setting and assistance with activities of daily living. Also provides licensed nursing

services. Acquired Emeritus Corporation (7/14). The company currently owns 1149 communities in 46 states, including independent

and assisted living facilities. Has about 30,000 full-time employees.

All directors and executive officers jointly own 1.3% of common

stock (4/15 Proxy). Nonexecutive Chrmn.: Jeffrey R. Leeds. CEO:

T. Andrew Smith. Incorporated: Delaware. Address: 111 Westwood

Place, Suite 400, Brentwood, TN 37027. Telephone: 615-221-2250.

Internet: www.brookdaleliving.com.

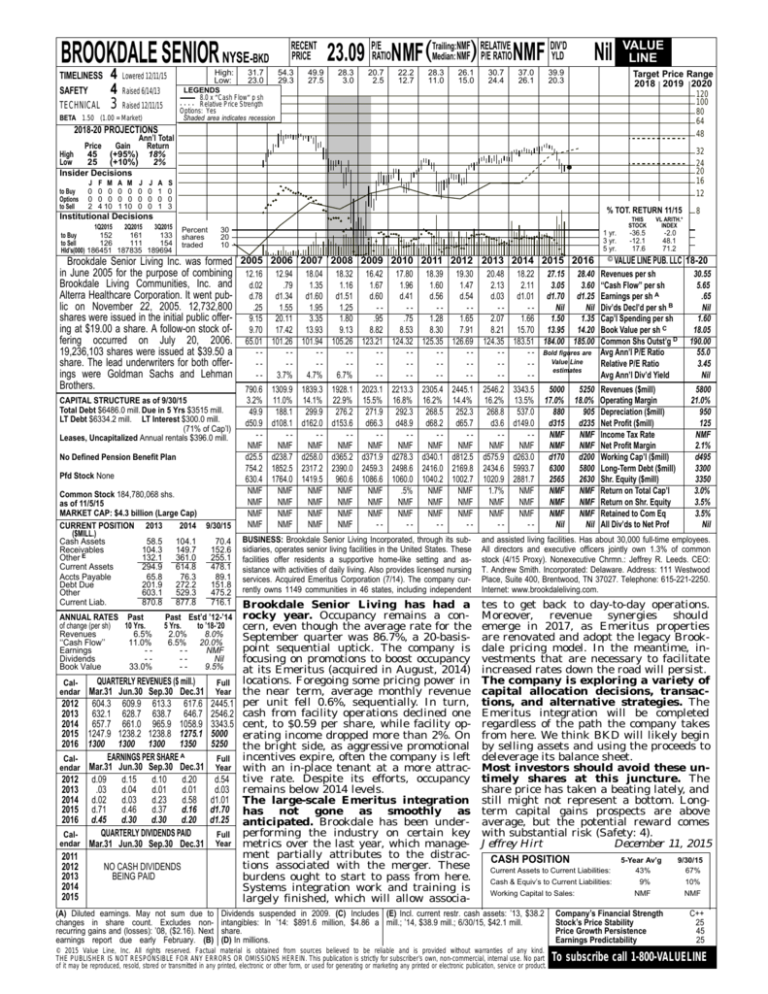

Brookdale Senior Living has had a

rocky year. Occupancy remains a concern, even though the average rate for the

September quarter was 86.7%, a 20-basispoint sequential uptick. The company is

focusing on promotions to boost occupancy

at its Emeritus (acquired in August, 2014)

QUARTERLY REVENUES ($ mill.)

Full locations. Foregoing some pricing power in

Mar.31 Jun.30 Sep.30 Dec.31 Year the near term, average monthly revenue

604.3 609.9 613.3 617.6 2445.1 per unit fell 0.6%, sequentially. In turn,

632.1 628.7 638.7 646.7 2546.2 cash from facility operations declined one

657.7 661.0 965.9 1058.9 3343.5 cent, to $0.59 per share, while facility op1247.9 1238.2 1238.8 1275.1 5000 erating income dropped more than 2%. On

1300 1300 1300 1350 5250 the bright side, as aggressive promotional

EARNINGS PER SHARE A

Full incentives expire, often the company is left

Mar.31 Jun.30 Sep.30 Dec.31 Year with an in-place tenant at a more attracd.09

d.15

d.10

d.20

d.54 tive rate. Despite its efforts, occupancy

.03

d.04

d.01

d.01

d.03 remains below 2014 levels.

d.02

d.03

d.23

d.58 d1.01 The large-scale Emeritus integration

d.71

d.46

d.37 d.16 d1.70 has

not

gone

as

smoothly

as

d.45 d.30 d.30 d.20 d1.25 anticipated. Brookdale has been underQUARTERLY DIVIDENDS PAID

Full performing the industry on certain key

Mar.31 Jun.30 Sep.30 Dec.31 Year metrics over the last year, which management partially attributes to the distractions associated with the merger. These

NO CASH DIVIDENDS

BEING PAID

burdens ought to start to pass from here.

Systems integration work and training is

largely finished, which will allow associa-

tes to get back to day-to-day operations.

Moreover,

revenue

synergies

should

emerge in 2017, as Emeritus properties

are renovated and adopt the legacy Brookdale pricing model. In the meantime, investments that are necessary to facilitate

increased rates down the road will persist.

The company is exploring a variety of

capital allocation decisions, transactions, and alternative strategies. The

Emeritus integration will be completed

regardless of the path the company takes

from here. We think BKD will likely begin

by selling assets and using the proceeds to

deleverage its balance sheet.

Most investors should avoid these untimely shares at this juncture. The

share price has taken a beating lately, and

still might not represent a bottom. Longterm capital gains prospects are above

average, but the potential reward comes

with substantial risk (Safety: 4).

Jeffrey Hirt

December 11, 2015

CASH POSITION

5-Year Av’g

9/30/15

ANNUAL RATES Past

of change (per sh)

10 Yrs.

Revenues

6.5%

‘‘Cash Flow’’

11.0%

Earnings

-Dividends

-Book Value

33.0%

Calendar

9/30/15

3.2%

49.9

d50.9

-NMF

d25.5

754.2

630.4

NMF

NMF

NMF

NMF

THIS

STOCK

70.4

152.6

255.1

478.1

89.1

151.8

475.2

716.1

Past Est’d ’12-’14

5 Yrs.

to ’18-’20

2.0%

8.0%

6.5% 20.0%

-NMF

-Nil

-9.5%

(A) Diluted earnings. May not sum due to

changes in share count. Excludes nonrecurring gains and (losses): ’08, ($2.16). Next

earnings report due early February. (B)

Current Assets to Current Liabilities:

Cash & Equiv’s to Current Liabilities:

Working Capital to Sales:

Dividends suspended in 2009. (C) Includes (E) Incl. current restr. cash assets: ’13, $38.2

intangibles: In ’14: $891.6 million, $4.86 a mill.; ’14, $38.9 mill.; 6/30/15, $42.1 mill.

share.

(D) In millions.

© 2015 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

43%

9%

NMF

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

67%

10%

NMF

C++

25

45

25

To subscribe call 1-800-VALUELINE