Burgundy Focus Canadian Equity Fund

advertisement

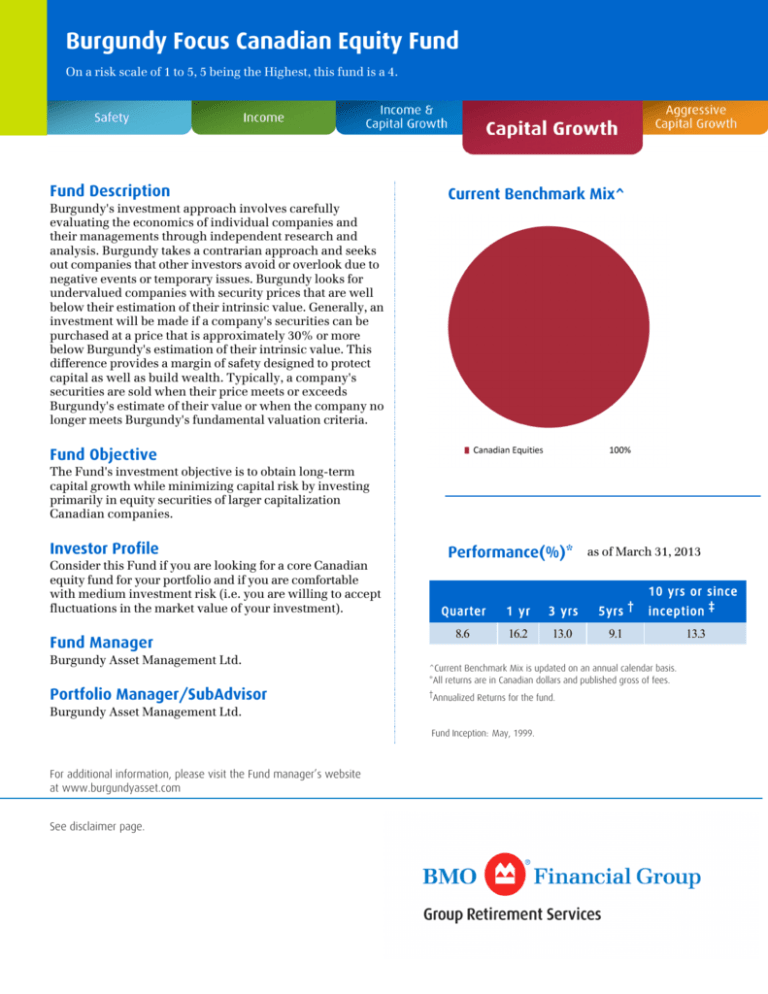

Burgundy Focus Canadian Equity Fund On a risk scale of 1 to 5, 5 being the Highest, this fund is a 4. Fund Description Burgundy's investment approach involves carefully evaluating the economics of individual companies and their managements through independent research and analysis. Burgundy takes a contrarian approach and seeks out companies that other investors avoid or overlook due to negative events or temporary issues. Burgundy looks for undervalued companies with security prices that are well below their estimation of their intrinsic value. Generally, an investment will be made if a company's securities can be purchased at a price that is approximately 30% or more below Burgundy's estimation of their intrinsic value. This difference provides a margin of safety designed to protect capital as well as build wealth. Typically, a company's securities are sold when their price meets or exceeds Burgundy's estimate of their value or when the company no longer meets Burgundy's fundamental valuation criteria. Current Benchmark Mix^ Fund Objective The Fund's investment objective is to obtain long‐term capital growth while minimizing capital risk by investing primarily in equity securities of larger capitalization Canadian companies. Investor Profile Performance(%)* Consider this Fund if you are looking for a core Canadian equity fund for your portfolio and if you are comfortable with medium investment risk (i.e. you are willing to accept fluctuations in the market value of your investment). Fund Manager Burgundy Asset Management Ltd. as of March 31, 2013 10 yrs or since Quarter 1 yr 3 yrs 8.6 16.2 13.0 5yrs † inception ‡ 9.1 13.3 Portfolio Manager/SubAdvisor †Annualized Returns for the fund. Burgundy Asset Management Ltd. Fund Inception: May, 1999. For additional information, please visit the Fund manager’s website at www.burgundyasset.com See disclaimer page. ^Current Benchmark Mix is updated on an annual calendar basis. *All returns are in Canadian dollars and published gross of fees. Burgundy Focus Canadian Equity Fund Burgundy Mutual Funds are offered by Burgundy Asset Management Ltd., a financial services firm and separate legal entity from Bank of Montreal. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus of the mutual fund before investing. Except as otherwise noted, the indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed or covered by the Canada Deposit Insurance Corporation, the Régie de l’assurance­dépôts du Québec or by any other government deposit insurer. The value of mutual funds change frequently and past performance may not be repeated. The returns of different series of a fund may differ for a number of reasons, including if the series was not issued and outstanding for the entire reporting period and because of the different levels of administration and management fees payable for each series. This fund profile is provided for informational purposes only. Particular investments and/or trading strategies should be evaluated relative to each individual's investment objectives. The information contained in this fund profile is not, and should not be construed as, investment or tax advice. You should not act or rely on the information contained in this fund profile without seeking the advice of an appropriate professional advisor. ® “BMO (M­bar roundel symbol)” is a registered trade­mark of Bank of Montreal, used under licence. Group Retirement Services are provided by BMO Group Retirement Services Inc. which is a group retirement firm and separate legal entity from Bank of Montreal.