Accounting Bonds & Notes Payable Exam

advertisement

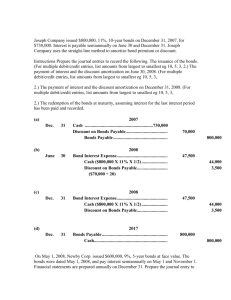

• 170 outof170points(100%) 1. award: 10 out of 10.00 Tano issues bonds with a par value of $180,000 on January 1, 20 13. The bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and the bonds are sold for $170,862. 1. What is the amount of the discount on these bonds at issuance? Discount 9,1 38.I $ 2. How much total bond interest expense will be recognized over the life of these bonds? iTotal bond interest expense over fife of bonds: Amount repaid: 6.1 payments of 7,200.I $ $ 43,200 --~ Par value at maturity 180,000.I 223,200 Total repaid --- Less amount borrowed 170,862.I Total bond interest expense $ 3. Use the straight-line method to amortize the discount for these bonds. Semiannual PeriodEnd 01/01/20 13 Unamortized Discount $ carrying Value 9,1 38,./ $ 170,862.I 06/30/20 13 7,615.,I 172,385.I 12/3112013 6,092,./ 173,908.I 06/30120 14 4,569,./ 175,43 1.I 12/31/20 14 3,046,./ 176,954.I 06/30120 15 1,523 178,477 12/3 112015 $ 0 $ 180,000 2. award: 10 out of 10.00 Prepare the journal entries for the issuance of th e bonds in both OS 14-1 and OS 14-2. Assume that both bonds are issued for cash on January 1, 20 13. 1. Enviro Company issues 8%, 10-year bonds with a par value of $250,000 and semiannual interest payments. On the issue date, the annual market rate forthese bonds is 10%, which implies a selling price of 87 112. The straight·line method is use d to allocate interest expense. General Journal Date Jan. 1, 20 11 ./ J.cash Discount on bonds payable Bonds payable - Debit ./ Credit 218,750./ 31,250./1 ./] 250,000./ 2. Garcia Company issues 10%, 15·year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate forthese bonds is 8%, which implies a selling price of 11 7 1/4 . The effective interest method is used to allocate interest expense. Date Jan. 1, 20 11 General Journal II Gash Bonds payable Premium on bonds payable Debit ./ ./ ./ Credit 28 1,400./1 240,000./ 41,400./ m.vard: 3. 10 out of 10.00 .................. ··points·· ..................................................................................................................................................................................................................... Sylvestor Company issues 10%, five-year bonds, on December 31, 20 12, with a par value of $100,000 and semiannual interest payments. Semiannual Period-End Unamortized Discount Carrying Value (0) 1213 112012 $ 7,360 6,624 $ 92,640 (1) 6130120 13 (2) 12/3112013 5,888 93,376 94, 11 2 Use the above bond amortization table and prepare journal entries to record the following. (a) The issuance of bonds on December 31, 20 12. Date Dec. 31 Debit General Journal Cash Discount on bonds payable Bonds payable .I .I .I Credit 92,640./ 7,360./ 100,000./ (b) The first interest payment on June 30, 20 13. Date Jun 30 Debit General Journal _[Bond interest expense .I Gash ./ Discount on bonds payable vii Credit 5,736./J 5,000./ I 736./ (c) The second interest payment on December 31, 20 13. Date Dec.3 1 Debit General Journal Bond interest expense Cash Discount on bonds payable .I .I .I Credit 5,736./ '- 5,000./ 736./ 4. award: 10 out of 10.00 Garcia Company issues 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%, which implies a selling price of 117 V4. The effective interest method is used to allocate interest expense. 1. What are the issuer's cash proceeds from issuance of these bonds? ~,;; sh~ pr;,.; o,;; ce;,.;e;,.; d;,.; s___ $ 28 1,400.I 2. What total amount of bond interest expense will be recognized over the life of these bonds? :rotaI bond interest expense over Die of bonds: Amount repaid: ---30.I payments of $ 12,000.1 $ 360,000 --~-- Par value at maturity 240,000V" Total repayments 600,000 Less amount borrowed 28 1,400.I Total bond interest expense $ 318,600 3. What is the amount of bond interest expense recorded on the first interest payment date? Bond interest expense $ 11,256.I • P<•• IQuestion #5 (of 17) • I nexn ·····················points ·················································································· ····················································································································· ·· On January 1, 20 13, Eagle borrows $100,000 cash by signing a four-year, 7% installment note. The note requires four equal total payments of accrued interest and principal on December 31 of each year from 20 13 through 20 16. ( Tab!e 0.1, Table 0.2, Table a.3, and Table a.4) (Use appropriate factor(s) from the tables provided.) Prepare the journal entries for Eagle to record the loan on January 1, 20 13, and the four payments from December 31, 20 13, through December 31, 2-0 16. I Interest Rate II Notes Payable 7.0% $ Table Value 100,000vl 3 3s72v1 cash Paid = I$ 29.523 =~~-~-- Date Jan 01, 20 13 Dec 31, 20 13 Gash Notes payable vi vi Interest expense vi vi vi Notes payable Cash Dec 31, 2014 Interest expense Notes payable Cash Dec 31, 20 15 Interest expense Notes payable Cash Dec 31, 20 16 Debit General Journal Interest expense Notes payable Cash vi vi vi 100,000vl 100,000vl 7,000vl 22,523vl 29,523vl 5,423vlt 24,l OOvl 29,523vl vi vi vi vi vi vi Credit 29,523vl 1,933vl 27,590vl 29,523vl 6. award: 10 out of 10.00 ..............poii'its ........................................................ .. On January 1, 20 13, the $2,000,000 par value bonds of Spitz Company with a carrying value of $2,000,000 are converted to 1,000,000 shares of$ 1.00 par value common stock. Record the entry for the conversion of the bonds. Genera l Journal Date Jan. 1, 20 11 I Bonds payable Debit ./ Credit 2,000,000./ Common stock, $1 par ./ 1,000,000./ Paid-In capital in excess of par value ./ 1,000,000./ award: 10 out of 7 • 10.00 ............ ··points ...................................................... · · Enviro Company issues 8%, 10-year bonds with a par value of $250,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%, which implies a selling price of 87 11.2. The straight·line method is used to allocate interest expense. 1. What are the issuer's cash proceeds from issuance of these bonds? Gash proceeds $ ~~~~~~~~~ 218,750.I 2. What total amount of bond interest expense will be recognized over the life of these bonds? Total bond interest expense over life of bonds: Amount repaid: 20.I payments of $ 10,000.11$ 200,000 ~ Par value at maturi~/ 250,000.I J Total repayments Less amount borro'Aoed tTotal bond interest expense 450,000 218,750.I $ , •, 231,250 3. What is the amount of bond interest expense recorded on the first interest payment d ate? Bond interest expense $ ~~~~~~~~~-- 11,563.I award: 10 out of 8 . ·.................. 10.00 pomts ..................................................................................................·· ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... .. On January 1, 2013, Eagle borrows $100,000 cash by signing a four-year, 7% installment note. The note requires four equal total payments of accrued interest and principal on December 31 of each year from 2013 through 20 16. (Table 0.1. Tab!e 0.2, Table 8.3, and Tab'• 0.4) (Use appropriate factor(s) from the tables provided.) 1. Compute the amount of each of the four equal total payments. Initial Note Balance Interest Rate Amount of Each Payment Table Value 100,000.11 3.3872./ = j$ 29,523 2. Prepare an amortization table for this installment note. (Round your intermediate calculations to the nearest dollar amount.) Payments (A) (B) (C) (D) (E) Ending Beginning Debit Interest Debit Notes Credit Ending Date Balance Expense Payable cash Balance Period $ 20 13 100,000./ $ 7,000./ $ 22,523./ $ 29,523./ $ 77,477./ 20 14 77,477./ 5,423./ 24,100./ 29,523./ 53,377./ 20 15 53,377./ 3,736v' 25,787./ 29,523v' 27,590v' 20 16 27,590./ 1,933 27,590 29,523v' Total J 1$ 18,092 1$ 100,000 ' $ 118,092 0 9• award: 10 out of 10.00 ............ ··points ......................................................... · .. WoodwicK Company issues 10%, five.year bonds, on December 31, 20 12, with a par value of $200,000 and semiannual interest payments. Semiannual PeriodEnd (0) 12/3112012 (1) 6/30/20 13 (2) 12/31/20 13 Unamortized Premium $16,222 Carrying Value $2 16,222 214,600 212,978 14,600 12,978 Use the above straight·line bond amortization table and prepare journal entries for the following. (a) The issuance of bonds on December 31, 20 12. (b)The first interest payment on June 30, 20 13. (c)The second interest payment on December 3 1, 20 13. Genera l Journal Date Dec 31, 20 12 Cash Premium on bonds payable Bonds payable Jun 30, 2013 Bond interest expense Premium on bonds payable Cash Dec 31, 20 13 Bond interest expense Premium on bonds payable Cash Debit ./ 216,222./ ./ ./f - - ./ ./ ./ 8,378./ ./ ./ ./ 8,378./ Credit 16.222./ 200,000./ 1,622./ 10,000./ 1,622./ 10,000./ 10. 8'1Nard: 10 out of 10.00 On July 1, 2013, Advocate Company exercises. an $8,000 call option (plus par value) on its outstanding bonds that have a carrying value of $416,000 and a par value of $400,000. The company exercises the call option after the semiannual interest is paid on June 30, 20 13. Record the entry to retire the bonds. General Journal Dllte Jul01 Bonds payable Premium on bonds payable Cash Gain on retirement of bonds Debit 400,000./ 16,000./ Credit 11. sward: 10 out of 10.00 ··························points ·· Dobbs Company issues 5%, two-year bonds, on December 31, 20 13, with a par value of $200,000 and semiannual interest payments. Semiannual PeriodEnd (0) 12/31/2013 (1) 6/30/20 14 (2) 12/3112014 (3) 6/3012015 (4) 12/31/20 15 Unamortized Discount Carrying Value $12,000 9,000 6,000 3,000 0 $188,000 191,000 194,000 197,000 200,000 Use the above straight-line bond amortization table and prepare journal entries for the following. Required : (a)The issuance of bonds on December 31, 201 3. Genera IJournal Date Dec 31, 20 13 Cash Discount on bonds payable Bonds payable -~-- Debit ./ ./ ./ Credit 188,000./ 12,000./ 200,000./ (b)The first through fourth interest payments on each June 30 and December 31. General Journal Date Jun 30, 20 14 Bond interest expense Discount on bonds payable Gash - - Dec 31, 20 14 Bond interest expense Discount on bonds payable Cash Debit ./ ./ ./ 8,000./ ./ ./ ./ 8,000./ Credit 3,000./ 5,000./ 3,000./ 5,000./ I Jun 30, 20 15 Bond interest expense Discount on bonds payable Gash Dec 31, 20 15 I Bond interest expense Discount on bonds payable Cash ./ ./ ./ 8,000./ ./ ./ ./ 8,000./ 3,000./ 5,000./ 3,000./ 5,000./ (c)Record the payment to retire tl1e bonds on December 31, 20 15. Date Dec 31, 20 15 ------ General Journal Bonds payable Cash Debit ./ ./ Credit 200,000./ 200,000./ award: 10 out of 12 • 10.00 ............ ··points .......................................................................................................................................... .. On January 1, 20 13, Boston Enterprises issues bonds that have a $3,400,000 par value, mature in 20 years, and pay 9% interest semiannually on June 30 and December 31. The bonds are sold at par. 1. How much interest will Boston pay (in cash) to the bondholders every six months? x 3,400,000.,I $ ____ Semiannual Rate Par (maturityl Value 4.5%.,I -----~- Semiannual cash Interest P ment __ =_,_$ 153,000 2. Prepare journal entries for the following. (a)The issuance of bonds on January 1, 20 13. General Journal Date Jan 01, 20 13 Debit .,I .,I Cash Bonds payable Credit 3,400,000.,I 3,400,000.,I (b) The first interest payment on June 30, 20 13. Gene~al Journal Date June 30, 2013 1-- Bono interest expens-e Debit ./ Credit 153,000./ Cash 153,000.,I (c) The second interest payment on December 3 1, 20 13. General Journal Date Dec 3 1, 20 13 Bond interest expense Cash Debit .,I .,I Credit 153,000.,I 153,000.,I 3. Prepare the journal entry for issuance of bonds assuming. (a) The bonds are issued at 98. Date Jan 01, 20 13 Gash General Journal -- Discount on bonds payable Bonds payable Debit .,I .,I .,I Credit 3,332,000.,I 68,000.,I 3,400,000.,I (b) The bonds are issued at 102. General Journal Date Jan 01, 20 13 Gash Bonds payable l Premium on bonds payable -~-- Debit .,I .,I .,I Credit 3,468,000./ ~ 3,400,000.,I 68,000.,I ---- 13. award: 10 out of 10.00 · ·· ·· ·· ·· ····poifits · ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ·· ··· · Quatro Co. issues bonds dated January 1, 20 13, with a par value of $400,000. The bonds' annual contract rate is 13%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $409,850. 1. What is the amount of the premium on these bonds at issuance? Premium 9,850./ $ 2. How much total bond interest expense will be recognized over the life of these bonds? ifotal bond interest expense over life of bonds: Amount repaid: -~-- 6./ payments of --- 26,000./ $ $ Par value at maturi~/ Total repaid 156,000 400,000./ ---- 556,000 Less amount borrowed - -1$ Total bond interest expense 409,850./ _J46J 50 3. Prepare an amortization table for these bonds; use the straight-line method to amortize the premium. (Round your intermediate calculations to the nearest dollar amount.) Unamortize Semiannual PeriodEnd 01/0112013 $ carrying Value 9,850./ $ 409,850./ 06/30/20 13 8,208.,I 408,208./ 12/3 112013 6,566.,I 406,566./ 06/30/20 14 4,924.,I 404,924 1213112014 3,282.,I 403,282 06/30/20 15 1,~ 40 1,640 12/3 112015 400,000 14 • award: 10 out of 10.00 · · · · · · ...points · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · · Atlanta Company Total liabilities Total equity Compute the $ 429,000 572,000 debt-to-equi~/ Spokane Company $ 548,000 1,827 ,000 ratio for each of the following companies. Debt to equilV ratio Choose Nwnerator: 11-~~~~~~...-~~~ Total liabilities I vi Atlanta Company 429,000./ Spokane Company 548,000./ Choose Denominator: Total equi~/ Which company appears to have a riskier financing structure? Explain. 0 Spokane Company ® Atlanta Company ;J ./ Debt·to-equi!y ratio 572,000./ 0.75 1,827,000./ 0.30 15. 8'1Nard: 10 out of 10.00 Select the phrase that best fits each term of the description A through H . Description IRecords and tracks the bondholders' names. A ...l Items Registered bond 8. Is unsecured; backed only by the issuer's cre<lit standing. Debenture C. .Has varying maturi~/ dates for amounts owed . Serial bond D. !Identifies rights and responsibilities of the issuer and the bondholders. Bond indenture E lean be exchanged for shares of the issuer's stock. Convertible bond nregistered; interest is paid to whoever possesses t~m. Maintains a separate asset account from which bondholders are paid at 1ma"' tu"' ri,, ~/~ · __ TP1edges specific assets of the issuer as collateral. Bearer bond G • H. Sinking fund bond Secured bond .) ./ ./ ./ ./ ./ ./ ./ 16. 8'1Nard: 10 out of 10.00 Montclair Company is considering a project that will require a $500,000 loan. It presently has total liabilities of $220,000, and total assets of $6 10, 000. 1. Compute Montclair's (a) present debt-to-equity ratio and (b) the debt-to-equity ratio assuming it borrows $500,000 to fund the project. Choose Numerator: Total liabilities Choose Denominator: ./ Total equi~/ ./ Debt-to-Equi~/ Ratio (a) $ 220,000./ I $ 390,000./ 0.56 (b) $ 720,000./ I $ 390,000./ _..185 17. eward: 10 out of 10.00 Murray Company borrows $340,000 cash from a bank and in return signs an installment note for five annual payments of equal amount, with the first payment due one year after the note is signed. Compute the amount of the annual payment for each of the following annual market rates: (Table s.3) (Use PV factors from table provided.) Initial cash Proceeds Market Rate (a) (b) I- (C) tI PY Factor 4.0% $ 340,000./ I 8.0% $ 340,000./ I ./ ./ 12.0% $ 340,000./ I ./ II 4.45 18./1 = = 3.6048./ = 3.9927./ Amount of annual payment 1$ ,$ •$ 76,374 85, 155 94,3191 J