Credit Suisse Social Awareness Index - Credit Suisse

Credit Suisse Social Awareness Index

Powered by HOLT

®

November 2010

The Credit Suisse Social Awareness Index Powered by HOLT ® is part of the Credit Suisse series of equity indices

Credit Suisse Social Awareness Index Details

■ Calculated and maintained by Standard & Poor’s

■ Rebalanced semi-annually (March and September)

■ Equally weighted

■ Calculated as a synthetic price-return and total return index

■ Calculated in US Dollars, Euros and Swiss Francs

■ For further details visit www.credit-suisse.com/indices

The HOLT series of equity indices offers investors exposure to portfolios of stocks, which are screened for attractiveness using HOLT’s advanced corporate performance and valuation framework. The factors and categories used in the screening process have shown in simulations to consistently identify stocks that collectively outperform the market.

HOLT is a corporate performance and valuation advisory service of Credit

Suisse. It offers unique insights into corporate performance and valuation, emphasizing a company’s cash-

US Dollar Index

Euro Index

Swiss Franc Index

Social Awareness

Bloomberg Code

CSSAI

CSSAIE

CSSAIC

■ The Credit Suisse Social Awareness Index includes companies that adhere to the ten principles of the United Nations Global Compact.

■ RiskMetrics’ Global Compact Plus Screen is used to measure companies’ performance and strategies against these ten principles.

■

■

The UN Global Compact is a framework for businesses that are committed to aligning their operations and strategies with ten universally accepted principles in the areas of human rights, labour standards, the environment and anticorruption.

The Global Compact’s ten principles in these areas are derived from:

The Universal Declaration of Human Rights

The International Labour Organisation’s Declaration on

Fundamental Principles and Rights at Work

The Rio Declaration on Environment and Development

The United Nations Convention Against Corruption

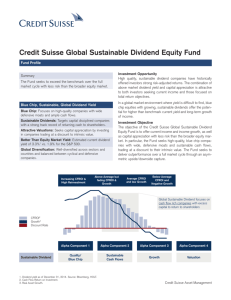

Index historical performance

The Credit Suisse Social Awareness Index has outperformed major indices: generating ability and overall potential for value creation.

HOLT’s proprietary framework currently includes over 20,000 stocks in more than 60 countries. Companies are comparable across sectors and regions, and over time, because accounting and inflation distortions are systematically treated to assess the underlying economics of the business.

Contact Us

300

250

200

150

100

50

For more information, professional investors should contact their Credit

Suisse representative, or email:

0

Mar-03 Apr-04 May-05 Jun-06 Jul-07 Aug-08 Sep-09 Oct-10

CS Social Awareness DJ World Sustainability hs.indices@credit-suisse.com

FTSE4Good Global 100 MSCI World

Source: Bloomberg

Figures showing the performance of the Credit Suisse Social Awareness Index refer to simulated past performance up to April 2008 and real performance thereafter. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance.

Credit Suisse Social Awareness Index

Powered by HOLT

®

The best of HOLT is captured in its scoring model, which is used to screen for the most attractive ideas. Tried and tested factors are divided into three categories, which are ranked and then weighted to give an overall score per company.

Operational performance: Identifies companies with appealing corporate performance characteristics

Valuation: Identifies stocks that are attractively valued according to the

HOLT valuation model

Momentum: Identifies stocks gaining from positive market sentiment

How HOLT creates an index

The Credit Suisse Social Awareness

Index is an equally weighted index of

60 stocks that is rebalanced semiannually. The 60 stocks with the highest score according to HOLT’s scoring model are selected for the index.

A global universe of companies which adhere to the 10 principles of the UN Global Compact

Top 300 stocks by market capitalisation

HOLT Screening

Top 60 Stocks

Index risk/return profile

12%

10%

8%

DJ World

Sustainability

CS Social

Awareness

6% MSCI World

4%

FTSE 100

DJ EURO

STOXX 50

2%

DJ Global Titans

FTSE4Good

Global 100

0%

15% 17% 19% 21% 23% 25%

Risk

2

1 Compounded annual return from 14 th March 2003 to 29 th October 2010

2 Annualised realised volatility from 14 th March 2003 to 29 th October 2010

Source: Bloomberg

Figures showing the performance of the Credit Suisse Social Awareness Index refer to simulated past performance up to April 2008 and real performance thereafter. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance.

Index Regional Breakdown

Current composition in % as of rebalancing date

Rest of World

13%

Non–Japan Asia

7%

Japan

7%

Europe

30%

43%

North America

Source: Credit Suisse HOLT

This material has been prepared by Credit Suisse International. Credit Suisse International is authorised and regulated by the Financial Services Authority, 25 The North Colonnade, Canary Wharf, London,

E14 5HS.

References to Credit Suisse include all of the subsidiaries and affiliates of Credit Suisse AG operating under its investment banking division. For more information on our structure, please follow the attached link: http://www.credit-suisse.com/en/who_we_are/ourstructure.html. This material is not investment research or a research recommendation for the purposes of the rules of the Financial Services

Authority (the “FSA rules”) as it does not constitute substantive research or analysis. It has not been prepared by Credit Suisse's research department. All Credit Suisse research recommendations can be accessed through the following hyperlink: https://s.research-and-analytics.csfb.com/login.asp subject to the use of a suitable login. This material is provided for information purposes only, is intended for your use only and does not constitute an invitation or offer to subscribe for or purchase any of the products or services mentioned. The information provided is not intended to provide a sufficient basis on which to make an investment decision and is not a personal recommendation. It is intended only to provide observations and views of the individuals preparing the material, which may be different from, or inconsistent with, the observations and views of Credit Suisse analysts or other Credit Suisse personnel, or the proprietary positions of Credit Suisse. Observations and views of the individuals preparing this material may change at any time without notice. Information and opinions presented in this material have been obtained or derived from sources believed by Credit Suisse to be reliable, but Credit Suisse makes no representation as to their accuracy or completeness. To the extent permitted by applicable law, Credit Suisse accepts no liability for loss arising from the use of this material. This material is not for distribution to retail clients and is directed exclusively at Credit Suisse's market professional and institutional clients. Moreover, any investment or service to which this material may relate will not be made available by Credit Suisse to such retail customers. All valuations are subject to Credit Suisse valuation terms. Information provided on trades executed with Credit Suisse will not constitute an official confirmation of the trade details. No representation or warranty is made that any indicative performance or return indicated will be achieved in the future. The Credit Suisse Indices are based upon the rules proposed at this time which may be subject to change. Index members may be removed or added based upon the Credit Suisse Index’s criteria for inclusion and removal. Such criteria may include subjective measures and may be changed or modified without notice. Therefore, the actual performance of the Credit Suisse Indices may vary substantially from the performance presented herein. Past performance is not indicative of future performance. Credit Suisse does not guarantee the accuracy or completeness of the Credit Suisse Indices and makes no representation as to the advisability or suitability of investing in products based on the Credit Suisse Indices. Nothing in this material constitutes investment, legal, accounting or tax advice This material is not to be relied upon in substitution for the exercise of independent judgment. Before entering into any transaction, you should consider the suitability of the transaction to your particular circumstances and independently review (with your professional advisers as necessary) the specific financial risks as well as legal, regulatory, credit, tax and accounting consequences. This document may not, without Credit Suisse’s written consent, be reproduced, in whole or in part, nor summarised, excerpted from, quoted or otherwise publicly referred to, nor discussed with or disclosed to any third party. CFROI®, HOLT, HOLTfolio, HOLTSelect,

ValueSearch, AggreGator, Signal Flag and “Powered by HOLT” are trademarks or service marks or registered trademarks or registered service marks of Credit Suisse AG or its affiliates in the United

States and other countries. HOLT is a corporate performance and valuation advisory service of Credit Suisse. The Credit Suisse Indices are the exclusive property of Credit Suisse. Credit Suisse has contracted with Standard & Poor’s to maintain and calculate the index. S&P shall have no liability for any errors or omissions in calculating the index. “Standard & Poor’s” is a trademark of The McGraw-Hill

Companies, Inc

The MSCI sourced information is the exclusive property of Morgan Stanley Capital International Inc. (MSCI). Without prior written permission of MSCI, this information and any other MSCI intellectual property may not be reproduced, redisseminated or used to create any financial products, including any indices. This information is provided on an “as is” basis. The user assumes the entire risk of any use made of this information. MSCI, its affiliates and any third party involved in, or related to, computing or compiling the information hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. MSCI, Morgan Stanley Capital International and the MSCI indexes are services marks of

MSCI and its affiliates .

© 2010 Credit Suisse AG and its subsidiaries and affiliates. All rights reserved.