Study Guide Solutions -

advertisement

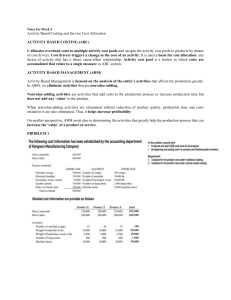

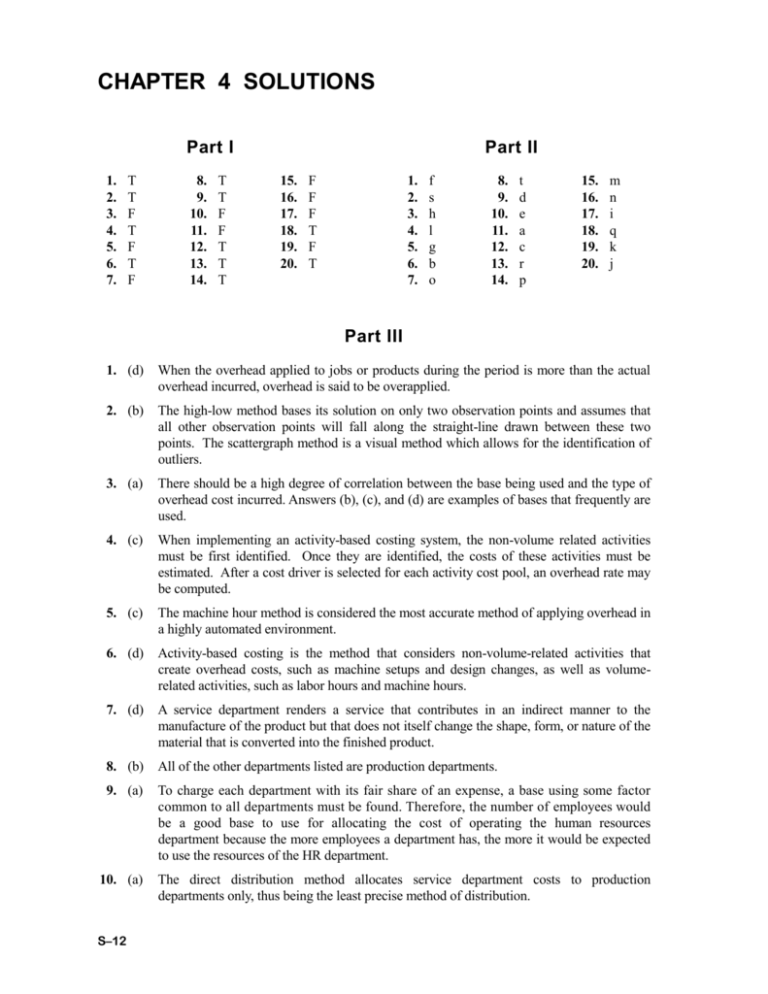

CHAPTER 4 SOLUTIONS Part I 1. 2. 3. 4. 5. 6. 7. T T F T F T F 8. 9. 10. 11. 12. 13. 14. T T F F T T T Part II 15. 16. 17. 18. 19. 20. F F F T F T 1. 2. 3. 4. 5. 6. 7. f s h l g b o 8. 9. 10. 11. 12. 13. 14. t d e a c r p 15. 16. 17. 18. 19. 20. m n i q k j Part III 1. (d) When the overhead applied to jobs or products during the period is more than the actual overhead incurred, overhead is said to be overapplied. 2. (b) The high-low method bases its solution on only two observation points and assumes that all other observation points will fall along the straight-line drawn between these two points. The scattergraph method is a visual method which allows for the identification of outliers. 3. (a) There should be a high degree of correlation between the base being used and the type of overhead cost incurred. Answers (b), (c), and (d) are examples of bases that frequently are used. 4. (c) When implementing an activity-based costing system, the non-volume related activities must be first identified. Once they are identified, the costs of these activities must be estimated. After a cost driver is selected for each activity cost pool, an overhead rate may be computed. 5. (c) The machine hour method is considered the most accurate method of applying overhead in a highly automated environment. 6. (d) Activity-based costing is the method that considers non-volume-related activities that create overhead costs, such as machine setups and design changes, as well as volumerelated activities, such as labor hours and machine hours. 7. (d) A service department renders a service that contributes in an indirect manner to the manufacture of the product but that does not itself change the shape, form, or nature of the material that is converted into the finished product. 8. (b) All of the other departments listed are production departments. 9. (a) To charge each department with its fair share of an expense, a base using some factor common to all departments must be found. Therefore, the number of employees would be a good base to use for allocating the cost of operating the human resources department because the more employees a department has, the more it would be expected to use the resources of the HR department. 10. (a) The direct distribution method allocates service department costs to production departments only, thus being the least precise method of distribution. S–12 Chapter Four Solutions Part IV High volume ......................................... Low volume .......................................... Difference ............................................. Machine Hours 720 320 400 Electricity Expense $38,000 22,000 $16,000 Variable cost per machine hour: $16,000 ÷ 400 = $40 Fixed cost: Cost at low volume........................................ Variable cost (320 × $40) .............................. Fixed cost....................................................... $22,000 12,800 $ 9,200 OR Fixed cost: Cost at high volume....................................... Variable cost (720 × $40) .............................. Fixed cost....................................................... $38,000 28,800 $ 9,200 S–13 Part V Total Production Departments Preparation $6,000 Distribution of service departments: Utilities: 70% metered hours* .... (30%) 30% sq. footage**........ (36%) Mixing $5,700 1,512 a (36%) 778 (26%) Service Departments Packaging $6,950 Utilities $7,200 (50%) 2,395 (25%) (14%) 706 (5,040) (10%) 504) (6%) 302) (4%) 202) 562 (24%) 518 (2,160) (4%) 86) (2%) 43) (8%) 173) b (10%) 479) (5%) 239) 1,198 (10%) 479 $4,790) $(4,790) $3,699) Materials handling ......... (45%) 1,664 (35%) 1,295 (20%) 740 Factory office ................. (50%) 1,594 (40%) 1,276 (10%) 319 $35,500 $13,943 $11,845 500,000 300,000 $9,712 Bases: Pounds handled .............. Direct labor costs ........... Rates ................................. *$7,200 × .70 = $5,040 **$7,200 × .30 = $2,160 a 1,500 ÷ 5,000 × $5,040 = $1,512 b 4,000 ÷ 50,000 × $2,160 = $173 $10,000 $.0279 per pound handled Factory Office $2,575 1,814 $7,200) Maintenance ................... Maintenance $4,200 Materials Handling $2,875 $.0395 per pound handled 97.12% of direct labor cost $3,189) $(3,699) $(3,189) Chapter Four Solutions Part VI Cost of Job 007: Direct materials ................................................................................ Direct labor....................................................................................... Factory overhead: Material handling (400 tons × $20/ton) ..................................... Machine usage (200 hrs. × $40/hr.) ........................................... Machine setups (2 setups × $1,000/setup) ................................. Inspections (10 hrs. × $50/hr.)……………………………….. Design changes (1 design change × $2,000/change) ................. Total cost .......................................................................................... $ 10,000 4,000 8,000 8,000 2,000 500 2,000 $34,500 S–15