Spatial Dependence in International Office Markets

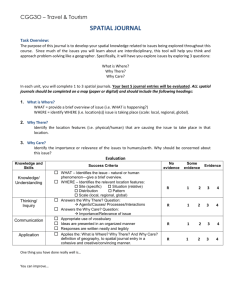

advertisement