BUS144 - Chapter 12 Solutions

advertisement

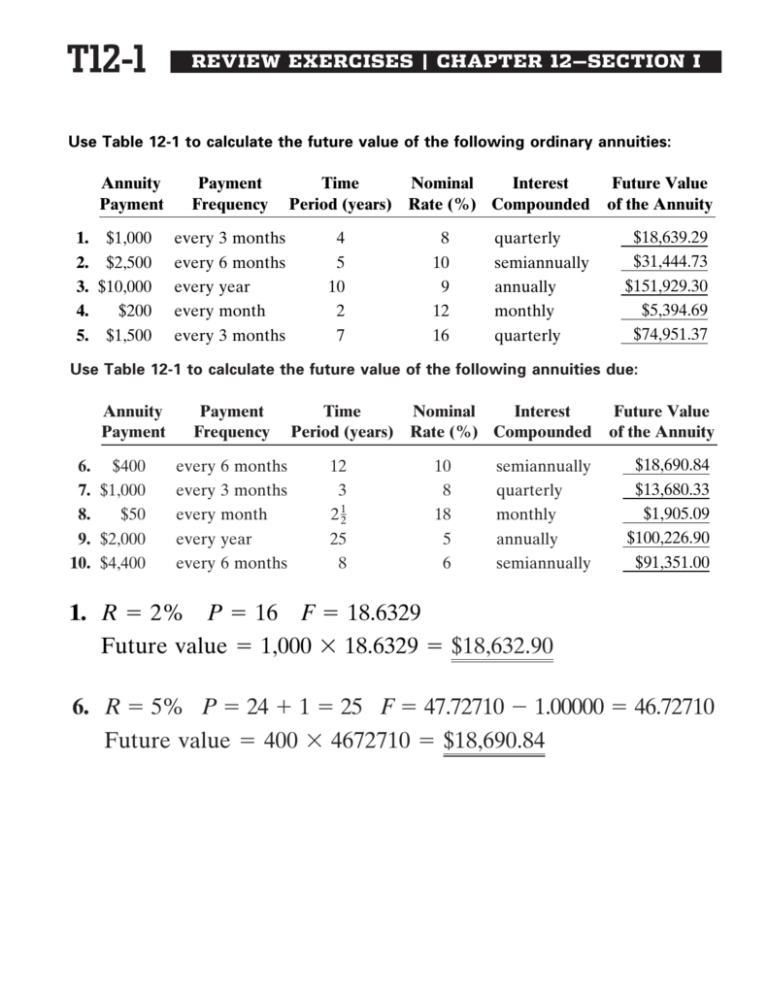

T12-1 REVIEW EXERCISES | CHAPTER 12—SECTION I Use Table 12-1 to calculate the future value of the following ordinary annuities: Annuity Payment 1. $1,000 2. $2,500 3. $10,000 4. $200 5. $1,500 Payment Frequency every every every every every 3 months 6 months year month 3 months Time Nominal Interest Period (years) Rate (%) Compounded 4 5 10 2 7 8 10 9 12 16 quarterly semiannually annually monthly quarterly Future Value of the Annuity $18,639.29 $31,444.73 $151,929.30 $5,394.69 $74,951.37 Use Table 12-1 to calculate the future value of the following annuities due: Annuity Payment 6. $400 7. $1,000 8. $50 9. $2,000 10. $4,400 Payment Frequency every every every every every 6 months 3 months month year 6 months Time Nominal Interest Period (years) Rate (%) Compounded 12 3 2 12 25 8 10 8 18 5 6 semiannually quarterly monthly annually semiannually Future Value of the Annuity $18,690.84 $13,680.33 $1,905.09 $100,226.90 $91,351.00 1. R 5 2% P 5 16 F 5 18.6329 Future value 5 1,000 3 18.6329 5 $18,632.90 6. R 5 5% P 5 24 1 1 5 25 F 5 47.72710 2 1.00000 5 46.72710 Future value 5 400 3 4672710 5 $18,690.84 T12-2 REVIEW EXERCISES | CHAPTER 12—SECTION I Solve the following exercises by using Table 12-1: 11. Liberty Savings & Loan is paying 6% interest compounded monthly. How much will $100 deposited at the end of each month be worth after 2 years? 1 R 5 % P 5 24 F 5 25.43196 2 Annuity 5 25.43196 3 100 5 $2,543.20 12. Emory Distributors, Inc., deposits $5,000 at the beginning of each 3-month period for 6 years in an account paying 8% interest compounded quarterly. a. How much will be in the account at the end of the 6-year period? R 5 2% P 5 24 1 1 5 25 F 5 32.03030 2 1.00000 Account value 5 31.03030 3 5,000 5 $155,151.50 b. What is the total amount of interest earned in this account? Total investment 5 5,000.00 3 24 5 120,000.00 Interest earned 5 155,151.50 2 120,000.00 5 $35,151.50 13. When Chuck Darwin was born, his parents began depositing $500 at the beginning of every year into an annuity to save for his college education. If the account paid 7% interest compounded annually for the first 10 years and then dropped to 5% for the next 8 years, how much is the account worth now that Chuck is 18 years old and is ready for college? Amount $500.00 R 5 7% P 5 10 1 1 5 11 F 5 15.78360 2 1.00000 500.00 3 14.78360 5 $7,391.80 First 10 years Amount $7,391.80 R 5 5% P 5 8 F 5 1.47746 (Table 11-1) $7,391.80 3 1.47746 5 $10,921.09 First 10 years compounded 8 more years Amount $500.00 R 5 5% P 5 8 1 1 5 9 F 5 11.02656 2 1.00000 500.00 3 10.02656 5 5,013.28 Next 8 years $10,921.09 1 $5,013.28 5 $15,934.37 Total after 18 years REVIEW EXERCISES | CHAPTER 12—SECTION I 1 years? 2 FV 5 (1 1 .01) 3 81,669.67 5 $82,486.37 Annuity due c. (Optional) Use the formula for an annuity due to calculate how much would be in the account after 5 years if it had been an annuity due. P 5 60 (1 1 .01) 60 2 1 FV 5 1,000 5 $81,669.67 Ordinary annuity .01 R 5 1% b. (Optional) Use the formula for an ordinary annuity to calculate how much would be in the account if the owner saved for 5 years. R 5 1% P 5 30 F 5 34.78489 1,000.00 3 34.78489 5 $34,784.89 a. How much will be available for the second store after 2 14. Surfside Hardware has been in business for a few years and is doing well. The owner has decided to save for a future expansion to a second location. He invests $1,000 at the end of every month at 12% interest compounded monthly. T12-3 BUSINESS DECISION | CHAPTER 12—SECTION I 251,405.04 2 209,282.37 5 $42,122.67 More R 5 6% P 5 30 1 1 5 31 F 5 84.80168 2 1.00000 3,000.00 3 83.80168 5 $251,405.04 d. If you found a bank that paid 6% interest compounded annually, rather than 5%, how much more would you have in the account after 30 years? R 5 5% P 5 30 1 1 5 31 F 5 70.76079 2 1.00000 3,000.00 3 69.76079 5 $209,282.37 c. When you retire in 30 years, what will be the total worth of the account? R 5 5% P 5 20 1 1 5 21 F 5 35.71925 2 1.00000 3,000.00 3 34.71925 5 $104,157.75 b. How much would the account be worth after 20 years? R 5 5% P 5 10 1 1 5 11 F 5 14.20679 2 1.00000 3,000.00 3 13.20679 5 $39,620.37 a. How much would the account be worth after 10 years? 15. As part of your retirement plan, you have decided to deposit $3,000 at the beginning of each year into an account paying 5% interest compounded annually. PLANNING YOUR NEST EGG T12-4 REVIEW EXERCISES | CHAPTER 12—SECTION II $300 $2,000 $1,600 $1,000 $8,500 every every every every every 6 months year 3 months month 3 months Payment Frequency 7 20 6 1 34 3 10 7 12 6 16 semiannually annually quarterly monthly quarterly Time Nominal Interest Period (years) Rate (%) Compounded $2,969.59 $21,188.02 $27,096.86 $19,887.98 $79,773.10 Present Value of the Annuity 6. 7. 8. 9. 10. $1,400 $1,300 $500 $7,000 $4,000 Annuity Payment every every every every every year 3 months month 6 months year Payment Frequency 10 4 2 14 12 18 11 12 18 8 7 annually quarterly monthly semiannually annually Time Nominal Interest Period (years) Rate (%) Compounded $9,151.87 $16,819.32 $11,199.32 $110,997.88 $43,052.88 Present Value of the Annuity Use Table 12-2 to calculate the present value of the following annuities due: 1. 2. 3. 4. 5. Annuity Payment Use Table 12-2 to calculate the present value of the following ordinary annuities: T12-5 9. R 5 4% P 5 23 F 5 14.85684 1 1.00000 Amount 5 7,000.00 3 15.85684 5 $110,997.88 10. R 5 7% P 5 17 F 5 9.76322 1 1.00000 Amount 5 4,000.00 3 10.76322 5 $43,052.88 5. R 5 4% P 5 12 F 5 9.3850 Amount 5 8,500.00 3 9.38507 5 $79,773.10 1 8. R 5 1 % P 5 26 F 5 21.39863 1 1.00000 2 Amount 5 500.00 3 22.39863 5 $11,199.32 3. R 5 3% P 5 24 F 5 16.93554 Amount 5 1,600.00 3 16.93554 5 $27,096.86 1 4. R 5 % P 5 21 F 5 19.88798 2 Amount 5 1,000.00 3 19.88798 5 $19,887.98 7. R 5 3% P 5 15 F 5 11.93794 1 1.00000 Amount 5 1,300.00 3 12.93794 5 $16,819.32 CHAPTER 12—SECTION II 2. R 5 7% P 5 20 F 5 10.59401 Amount 5 2,000.00 3 10.59401 5 $21,188.02 | 6. R 5 11% P 5 9 F 5 5.53705 1 1.00000 Amount 5 1,400.00 3 6.53705 5 $9,151.87 REVIEW EXERCISES 1. R 5 5% P 5 14 F 5 9.89864 Amount 5 300.00 3 9.89864 5 $2,969.59 T12-6 REVIEW EXERCISES | CHAPTER 12—SECTION II R 5 6% P 5 10 2 1 5 9 F 5 6.80169 1 1.00000 Amount 5 2,000.00 3 7.80169 5 $15,603.38 12. Maureen O’Connor wants to receive an annuity of $2,000 at the beginning of each year for the next 10 years. How much should be deposited now at 6% compounded annually to accomplish this goal? 1 R 5 % P 5 24 F 5 22.56287 2 Amount 5 400.00 3 22.56287 5 $9,025.15 11. Transamerica Savings & Loan is paying 6% interest compounded monthly. How much must be deposited now to withdraw an annuity of $400 at the end of each month for 2 years? Solve the following exercises by using Table 12-2: T12-7 REVIEW EXERCISES | CHAPTER 12—SECTION II R 5 7% P 5 4 2 1 5 3 F 5 2.62432 1 1.00000 Amount 5 2,000.00 3 3.62432 5 $7,248.64 14. Andrew Zorich is the grand prize winner in a college tuition essay contest sponsored by a local scholarship fund. The winner receives $2,000 at the beginning of each year for the next 4 years. How much should be invested at 7% interest compounded annually to pay the prize? R 5 2% P 5 4 F 5 3.80773 Amount 5 100,000.00 3 3.80773 5 $380,773.00 13. As the chief accountant for the Wentworth Corporation, you have estimated that the company must pay $100,000 income tax to the IRS at the end of each quarter this year. How much should be deposited now at 8% interest compounded quarterly to meet this tax obligation? T12-8 T12-9 BUSINESS DECISION | CHAPTER 12—SECTION I I THE SETTLEMENT 15. Churchill Enterprises has been awarded an insurance settlement of $5,000 at the end of each 6-month period for the next 10 years. a. As their accountant, calculate how much the insurance company must set aside now, at 6% interest compounded semiannually, to pay this obligation to Churchill. R 5 3% P 5 20 F 5 14.87747 Amount 5 5,000.00 3 14.87747 5 $74,387.35 b. (Optional) Use the present value of an ordinary annuity formula to calculate how much the insurance company would have to invest now if the Churchill settlement was changed to $2,500 at the end of each 3-month period for 10 years, and the insurance company could earn 8% interest compounded quarterly. R 5 2% P 5 40 Amount 5 $2,500.00 1 2 (1.02) 240 1 2 (1 1 i) 2n PV 5 2,500.00 3 PV 5 PMT 3 i .02 PV 5 2,500.00 3 1 2 (1 1 .02) 240 .02 2,500.00 3 27.35547924 5 $68,388.70 c. (Optional) Use the present value of an annuity due formula to calculate how much the insurance company would have to invest now if the Churchill settlement was paid at the beginning of each 3-month period rather than at the end. R 5 2% P 5 40 Amount 5 $2,500.00 PV annuity due 5 (1 1 i) 3 PV ordinary annuity PV 5 (1 1 .02) 3 68,388.70 5 $69,756.47 T12-10 REVIEW EXERCISES | CHAPTER 12—SECTION I I I For the following sinking funds, use Table 12-1 to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity): Sinking Fund Payment 1. $2,113.50 2. $9,608.29 $55.82 3. $203.93 4. $859.13 5. Payment Frequency every every every every every Time Period (years) Nominal Rate (%) Interest Compounded Future Value (Objective) 8 14 5 1 12 4 10 9 12 12 16 semiannually annually quarterly monthly quarterly $50,000 $250,000 $1,500 $4,000 $18,750 6 months year 3 months month 3 months 1. R 5 5% P 5 16 FV 5 50,000.00 Table factor 5 23.65749 50,000.00 Payment 5 5 $2,113.50 23.65749 4. R 5 1% P 5 18 FV 5 4,000.00 Table factor 5 19.61475 4,000.00 5 $203.93 Payment 5 19.61475 2. R 5 9% P 5 14 FV 5 250,000.00 Table factor 5 26.01919 250,000 5 $9,608.29 Payment 5 26.01919 5. R 5 4% P 5 16 FV 5 18,750.00 Table factor 5 21.82453 18,750.00 Payment 5 5 $859.13 21.82453 3. R 5 3% P 5 20 FV 5 1,500.00 Table factor 5 26.87037 1,500.00 5 $55.82 Payment 5 26.87037 T12-11 REVIEW EXERCISES | CHAPTER 12—SECTION I I I You have just been hired as a loan officer at the Eagle National Bank. Your first assignment is to calculate the amount of the periodic payment required to amortize (pay off) the following loans being considered by the bank (use Table 12-2): Loan Payment 6. $4,189.52 $336.36 7. $558.65 8. 9. $1,087.48 $51.83 10. Payment Period every every every every every Term of Loan (years) Nominal Rate (%) Present Value (Amount of Loan) 12 5 134 8 1.5 9 8 18 6 12 $30,000 $5,500 $10,000 $13,660 $850 year 3 months month 6 months month 6. R 5 9% P 5 12 PV 5 30,000.00 Table factor 5 7.16073 30,000.00 5 $4,189.52 Payment 5 7.16073 7. R 5 2% P 5 20 PV 5 5,500.00 Table factor 5 16.35143 5,500.00 Payment 5 5 $336.36 16.35143 1 8. R 5 1 % P 5 21 PV 5 10,000.00 2 Table factor 5 17.90014 10,000.00 Payment 5 5 $558.65 17.90014 9. R 5 3% P 5 16 PV 5 13,660.00 Table factor 5 12.56110 13,660.00 Payment 5 5 $1,087.48 12.56110 10. R 5 1% P 5 18 PV 5 850.00 Table factor 5 16.39827 850.00 5 $51.83 Payment 5 16.39827 T12-12 REVIEW EXERCISES | CHAPTER 12—SECTION I I I 11. West Coast Industries established a sinking fund to pay off a $10,000,000 loan for a corporate jet that comes due in 8 years. a. What equal payments must be deposited into the fund every 3 months at 6% interest compounded quarterly for West Coast to meet this financial obligation? R 5 1 12% P 5 32 PV 5 10,000,000.00 Factor 5 40.68829 10,000,000.00 Payment 5 5 $245,770.96 40.68829 b. What is the total amount of interest earned in this sinking fund account? 245,770.96 3 32 5 7,864,670.72 Amount of interest 5 10,000,000.00 2 7,864,670.72 5 $2,135,329.28 12. Tina Woodruff bought a new Toyota Matrix for $15,500. She made a $2,500 down payment and is financing the balance at the Mid-South Bank over a 3-year period at 12% interest. As her banker, calculate what equal monthly payments will be required by Tina to amortize the car loan. R 5 1% P 5 36 PV 5 (15,500.00 2 2,500.00) 5 13,000.00 Factor 5 30.10751 13,000.00 5 $431.79 Payment 5 30.10751 13. Green Thumb Landscaping buys new lawn equipment every 3 years. It is estimated that $25,000 will be needed for the next purchase. The company sets up a sinking fund to save for this obligation. a. What equal payments must be deposited every 6 months if interest is 8% compounded semiannually? R 5 4% P 5 6 FV 5 25,000.00 Factor 5 6.63298 25,000.00 5 $3,769.04 Payment 5 6.63298 b. What is the total amount of interest earned by the sinking fund? 6 3 3,769.04 5 22,614.24 Amount of interest 5 25,000.00 2 22,614.24 5 $2,385.76 REVIEW EXERCISES | CHAPTER 12—SECTION III R 5 1.5% P 5 16 FV 5 7,500.00 Factor 5 17.93237 7,500.00 Payment 5 5 $418.24 17.93237 15. Brian and Erin Joyner are planning a safari vacation in Africa in 4 years and will need $7,500 for the trip. They decide to set up a sinking fund savings account for the vacation. They intend to make regular payments at the end of each 3-month period into the account that pays 6% interest compounded quarterly. What periodic sinking fund payment will allow them to achieve their vacation goal? R 5 12% P 5 25 PV 5 200,000.00 Factor 5 7.84314 200,000.00 Payment 5 5 $25,499.99 7.84314 14. Karen Moore is ready to retire and has saved up $200,000 for that purpose. She wants to amortize (liquidate) that amount in a retirement fund so that she will receive equal annual payments over the next 25 years. At the end of the 25 years, there will be no funds left in the account. If the fund earns 12% interest, how much will Karen receive each year? T12-13 T12-14 REVIEW EXERCISES | CHAPTER 12—SECTION I I I (Optional) Solve the following exercises by using the sinking fund or amortization formulas: 16. Howard Lockwood purchased a new home for $225,000 with a 20% down payment and the remainder amortized over a 15-year period at 9% interest. a. What is the amount of the house that was financed? 225,000.00 3 .2 5 45,000.00 Amount financed 5 225,000.00 2 45,000.00 5 $180,000.00 b. What equal monthly payments are required to amortize this loan over 15 years? R 5 .75% P 5 180 PV 5 180,000 Amortization payment 5 PV 3 i .0075 5 180,000 3 1 2 (1 1 i) 2n 1 2 (1 1 .0075) 2180 5 180,000 3 .0075 5 180,000 3 .010142666 .73945057 Payment amount 5 $1,825.68 c. What equal monthly payments are required if Howard decides to take a 20-year loan rather than a 15? R 5 .75% P 5 240 PV 5 180,000 Amortization payment 5 PV 3 i .0075 2n 5 180,000 3 1 2 (1 1 i) 1 2 (1 1 .0075) 2240 5 180,000 3 Payment 5 $1,619.51 .0075 5 180,000 3 .00899726 .833587155 REVIEW EXERCISES | CHAPTER 12—SECTION III P 5 60 i .01 5 1,000,000.00 3 (1 1 i) n 2 1 (1 1 .01) 60 2 1 FV 5 1,000,000.00 60 3 12,244.45 5 734,667.00 Interest earned 5 1,000,000.00 2 734,667.00 5 $265,333.00 b. What is the total amount of interest earned in the account? .01 Payment 5 1,000,000.00 3 5 $12,244.45 .816696699 Payment 5 FV 3 R 5 1% a. What equal monthly sinking fund payments are required to accumulate the needed amount? 17. The Sunset Harbor Hotel has a financial obligation of $1,000,000 due in 5 years. A sinking fund is established to meet this obligation at 12% interest compounded monthly. T12-15 T12-16 BUSINESS DECISION | CHAPTER 12—SECTION I I I DON’T FORGET INFLATION! 18. You are the vice president of finance for Casablanca Enterprises, Inc., a manufacturer of office furniture. The company is planning a major plant expansion in 5 years. You have decided to start a sinking fund to accumulate the funds necessary for the project. Current bank rates are 8% compounded quarterly. It is estimated that $2,000,000 in today’s dollars will be required; however, the inflation rate on construction costs and plant equipment is expected to average 5% per year for the next 5 years. a. Use the compound interest concept from Chapter 11 to determine how much will be required for the project, taking inflation into account. From Table 11-1, future value at compound interest, R 5 5% P 5 5 Factor 5 1.27628 FV 5 2,000,000.00 3 1.27628 5 $2,552,560.00 b. What sinking fund payments will be required at the end of every 3-month period to accumulate the necessary funds? R 5 2% P 5 20 FV 5 $2,552,560.00 Factor 5 24.29737 2,552,560.00 FV Payment 5 5 5 $105,054.99 Factor 24.29737