Power Point Slide Show

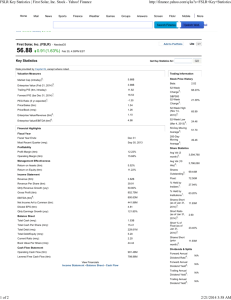

advertisement

The Aerospace and Defense Industry By Matthew O’Malley Michael Mulhearn Bianca Thon Dina Pappas EDO Corporation EDO Corporation • Industry – Aerospace and Defense • Supplier of highly engineered products for government and industry worldwide • Advanced electronic, electromechanical and information systems are products which are critical to the mission success of its customers 3 Reportable Segments: 1. Defense 2. Space and Communication Products 3. Engineered Materials The Defense segment • Provides integrated defense systems and components • Information technology and support systems • Services for military forces and governments worldwide Space and Communication Products • Addresses the remote sensing, communication, and navigation industries • Produces ultra-miniature electronics and a broad line of antennas Engineered Materials Segment • Supplies piezoelectric ceramics and advanced composites for the communication, navigation, chemical, paper, and oil industries Valuation Ratios • Price/Book (mrq) = • Price/Earnings(ttm) = • Price/Sales(ttm) = 2.00 33.84 0.56 Financial Strength • Current Ratio(mrq) • Debt/Equity(mrq) • Total Cash(mrq) = = = 1.70 0.88 $17.0M Financial Strength (cont) • Quick Ratio (mrq) = 1.3 • Total Debt / Equity = 0.9 • Return on Assets = 0.47% • Return on Equity = -0.39% MD & A • Sales from continuing operations for the second quarter of 2000 increased to $56.6M from $23.7M reported from the second quarter of 1999 • Operating earnings from continuing operations in the second quarter increased to $5.3M or 9.3% of sales from $2.1M or 8.8% of sales • EDO believes it has adequate liquidity and sufficient capital to fund its current operating plan Chart – EDO Corp Lockheed-Martin Corporation Some Big Numbers • Systems Integration $9.7 billion • Space Systems $7.1 billion • Aeronautical Systems $5.5 billion • Technology Services $2.3 billion News • Successful first flight of the JSF X-35A • Selected by the U.S. Army to update the systems on the Apache helicopters. • Lockheed’s COO leaves after only 6 months of service • Posted sales of $5,825,000,000 for the fiscal year ended 12/31/99. Ratios Quick Ratio Current Ratio Total Debt Price/Earnings Price/Sales Earnings (Per Share) Return on Equity Return on Assets 0.59 1.29 1.67 NM 0.51 -0.73 -4.85 -1.04 What is Primex? • Primex Technologies is an independent and innovative industrial corporation combining proven management and production capabilities with advanced research and development strengths in key technological areas. The company's flexibility allows it to capitalize on the synergy created by more than 100 years of proven success and expertise in supporting the defense, electronics and aerospace industries. Primex Technologies is made up of two divisions: the Ordnance and Tactical Systems (OTS) Division and the Aerospace and Electronics (AE) Division. Primex Technologies • 1999 was another successful year for Primex. Gross margins as a percentage of sales, which is a good measure of operating performance, increased from 21% in 1998 to 24% in 1999. This, combined with a 10% increase in sales, resulted in a 76% improvement in operating income and an increase in earnings per share (excluding one time gains in 1998) of 41%. The Company also experienced strong cash flow growth. Earnings before interest, taxes, depreciation and amortization grew 46% during 1999 to $71 million. Primex technologies • Early in 2000, we announced a restructuring of the Aerospace segment, which includes reviewing strategic alternatives for the electronic products business unit. This restructuring will reduce costs, improve competitiveness, and better focus this segment on the bottom line. To accomplish this, a restructuring charge of approximately $4 million will be recorded in the first quarter of 2000, but management expects that the benefits realized in 2000 will exceed the amount of the charge. Primex Technologies Primex technologies Valuation Ratios Financial Strength Price/Earnings (TTM)>15.45 Price/Sales (TTM)>.58 Price/Book (MRQ)>1.63 Price/Cash Flow (TTM)>15.43 Quick Ratio (MRQ)>1.31 Current Ratio (MRQ)>2.29 LT Debt/Equity (MRQ) >.92 Total Debt/Equity (MRQ) >.95 Mgmt Effectiveness Return on Equity (TTM)>11.13 Return on Assets (TTM) >4.33 Return on Investment (TTM)>5.41 Profitability Gross Margin (TTM) % >24.68 Operating Margin (TTM) % >8.01 Profit Margin (TTM) % >3.77 Ratio Comparisons EDO Hawker Lockheed Primex Quick 1.3 0.20 0.59 1.31 Current 1.7 0.57 1.29 2.29 Debt/Eq .88 3.94 1.67 .95 Return on Assets .47 -0.35 -1.04 4.33 Why the potential investor should choose Primex? Current Ratio • The high current ratio is very attractive to the potential investor. This gives us confidence in the firm’s ability to compensate for debts arising from operating, investing, and financing activities. • We have great confidence in Primex’s ability to generate cash to meet its short-term obligations. Quick Ratio • To further examine Primex’s working capital, we also investigated the acid test. This would give us a more reliable picture of liquidity. • Again, the most attractive of 1.31 exceeded the general test-level of 1:1. This strongly implies that quick current assets can cover their current liabilities.