Slide 1 - Focus Structured Solutions

advertisement

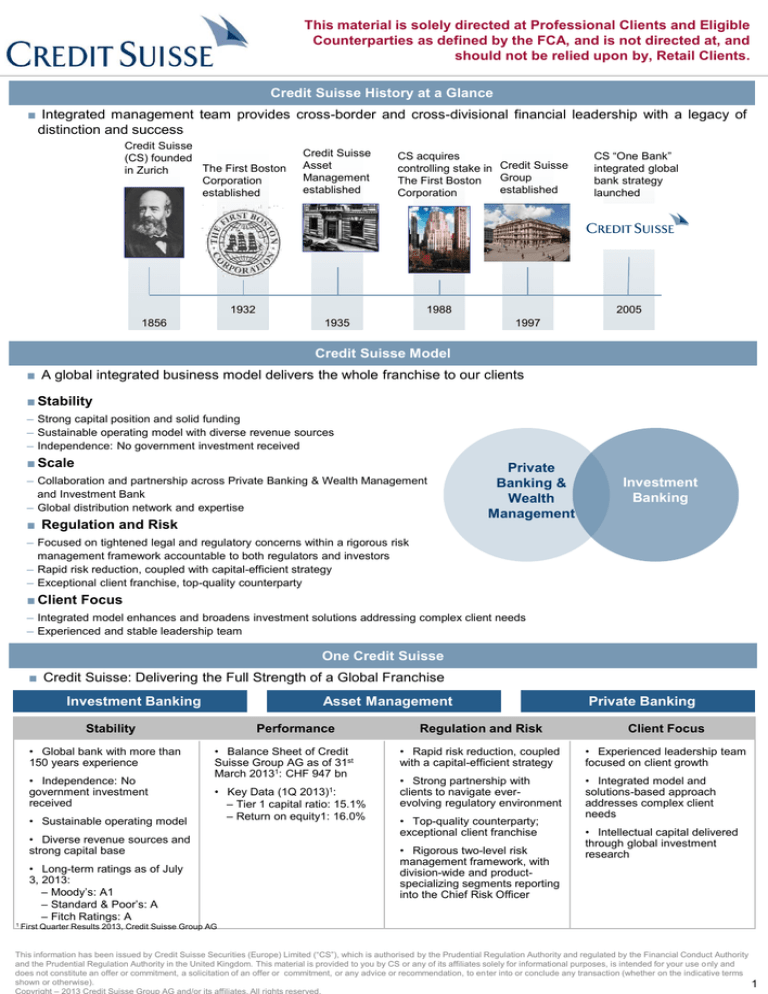

This material is solely directed at Professional Clients and Eligible Counterparties as defined by the FCA, and is not directed at, and should not be relied upon by, Retail Clients. Credit Suisse History at a Glance ■ Integrated management team provides cross-border and cross-divisional financial leadership with a legacy of distinction and success Credit Suisse (CS) founded The First Boston in Zurich Corporation established Credit Suisse Asset Management established CS acquires controlling stake in Credit Suisse Group The First Boston established Corporation 1932 1856 1988 1935 CS “One Bank” integrated global bank strategy launched 2005 1997 Credit Suisse Model ■ A global integrated business model delivers the whole franchise to our clients ■ Stability ─ Strong capital position and solid funding ─ Sustainable operating model with diverse revenue sources ─ Independence: No government investment received ■ Scale ─ Collaboration and partnership across Private Banking & Wealth Management and Investment Bank ─ Global distribution network and expertise ■ Regulation and Risk Private Banking & Wealth Management Investment Banking ─ Focused on tightened legal and regulatory concerns within a rigorous risk management framework accountable to both regulators and investors ─ Rapid risk reduction, coupled with capital-efficient strategy ─ Exceptional client franchise, top-quality counterparty ■ Client Focus ─ Integrated model enhances and broadens investment solutions addressing complex client needs ─ Experienced and stable leadership team One Credit Suisse ■ Credit Suisse: Delivering the Full Strength of a Global Franchise Investment Banking Asset Management Stability • Global bank with more than 150 years experience • Independence: No government investment received • Sustainable operating model Performance • Balance Sheet of Credit Suisse Group AG as of 31st March 20131: CHF 947 bn • Key Data (1Q 2013)1: – Tier 1 capital ratio: 15.1% – Return on equity1: 16.0% • Diverse revenue sources and strong capital base • Long-term ratings as of July 3, 2013: – Moody’s: A1 – Standard & Poor’s: A – Fitch Ratings: A 1 First Private Banking Regulation and Risk Client Focus • Rapid risk reduction, coupled with a capital-efficient strategy • Experienced leadership team focused on client growth • Strong partnership with clients to navigate everevolving regulatory environment • Integrated model and solutions-based approach addresses complex client needs • Top-quality counterparty; exceptional client franchise • Rigorous two-level risk management framework, with division-wide and productspecializing segments reporting into the Chief Risk Officer • Intellectual capital delivered through global investment research Quarter Results 2013, Credit Suisse Group AG This information has been issued by Credit Suisse Securities (Europe) Limited (“CS”), which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom. This material is provided to you by CS or any of its affiliates solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise). 1 This material is solely directed at Professional Clients and Eligible Counterparties as defined by the FCA, and is not directed at, and should not be relied upon by, Retail Clients. Credit Suisse: Your #1 Partner Leading Equities Franchise Capital Strengths as Competitive advantage “Look-through” Basel 3 common equity tier 1 ratio as of end 1Q13 in % Reported and operating under Basel 3 Estimated Basel 3 (operating under Basel 2.5) Estimated Basel 3 (operating under Basel 1) Figures are based on “look-through” estimates provided by 1Q13 company financial statements and results transcripts. 1 Pro forma Swiss core capital ratio: including ~100 basis points contribution from existing Tier 1 participation securities and ~20 basis points contribution from the assumed completion of the remaining capital measures announced in July 2012. 2 Post capital measure raise of EUR 2.8 bn as announced on April 29, 2013 RWAs: Basel 3 for Credit Suisse, Société Générale and UBS. Basel 2.5 for Barclays, Citigroup, Deutsche Bank, HSBC, JPMorgan and Morgan Stanley. Basel 1 for Bank of America and Goldman Sachs. Source: Per company financial statements and results transcripts. * Credit Suisse underlying in 2012 excludes PAF2 and assumes regular share based compensation. 1 Based on weighted average RoE Credit Suisse Global Brand Recognition ■ Sponsorship is a key tool to build our brand1 Culture We support outstanding institutions and young talents in the areas of classical music, fine arts and jazz. Highlights of our 29 member sponsorship portfolio include: New York Philharmonic The National Gallery Sports Ambassador Our commitment includes areas such as football, golf and equestrian sports. Highlights of our 16 member sponsorship portfolio include: Swiss Football Association As a world-renowned athlete with Swiss roots, Roger Federer is an impressive personality. Roger Federer and Credit Suisse stand for Swiss quality and have a high level of international recognition. Roger Federer Swiss PGA Sportgymnasium Davos Bolshoi Theatre Global Footprint, Local Skills ■ Credit Suisse has a presence in more than 50 countries with more than 150 offices Credit locations CreditSuisse Suisse locations Regional Regionalheadquarters headquarters Regional Headquarters Credit Suisse AG Paradeplatz 8 Zurich 8070 Switzerland Tel. +41 44 212 16 16 Fax +41 44 333 25 87 Centers CentersofofExcellence Excellence Credit Suisse Eleven Madison Avenue New York, NY 10010-3629 United States Tel. +1 212 325 2000 Fax +1 212 325 6665 Credit Suisse One Cabot Square London E14 4QJ United Kingdom Tel. +44 20 7888 8888 Fax +44 20 7888 1600 Credit Suisse Three Exchange Square 8 Connaught Place Hong Kong Tel. +852 2101 6000 Fax +852 2101 7990 This information has been issued by Credit Suisse Securities (Europe) Limited (“CS”), which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority in the United Kingdom. This material is provided to you by CS or any of its affiliates solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or commitment, or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise). 2