Credit Suisse Global Sustainable Dividend Equity Fund

Fund Profile

Summary

The Fund seeks to exceed the benchmark over the full

market cycle with less risk than the broader equity market.

In a global market environment where yield is difficult to find, blue

chip equities with growing, sustainable dividends offer the potential for higher than benchmark current yield and long-term growth

of income.

Blue Chip, Sustainable, Global Dividend Yield

Blue Chip: Focuses on high-quality companies with wide

defensive moats and ample cash flows.

Sustainable Dividends: Targets capital disciplined companies

with a strong track record of returning cash to shareholders.

Attractive Valuations: Seeks capital appreciation by investing

in companies trading at a discount to intrinsic value.

Better Than Equity Market Yield: Estimated current dividend

yield of 3.3%1 vs. 1.9% for the S&P 500.

Global Diversification: Well-diversified across sectors and

countries and balanced between cyclical and defensive

companies.

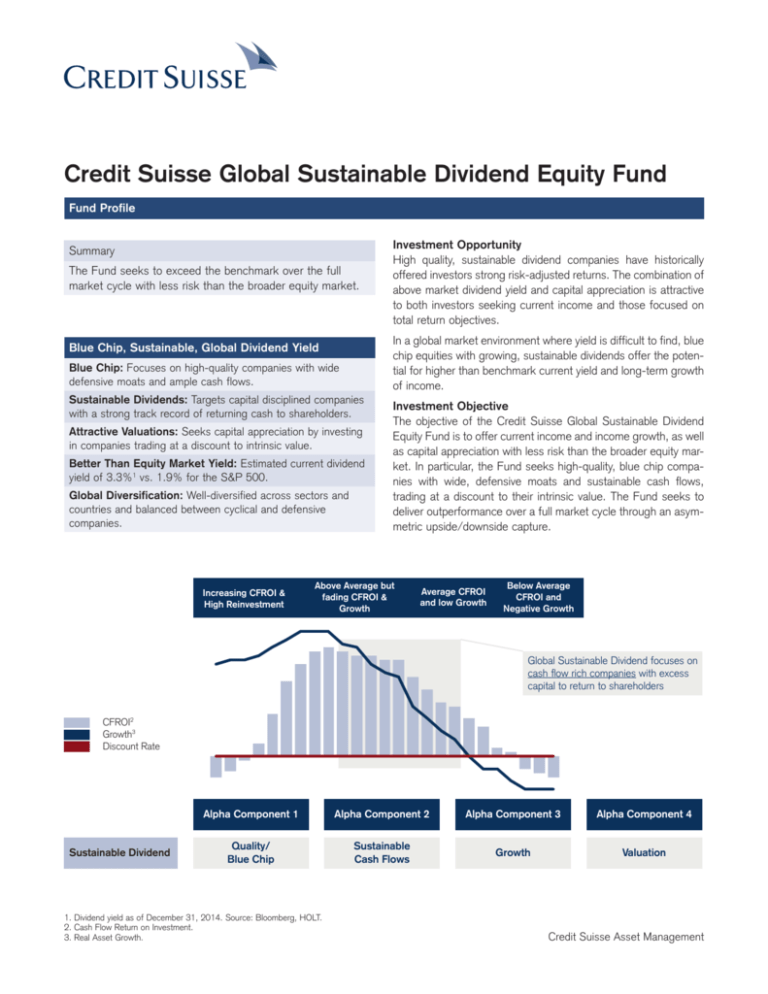

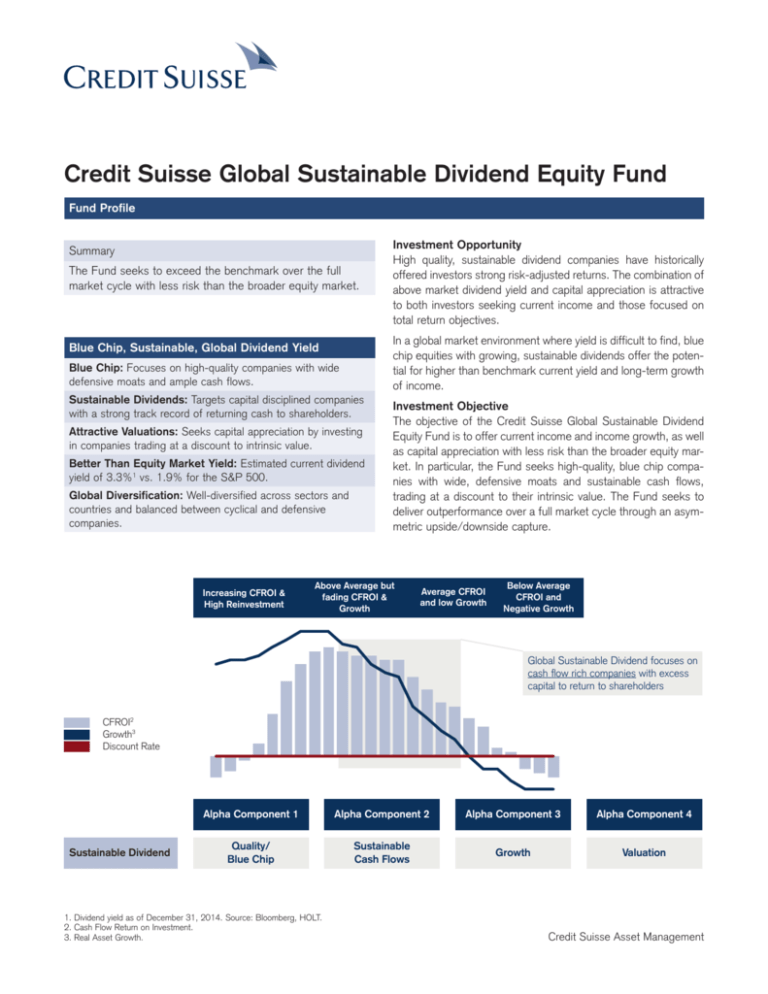

Increasing CFROI &

High Reinvestment

Investment Opportunity

High quality, sustainable dividend companies have historically

offered investors strong risk-adjusted returns. The combination of

above market dividend yield and capital appreciation is attractive

to both investors seeking current income and those focused on

total return objectives.

Investment Objective

The objective of the Credit Suisse Global Sustainable Dividend

Equity Fund is to offer current income and income growth, as well

as capital appreciation with less risk than the broader equity market. In particular, the Fund seeks high-quality, blue chip companies with wide, defensive moats and sustainable cash flows,

trading at a discount to their intrinsic value. The Fund seeks to

deliver outperformance over a full market cycle through an asymmetric upside/downside capture.

Above Average but

fading CFROI &

Growth

Average CFROI

and low Growth

Below Average

CFROI and

Negative Growth

Global Sustainable Dividend focuses on

cash flow rich companies with excess

capital to return to shareholders

CFROI2

Growth3

Discount Rate

Sustainable Dividend

Alpha Component 1

Alpha Component 2

Alpha Component 3

Alpha Component 4

Quality/

Blue Chip

Sustainable

Cash Flows

Growth

Valuation

1. Dividend yield as of December 31, 2014. Source: Bloomberg, HOLT.

2. Cash Flow Return on Investment.

3. Real Asset Growth.

Credit Suisse Asset Management

Investment Philosophy

Portfolio Managers

The Fund seeks current income, income growth and capital

appreciation, and is managed by an experienced portfolio management team with an average of 10 years experience, and

access to the resources of the Credit Suisse HOLT team.

Michael Valentinas, CPA, Director

Lead Portfolio Manager

Mike is a lead portfolio manager for the Global Sustainable

Dividend Equity Fund. He joined HOLT Value Associates in 2001

after spending three years as a tax and compensation consultant

for Arthur Andersen. He is a CPA and graduate of DePaul

University in Chicago, Illinois. Mike has been based in Boston,

New York and Chicago, where he currently resides.

ƁƁ High quality, blue chip companies with sustainable

competitive advantages

These companies generally have high and increasing economic returns on capital and low volatility of economic returns

over multi-year periods.

ƁƁ Cash rich companies with excess cash capital to return

to shareholders

These companies often exhibit high to moderate economic

returns, high to moderate free cash flows and high to moderate fixed charge coverage levels.

ƁƁ Companies with moderate sustainable growth levels

These companies have available cash flows for reinvestment

consistent with both the level of a particular year’s economic

returns and a continuation of existing capital structure and

existing dividend payout policy. Companies with moderate

sustainable growth levels often grow at greater than GDP

levels, have moderate to high dividend growth and low to

moderate dividend payout ratios.

ƁƁ Companies with attractive valuations

These companies have potential capital appreciation at or

better than peer median levels, low valuation multiples relative

to peers and dividend yields above market but not at distressed levels.

Adam Steffanus, CFA, Director

Lead Portfolio Manager

Adam is a lead portfolio manager for the Global Sustainable

Dividend Equity Fund. Adam joined Credit Suisse HOLT in 2005

after receiving his MBA from The University of Chicago Booth

School of Business. Prior to business school, Adam worked in

private equity, structuring leveraged buy-out transactions. Adam

is a CFA charterholder and an active member of the CFA Institute

and the CFA Society of Chicago. Adam is based in Chicago,

where he currently resides.

Investment Research

Heather Kidde, CFA, Vice President

Senior Research Analyst

Heather focuses on fundamental company analysis in her role as

the Senior Research Analyst for the Global Sustainable Dividend

Equity Fund. Heather joined Credit Suisse HOLT in 2010 after

spending 3 years in the Private Banking division. Heather is a

CFA charterholder and an active member of the CFA Institute

and the New York Society of Security Analysts (NYSSA). She is

a graduate of Colgate University and is based in New York.

Investment Process

The Global Sustainable Dividend Fund leverages the HOLT database as its primary data source. HOLT is an independent

research division of Credit Suisse which converts noisy accounting data into a standardized set of economic cash flows as a

function of a company’s asset base. HOLT makes adjustments

for varied accounting rules across geographies, rates of inflation,

and company risk profiles to provide a more uniform platform for

stock evaluation, and provides an objective and consistent valuation methodology for over 20,000 companies in 64 countries.

The portfolio management team then uses bottom-up, fundamental analysis to identify companies with a track record of cash

flow generation and the ability to sustain payment of dividends.

The portfolio will generally consist of 30–35 positions, although

the number can vary based on market conditions. Positions are

reviewed weekly and portfolio holdings are generally rebalanced

quarterly.

Credit Suisse Asset Management

Fund Terms

Launch Date

February 27, 2015

Liquidity

Daily

Benchmark

MSCI All Country World Index

Initial Minimum Investment

Class A: $2,500

Class C: $2,500

Class I: $250,000

Tickers

Class A: CGDAX

Class C: CGDCX

Class I: CGDIX

Maximum Sales Charge

Class A: 5.25%

Class C: 1.00%

Class I: None

Redemption Fee

None

Risks:

All investments involve some level of risk. Simply defined, risk is the possibility that you will lose money or not make money.

Principal risk factors for the fund are discussed below. Before you invest, please make sure you understand the risks that apply to

the fund. As with any mutual fund, you could lose money over any period of time. Investments in the fund are not bank deposits

and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Currency Risk: Currency risk is the risk that changes in currency exchange rates will negatively affect securities or instruments

denominated in, and/or payments received in, foreign currencies.

Derivatives Risk: The fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of risks such as

currency risk, liquidity risk, and market risk.

Equity Exposure Risk: The market values of equity securities, such as common stocks, may decline due to general market

conditions and are subject to greater fluctuations than certain other asset classes.

Foreign Securities Risk: A fund that invests outside the U.S. carries additional risks that include: Currency Risk, Emerging

Markets Risk, Information Risk, Political Risk, Access Risk and Operational Risk.

Futures Contracts Risk: Changes in the price of a futures contract may not always track the changes in market value of the

underlying reference asset, trading restrictions or limitations may be imposed and the fund may need to sell other investments if

it has insufficient cash to meet margin requirements.

Liquidity Risk: Certain portfolio holdings may be difficult or impossible to sell at the time and the price that the fund would like.

Manager Risk: If the fund’s portfolio managers make poor investment decisions, it will negatively affect the fund’s performance.

Market Risk: The market value of an instrument may fluctuate, sometimes rapidly and unpredictably.

Small- and Mid- Cap Stock Risk: Stocks of small- and mid-cap companies may be more volatile than those of larger companies.

Swap Agreements Risk: Swap agreements involve the risk that the party with whom the fund has entered into the swap will

default on its obligation to pay the fund and the risk that the fund will not be able to meet its obligations to pay the other party

to the agreement.

This material has been prepared by Credit Suisse Asset Management, LLC (“Credit Suisse”) on the basis of publicly available information, internally

developed data and other third party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from

public and third party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions

and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information, and

are subject to change at any time without notice and with no obligation to update. This material is for informational and illustrative purposes only and is

intended solely for the information of those to whom it is distributed by Credit Suisse. No part of this material may be reproduced or retransmitted in any

manner without the prior written permission of Credit Suisse. Credit Suisse does not represent, warrant or guarantee that this information is suitable for

any investment purpose and it should not be used as a basis for investment decisions. This material does not purport to contain all of the information

that a prospective investor may wish to consider. This material is not to be relied upon as such or used in substitution for the exercise of independent

judgment. Past performance does not guarantee or indicate future results.

This material should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or investment products

or to adopt any investment strategy. The securities identified and described do not represent all of the securities purchased, sold or recommended for

client accounts. The reader should not assume that any investments in companies, securities, sectors, strategies and/or markets identified or described

herein were or will be profitable and no representation is made that any investor will or is likely to achieve results comparable to those shown or will make

any profit or will be able to avoid incurring substantial losses. This informational report does not constitute research and may not be used or relied upon

in connection with any offer or sale of a security or hedge fund or fund of hedge funds. Performance differences for certain investors may occur due to

various factors, including timing of investment and eligibility to participate in new issues. Investment return will fluctuate and may be volatile, especially

over short time horizons. Each investor’s portfolio may be individually managed and may vary from the information shown in terms of portfolio holdings,

characteristics and performance. Current and future portfolio compositions may be significantly different from the information shown herein. Investing

entails risks, including possible loss of some or all of the investor’s principal. The investment views and market opinions/analyses expressed herein may

not reflect those of Credit Suisse Group as a whole and different views may be expressed based on different investment styles, objectives, views or

philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of

risks and uncertainties.

Alternative investments (e.g., Hedge Funds or Private Equity) are complex instruments and may carry a very high degree of risk. Such risks can arise

from extensive use of short sales, derivatives and debt capital. Furthermore, the minimum investment periods can be long. Alternative investments are

intended only for investors who understand and accept the associated risks.

Estimated fees and expenses are taken from the prospectus dated 02/28/15. Credit Suisse Opportunity Funds (the “Trust”) and Credit Suisse Asset

Management, LLC (“Credit Suisse”) have entered into a written contract limiting operating expenses (excluding certain expenses as described below)

to 0.95% of the fund’s average daily net assets for Class A shares, 1.70% of the fund’s average daily net assets for Class C shares and 0.70% of the

fund’s average daily net assets for Class I shares at least through February 28, 2016. The Trust is authorized to reimburse Credit Suisse for management

fees previously limited and/or for expenses previously paid by Credit Suisse, provided, however, that any reimbursements must be paid at a date not more

than three years after the end of the fiscal year during which such fees were limited or expenses were paid by Credit Suisse and the reimbursements

do not cause a class to exceed the applicable expense limitation in the contract at the time the fees were limited or expenses were paid. This contract

may not be terminated before February 28, 2016.

The current maximum initial sales charge for Class A shares is 5.25%. The initial sales charge is reduced for larger purchases. Purchases over

$1,000,000 or more are not subject to an initial sales charge but may be subject to a 1.00% CDSC on redemptions made within 12 months of purchase.

The current maximum CDSC for Class C shares is 1.00% during the first year.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC or any affiliate, are not insured by the

Federal Deposit Insurance Corporation and are not guaranteed by Credit Suisse Asset Management, LLC or any affiliate. Fund

investments are subject to investment risks, including loss of your investment.

The fund’s investment objectives, risks, charges and expenses (which should be considered carefully before invest­

ing), and more complete information about the fund, are provided in the Prospectus, which should be read carefully

before investing. You may obtain copies by calling 800-577-2321. For up-to-date performance, please visit our web­

site at www.credit-suisse.com/us/funds.

CREDIT SUISSE SECURITIES (USA), LLC, DISTRIBUTOR

Copyright © 2015 by CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.