Investment Analysis and Portfolio Management

advertisement

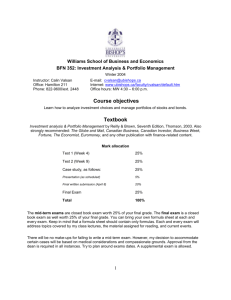

Investment Analysis and Portfolio Management Course Description The course integrates strategy, financial reporting, financial analysis and valuation, application of this framework and tools to fundamental analysis, and the role of intermediaries that use these tools in capital markets. The aim of the course is to provide students with basic theoretical knowledge and practical tools build and manage better portfolios. The discipline cover major topics such as quantitative methods of asset valuation and portfolio formation, stocks and bonds analysis and valuation for investment decision making, options pricing and using as investments, asset allocation, portfolio rebalancing, and portfolio performance measures Course Objectives By completing the course students should know the basic theoretical foundations of portfolio theory, be able to form market expectations and build strategic asset allocation, to select the optimal investment strategy Assessment The student’s performance in the Corporate Tax course will be evaluated as following: Current activity (30%). Case-study (30%). Exam (40%). Main reading 1. John L. Maginn, CFA (Editor), Donald L. Tuttle, CFA (Editor), Dennis W. McLeavey, CFA (Editor), Jerald E. Pinto, CFA (Editor). Managing Investment Portfolios: A Dynamic Process. 3rd Edition. April 2007 2. Investment Analysis and Portfolio Management - Prasanna Chandra - Tata McGraw Hill