IOOF Multi Series Balanced Trust

advertisement

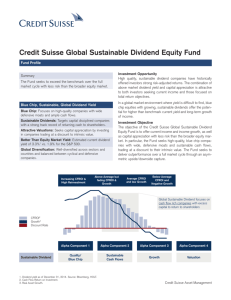

IOOF Multi Series Balanced Trust Strategy Profile Credit Suisse HOLT Australia Top 20 Custom Strategy Credit Suisse HOLT Australia Top 20 Custom Strategy Investment style At a glance Date of appointment: 22 December 2011 Style: Neutral (Quantitative) Funds allocated to manager: $25 million as at 30 June 2012 This strategy is managed by IOOF Investment Management Limited and is intended to track the Credit Suisse HOLT Australia Top 20 Custom Strategy which is created by Credit Suisse Securities Europe Limited. Company overview Credit Suisse was founded in 1856 and is one of Switzerland's oldest banks. It has private banking, investment banking and asset management businesses with 48,700 employees in 550 offices over 50 countries (as at 30 June 2012). It has assets under management of CHF 408 billion (as at 31 December 2011). HOLT is an equity advisory service provided by Credit Suisse, specialising in corporate performance and valuation. HOLT’s analysis offers unique insights, emphasising a company’s cash generating ability and overall potential for valuation creation when it comes to stock selection. The HOLT framework has been used for bottom up stock selection for inclusion in the portfolio, helping to create superior risk-adjusted return potential over the long term. Credit Suisse HOLT believes its ability to take a neutral view in generating investment ideas using a very strong bottom-up valuation discipline in selecting investments for inclusion in the portfolio, creates superior risk-adjusted return potential over the long term. IOOF Multi Series Balanced Trust Credit Suisse Holt Australia– Strategy Profile Stock selection Valuation Credit Suisse HOLT undertakes a quantitative evaluation of each of the top 200 Australian stocks ranked by market cap. The evaluation looks at the three factors, with each factor weighted as follows: • Percent Change to Best; the percentage difference between the HOLT forecast value and the past week’s closing share price. Factor Operations Momentum Valuation • Forecast Dividend Yield. Weight 30 per cent 50 per cent 20 per cent • Economic P/E • Value Cost Ratio; Enterprise Value over Net Assets. Portfolio construction The three factors used by Credit Suisse HOLT can be summarized as follows: Stock universe: Operations • Only companies that have published earnings estimates are recorded in the database. Cash Flow Return on Investment for the last reported year. This ratio measures gross cash flow to gross investments translated into an internal rate of return recognising the finite economic life of depreciating assets and the residual value of non-depreciating assets. The better the return on investment, the higher the score. • Top 200 companies by market capitalisation. • Includes all active companies at the relevant point in time. • Bankrupt and merged companies drop out of the sample in the month they stop trading on the exchange. Portfolio rebalance frequency: Quarterly rebalance. Momentum Number of stocks held: Twenty. • Cash Flow Return on Investment momentum over 13 weeks. Stock weights: Equally weighted at 5 per cent per stock. • Three month Price Momentum. Contact details Telephone: 1800 002 217 Email: info@ioof.com.au Web site: www.ioof.com.au Important information The Credit Suisse HOLT® Australia Top 20 Custom Strategy (‘Strategy’) is created by Credit Suisse Securities (Europe) Limited (‘CSSEL’). The Strategy (‘Reference Asset’) is the exclusive property of the creator and is licensed to IOOF. Credit Suisse and its affiliates (‘Credit Suisse’) do not manage the assets of the Trust nor take the needs of any person into consideration in composing, determining or calculating the Reference Asset. Credit Suisse makes no warranty or representation, express or implied, as to the results to be obtained from a Reference Asset, nor as to its performance and/or value at any time (past, present or future). CSSEL does not hold an Australian Financial Services Licence (‘AFSL’) and is exempt from the requirement to hold an AFSL under the Corporations Act (Cth) 2001 under ASIC Class Order 03/1099 in respect of the financial services provided in relation to this agreement. CSSEL is regulated by the UK Financial Services Authority (‘FSA’) and laws of the United Kingdom which differ from Australian laws. The rules of the FSA are not incorporated into this document. CSSEL is not authorised deposit taking institution and the Reference Asset does not represent a deposit or other liability of Credit Suisse AG, Sydney Branch. Credit Suisse AG, Sydney Branch does not guarantee any particular rate of return on, or the performance of either Reference Asset. Important Note Issued by IOOF Investment Management Limited (IIML) ABN 53 006 695 021 AFSL 230524. This is a general advice only and does not take into account your financial circumstances, needs and objectives. Before making any decision based on this document, you should assess your own circumstances or seek advice from a financial adviser. You should obtain and consider a copy of the Product Disclosure Statement available from us or your financial adviser, before you acquire a financial product. Information is current at the date of issue and may change. Issue date: 30 June 2012. PLA-4338 HOLT® is a trademark, service mark, registered trademark or registered service marks of Credit Suisse AG or its affiliates in the United States and other countries.