Understanding Financial Information for Bankruptcy

advertisement

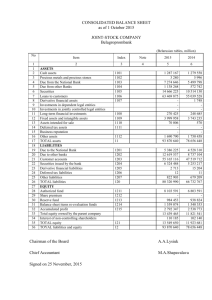

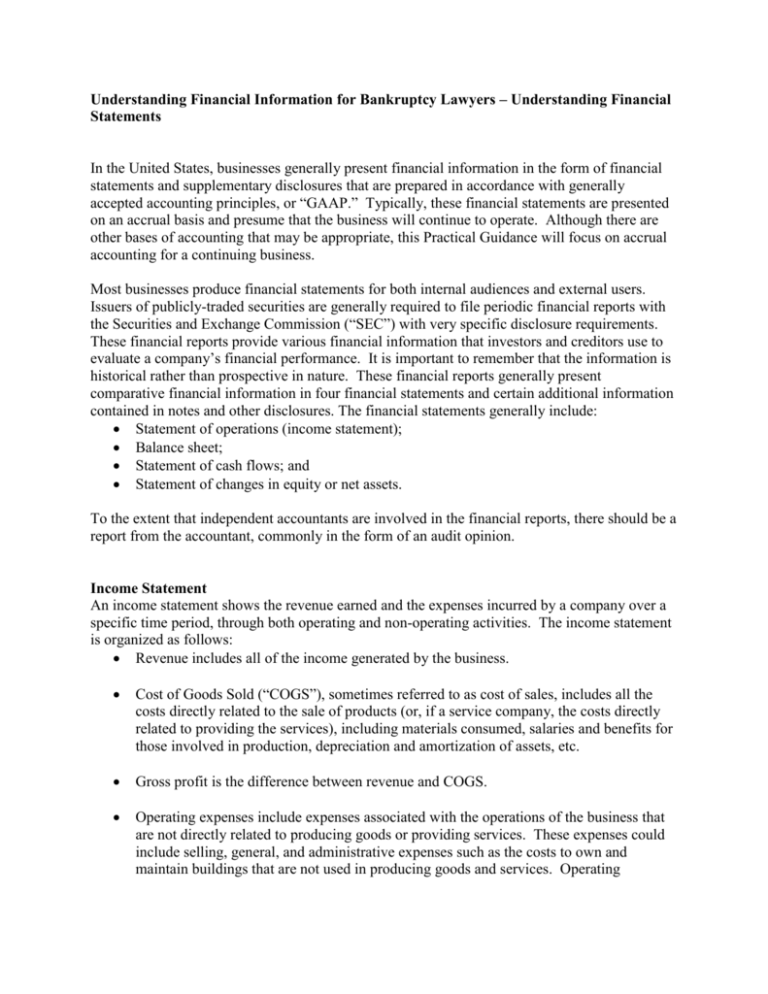

Understanding Financial Information for Bankruptcy Lawyers – Understanding Financial Statements In the United States, businesses generally present financial information in the form of financial statements and supplementary disclosures that are prepared in accordance with generally accepted accounting principles, or “GAAP.” Typically, these financial statements are presented on an accrual basis and presume that the business will continue to operate. Although there are other bases of accounting that may be appropriate, this Practical Guidance will focus on accrual accounting for a continuing business. Most businesses produce financial statements for both internal audiences and external users. Issuers of publicly-traded securities are generally required to file periodic financial reports with the Securities and Exchange Commission (“SEC”) with very specific disclosure requirements. These financial reports provide various financial information that investors and creditors use to evaluate a company’s financial performance. It is important to remember that the information is historical rather than prospective in nature. These financial reports generally present comparative financial information in four financial statements and certain additional information contained in notes and other disclosures. The financial statements generally include: Statement of operations (income statement); Balance sheet; Statement of cash flows; and Statement of changes in equity or net assets. To the extent that independent accountants are involved in the financial reports, there should be a report from the accountant, commonly in the form of an audit opinion. Income Statement An income statement shows the revenue earned and the expenses incurred by a company over a specific time period, through both operating and non-operating activities. The income statement is organized as follows: Revenue includes all of the income generated by the business. Cost of Goods Sold (“COGS”), sometimes referred to as cost of sales, includes all the costs directly related to the sale of products (or, if a service company, the costs directly related to providing the services), including materials consumed, salaries and benefits for those involved in production, depreciation and amortization of assets, etc. Gross profit is the difference between revenue and COGS. Operating expenses include expenses associated with the operations of the business that are not directly related to producing goods or providing services. These expenses could include selling, general, and administrative expenses such as the costs to own and maintain buildings that are not used in producing goods and services. Operating expenses often include accounting and legal expenses, payroll and benefits for administrative staff, utilities, maintenance, insurance, rent, repairs and maintenance, etc. Depreciation and amortization reflect the estimated decrease in value of tangible and intangible capital assets that are used by the business. Earnings Before Interest and Taxes (“EBIT”), or operating profit, is gross profit minus operating expenses and depreciation. EBIT shows the capacity of a business to repay its obligations. Net Income is EBIT less taxes and interest expenses. Below is a sample income statement: Sample Income Statement Total Revenue $100,000 COGS ($30,000) Gross Profit $70,000 Operating Expense ($18,000) Depreciation ($15,000) EBIT or Operating $37,000 Profit Interest Expense ($10,000) Taxes ($10,000) Net Income $17,000 Balance Sheet The balance sheet shows what a company owns and what it owes at a fixed point in time. The balance sheet provides detailed information about assets, liabilities, and shareholders’ equity. The relationship between these categories is as follows: Assets = Liabilities + Owners Equity. Assets are the property that a company owns. There are three basic types of assets: current assets, tangible fixed assets, and intangible assets. Current assets are cash or assets that will be converted to cash within the next year. A company’s current assets may include cash, inventories, and accounts receivable. Fixed assets represent the tangible, long-lived assets that a company may own. These are assets that are not scheduled to be converted into cash within the next year and include buildings, machinery, and land. Lastly, a company’s intangible assets are those assets that cannot be physically touched, such as intellectual property, branding, customer relationships, and goodwill. Assets are generally presented at historical cost rather than current market value. Although some assets may reflect adjustments to reflect reductions in value, assets are very rarely adjusted upwards to reflect increases in their value above their original cost. Liabilities are the debts and obligations of a company. There are two basic types of liabilities: current liabilities and non-current liabilities. Similar to current assets, current liabilities are the debts and financial obligations of a company that will be repaid within the next year. Accounts payable and accrued interest, wages, and current maturities of long-term debt can all be considered current liabilities. Conversely, non-current liabilities are the debts and financial obligations that will not come due within the next year. Common non-current liabilities are long-term debt and pension obligations. Shareholders’ equity is the equity stake currently held by a firm’s owners/investors. Shareholders' equity comes from two main sources. Paid in capital represents the funds that were originally invested in the company, along with any additional contributions made thereafter. Retained earnings represent the profit, after tax, that the company has generated from its operations. Below is a graphic representation of assets, liabilities, and shareholders' equity. Statement of Cash Flows The statement of cash flows details a company’s sources and uses of cash, including the net increase or decrease in cash for the period, and reconciles the amount of profit to the movement in cash in a given period. Generally, cash flow statements are divided into three main parts: cash flow from operations, investing, and financing. Each part summarizes the cash flow associated with each of these activities. When working with a troubled company, a recurring refrain is “cash is king,” and the statement of cash flows often reveals extremely valuable information about the business. Operations – Cash flow from operations reflects how much cash is generated from a company's business operations. Most companies report cash flow from operations using the indirect method, which reconciles net income or losses to the actual cash inflows/outflows from operations by adjusting for non-cash items reported on the income statement (e.g., depreciation) and changes in working capital and other operating assets (e.g., accounts receivable, inventory, accounts payable, etc.). Negative or declining cash flow from operations is often the first warning sign that a business is under stress. Another sign of distress may include positive cash flow generated from accounts payable, frequently referred to as “stretching.” Positive cash flow is generated when accounts payable balances increase over a period of time (due to slowing of payments or, in certain cases, non-payment), and is generally an indication that the business lacks liquidity. Investing – Cash flow from investing activities shows the cash flow impact of a business’s investments in its assets during a given period of time. Usually cash changes from investing are a "cash out" item as cash is used to buy new equipment, buildings, or other assets such as marketable securities. However, when a company divests of an asset, the cash generated from the transaction is considered a "cash in" item and is reported as a positive amount in the cash flow from investing activities section. Financing – Cash flow from financing activities represents the cash impact of changes in debt, loans, or the payment of dividends during a given period of time. Changes in cash from financing are "cash in" when capital is raised, and are "cash out" when interest or dividends are paid. Thus, if a company issues a bond to the public, the company receives cash inflows; however, when interest is paid to bondholders, the company is reducing its cash. Reports of Independent Accountants When outside accounts are involved in financial reporting, they are generally required to issue reports indicating their level of involvement from assisting in the preparation of the statements, reviewing the statements, and/or auditing the information contained therein. If the financial statements include an audit opinion, there may be “qualifications” to the opinion. Often, the audit opinion for the financial statements of troubled companies will state that the company may not be a “going concern.” In those cases, the reader should understand that the financial statements presume that the business will continue and do not address what may happen if the company files for protection under the Bankruptcy Code. Some common financial statement ratios and calculations are analyzed in the chart below. Common Financial Statement Ratios and Calculations Ratio Formula Purpose Gross margin (Revenue – Cost of A measure of profitability; Goods Sold) / indicates the percentage of Revenue total sales that the company retains after incurring the costs associated with producing the goods or providing services Operating margin Income from A measure of profitability; Operations / indicates how much of each Derived From Income Statement Income Statement Revenue EBITDA margin Interest coverage Earnings per share (EPS) Price-to-earnings ratio (P/E Ratio) Current ratio Quick ratio Days cash on hand (DCOH) Days sales outstanding (DSO) Inventory turnover ratio Days payable outstanding (DPO) Return on assets (ROA) Net Income before Interest, Taxes, Depreciation and Amortization / Revenue Net Income before Interest and Taxes / Interest Expense (Net Income – Dividends on Preferred Stock) / Average Outstanding Shares Price per Share / Earnings per Share dollar of revenue is left after operating expenses A measure of profitability; often used to approximate operating cash flows Income Statement A ratio used to determine how easily a company can pay interest on outstanding debt A measure of profitability; indicates the amount of profit earned during a period per share of common stock. Income Statement A valuation ratio; compares a company’s current share price against its per-share earnings Current Assets / A liquidity ratio; indicates the Current Liabilities ability of a business to satisfy current liabilities with current assets (Current Assets – A liquidity ratio; indicates the Inventories) / ability of a business to satisfy Current Liabilities current liabilities with its most liquid current assets Cash & Cash A liquidity ratio; indicates the Equivalents / number of days of cash ((Operating Expenses operating expenses a – Depreciation – company could cover with its Amortization)/# of cash on hand Days) (Accounts Receivable A working capital ratio; / Average Credit measures the average number Sales) * Number of of days that it takes for a Days company to collect revenue from a credit sale Cost of Sales / A working capital ratio; Average Inventory indicates how many times inventory is sold and replaced during a given period (Accounts Payable / A working capital ratio; Cost of Sales) * indicates how long it typically Number of Days takes a company to pay a trade creditor Net Income / A profitability/efficiency Average Total Assets metric; indicates how efficient Income Statement & Balance Sheet Income Statement & Balance Sheet Balance Sheet Balance Sheet Income Statement & Balance Sheet Income Statement & Balance Sheet Income Statement & Balance Sheet Income Statement & Balance Sheet Income Statement & Balance Sheet Debt-to-total-capital Debt-to-equity Total Debt / (Total Debt + Shareholder’s Equity) Total Debt / Shareholder’s Equity management is at utilizing assets to generate profits A leverage ratio; indicates the relative use of debt and equity as a source of capital A leverage ratio; indicates the relative use of debt and equity as a source of capital Balance Sheet Balance Sheet The relevance and application of each of these ratios is dependent on the type of business and industry being evaluated. Bibliography Entrepreneur Media, Inc. (n.d.). Entrepreneur. Retrieved December 18, 2012, from Income Statement: http://www.entrepreneur.com/encyclopedia/term/82202.html# Investopedia US. (2010, May 23). What is a Cash Flow Statement? Retrieved December 18, 2012, from Investopedia: http://www.investopedia.com/articles/04/033104.asp#axzz2A98o1eiU U.S. Securities and Exchange Commission. (2007, February 5). Beginners' Guide to Financial Statements. Retrieved December 18, 2012, from U.S. Securities and Exchange Commission: http://www.sec.gov/investor/pubs/begfinstmtguide.htm