2 - VWO Sell Proposal - The Brown Investment Group

advertisement

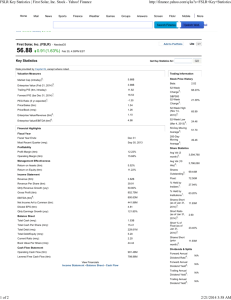

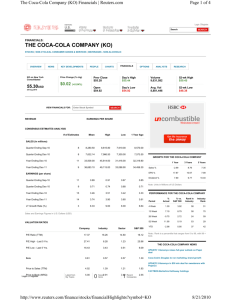

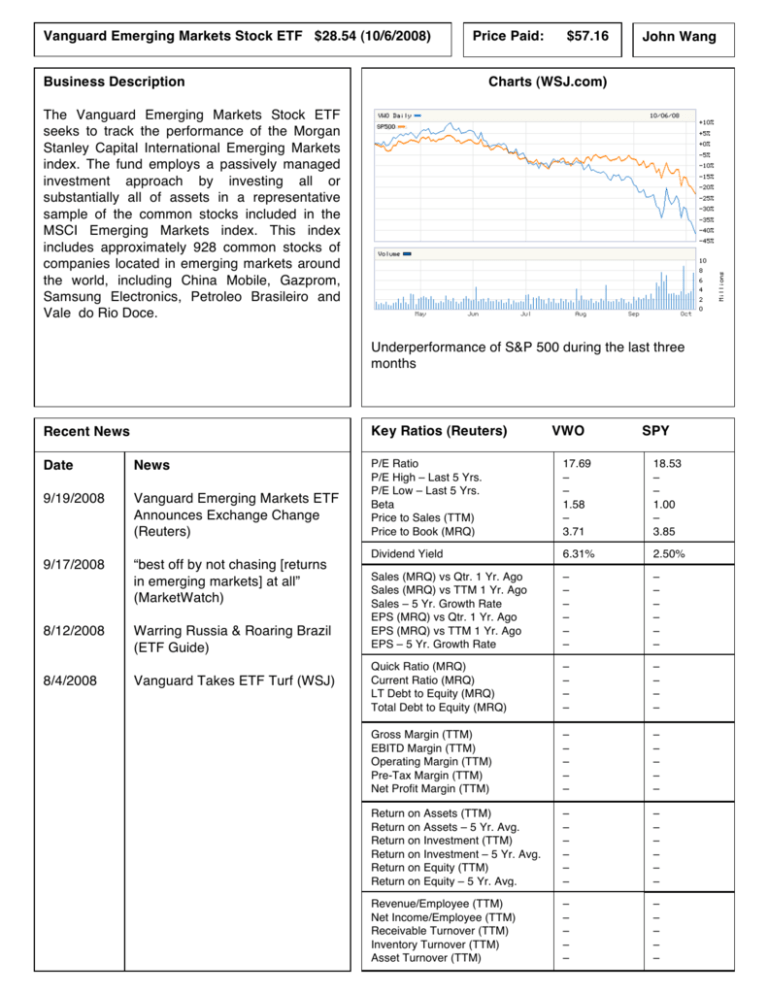

Vanguard Emerging Markets Stock ETF $28.54 (10/6/2008) Price Paid: Business Description $57.16 John Wang Charts (WSJ.com) The Vanguard Emerging Markets Stock ETF seeks to track the performance of the Morgan Stanley Capital International Emerging Markets index. The fund employs a passively managed investment approach by investing all or substantially all of assets in a representative sample of the common stocks included in the MSCI Emerging Markets index. This index includes approximately 928 common stocks of companies located in emerging markets around the world, including China Mobile, Gazprom, Samsung Electronics, Petroleo Brasileiro and Vale do Rio Doce. Underperformance of S&P 500 during the last three months Key Ratios (Reuters) Recent News Date News 9/19/2008 Vanguard Emerging Markets ETF Announces Exchange Change (Reuters) 9/17/2008 “best off by not chasing [returns in emerging markets] at all” (MarketWatch) 8/12/2008 Warring Russia & Roaring Brazil (ETF Guide) 8/4/2008 Vanguard Takes ETF Turf (WSJ) VWO SPY P/E Ratio P/E High – Last 5 Yrs. P/E Low – Last 5 Yrs. Beta Price to Sales (TTM) Price to Book (MRQ) 17.69 – – 1.58 – 3.71 18.53 – – 1.00 – 3.85 Dividend Yield 6.31% 2.50% Sales (MRQ) vs Qtr. 1 Yr. Ago Sales (MRQ) vs TTM 1 Yr. Ago Sales – 5 Yr. Growth Rate EPS (MRQ) vs Qtr. 1 Yr. Ago EPS (MRQ) vs TTM 1 Yr. Ago EPS – 5 Yr. Growth Rate – – – – – – – – – – – – Quick Ratio (MRQ) Current Ratio (MRQ) LT Debt to Equity (MRQ) Total Debt to Equity (MRQ) – – – – – – – – Gross Margin (TTM) EBITD Margin (TTM) Operating Margin (TTM) Pre-Tax Margin (TTM) Net Profit Margin (TTM) – – – – – – – – – – Return on Assets (TTM) Return on Assets – 5 Yr. Avg. Return on Investment (TTM) Return on Investment – 5 Yr. Avg. Return on Equity (TTM) Return on Equity – 5 Yr. Avg. – – – – – – – – – – – – Revenue/Employee (TTM) Net Income/Employee (TTM) Receivable Turnover (TTM) Inventory Turnover (TTM) Asset Turnover (TTM) – – – – – – – – – – Vanguard Emerging Markets Stock ETF $28.54 (10/6/2008) Price Paid: $57.16 John Wang Advantages (to sell) • Emerging markets are volatile. When developed markets are good, emerging markets are very good. When developed markets are bad, emerging markets are horrid. • VWO has 20.13% exposure to financials. • VWO lost 50% of its value since we bought last fall at $57.16, which was near the ETFʼs all-time peak of $57.57. There is no indication that we will be able to recapture the $2,518.56 losses within our investment horizon. • With over 900 holdings, upside gains from individual companies are limited. • As unlisted and private holdings do not have to comply with SEC regulations, there is little transparency with certain foreign companies. Gazprom is a shady state-owned monopoly and political tool. • Investing in an ETF relinquishes half the utility we gain from investing in individual stocks. It also infringes upon our liberty to choose between firms with questionable business practices (Gazprom) and ones that are socially responsible. Disadvantages (to sell) • A diversified equity portfolio should have some exposure to emerging markets. However, 4.8% of our portfolio is presently invested in SBS, a Brazilian sanitation services firm. • VWO presently trades at a 0.13% discount to the $31.24 NAV. • VWO maintains a strong dividend yield of 6.31%, but recent declines in price account for much of this. • VWO has a low expense ratio of 0.25, making it a better investment than some other emerging markets ETFs. Sector Allocations Holdings Stocks Bonds Sectors Financials Basic Materials Oil & Gas Telecommunications Technology Industrials Consumer Goods Consumer Services Utilities Health Care % of Total 20.13% 18.05% 17.86% 10.78% 9.78% 8.62% 5.39% 3.42% 3.12% 1.60% 91.84% 0.00% Top 10 Holdings (18.55% of Total Assets) Company % Assets Gazprom OAO (EDR) 4.09% China Mobile Ltd. 2.41% Petroleo Brasileiro Sa Petrobras 2.21% PETROBRAS –ON 1.95% Samsung Electronics 1.64% AMERICA MOVIL-L 1.43% Lukoil Company ADR 1.38% VALE R DOCE –PNA 1.29% VALE R DOCE –ON 1.09% Sasol Limited Group 1.06% Country Diversification (2007) (% of common stock) S. Korea – 15.4% China – 13.8% Brazil – 12.0% Taiwan – 11.3% Russia – 9.1% South Africa – 6.9% India – 6.8% Mexico – 5.1% Hong Kong – 2.4% Thesis: Although VWO offers us diversification, exposure to sheer volatility, rapidly cooling markets and financials indicate that we should cut losses as soon as possible. Limitations in our ability to choose where our money goes and lack of transparency suggest that we are better off investing elsewhere.