Solutions

advertisement

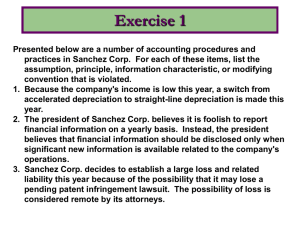

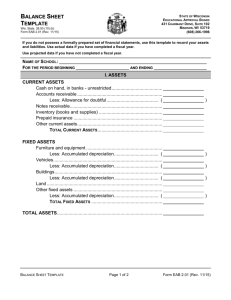

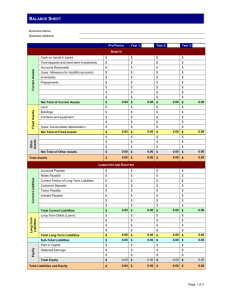

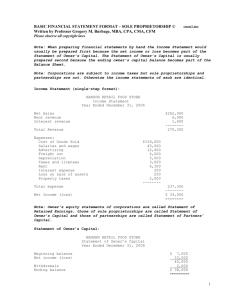

Intermediate Accounting I, ACCT-2154 Chapter 3 Practice Problem Solutions Exercise 3–3 1. f Accrued interest payable 2. d Franchise 3. -c Accumulated depreciation 4. a Prepaid insurance, for 2014 5. g Bonds payable, due in 10 years 6. f Current maturities of long-term debt 7. f Note payable, due in 3 months speculation 8. b Long-term receivables 9. b Bond sinking fund, will be used to retire bonds in 10 years 10. 11. 12. 13. 14. 15. 16. a c c f d h b Supplies Machinery Land, in use Unearned revenue Copyrights Preferred stock Land, held for 17. 18. a f Cash equivalents Wages payable Exercise 3–11 1. 2. 3. 4. 5. When related-party transactions occur, companies must disclose the nature of the relationship, provide a description of the transaction, and report the dollar amounts of the transactions and any amounts due from or to related parties. When an event that has a material effect on the company’s financial position occurs after the fiscal year-end, but before the financial statements actually are issued, the event is disclosed in a subsequent event disclosure note. The choice of the straight-line method to determine depreciation typically is disclosed in the company’s summary of significant accounting policies disclosure note. This information would be included in a disclosure note describing the company’s debt. The choice of the FIFO method to determine value inventory typically is disclosed in the company’s summary of significant accounting policies disclosure note. Exercise 3–5 VALLEY PUMP CORPORATION Balance Sheet At December 31, 2013 Assets Current assets: Cash ................................................................................ Marketable securities ...................................................... Accounts receivable, net of allowance for uncollectible accounts of $5,000 .............................. Inventories ...................................................................... Prepaid expenses ............................................................ Total current assets ................................................... $ 25,000 22,000 51,000 81,000 32,000 211,000 Investments: Marketable securities ...................................................... Land ................................................................................ Total investments ..................................................... Property, plant, and equipment: Land ................................................................................ Buildings ........................................................................ Equipment ...................................................................... Less: Accumulated depreciation ..................................... Net property, plant, and equipment .......................... $22,000 20,000 42,000 100,000 300,000 75,000 475,000 (125,000) 350,000 Intangible assets: Copyright ........................................................................ Total assets ............................................................ Liabilities and Shareholders' Equity Current liabilities: Accounts payable ........................................................... Interest payable ............................................................... Unearned revenues ......................................................... Note payable ................................................................... Current maturities of long-term debt .............................. Total current liabilities ............................................. Long-term liabilities: Note payable ................................................................... Shareholders’ equity: Common stock ................................................................ Retained earnings ........................................................... Total shareholders’ equity ........................................ Total liabilities and shareholders’ equity .............. 12,000 $615,000 $ 65,000 10,000 20,000 100,000 50,000 245,000 100,000 $200,000 70,000 270,000 $615,000