Fauji Fertilizers - Fortune Securities

advertisement

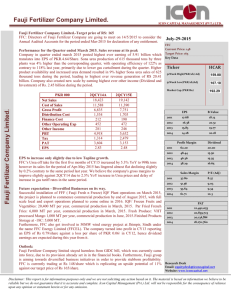

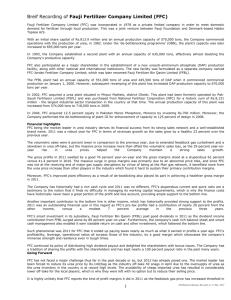

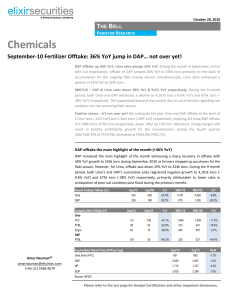

31st, October, 2007 Fauji Fertilizers Cultivating Riches! Key Stats FFC O/S shares (mn) 493 Market Capitalization (USD mn) With 20.1% of Pakistan’s GDP dependent on agriculture, the sector will continue to play a vital role in the country’s economic well-being going forward. GDP growth estimated to remain above 6% in the medium term bodes well with fertilizer offtake. Given the current urea and DAP shortfall, major players of the sector are adopting aggressive enhancement programs which would enable them to capitalize on the market conditions Revenues of fertilizer companies are expected to rise with rising urea and DAP prices where we expect them to register 6-year CAGR (CY06-12E) of 5.5% and 6.2% respectively. Urea offtake during Kharif’07 was 2.64 mn tons, witnessing a 10.4% YoY growth while DAP offtake recorded a 64.1% YoY growth to reach 0.64mn tons Budget FY08 contains several incentives announced for the fertilizer sector. Measures include, increase in subsidy on DAP, further relief in the form of 25% reduced electricity charges for tube-wells, availability of high acreage seeds at subsidized rates, and increase in support prices of main crops FFC enjoys an assured demand for its domestically manufactured product as well as imports. Strong identity and recognition of its brand 'Sona' allows FFC to charge a premium price. FFBL on the other hand has the edge of being the only DAP producer in Pakistan. Focus of the government towards a more balanced use of fertilizers encourages use of DAP which bodes well with FFBL Investment in Pak-Maroc Phosphore (PMP) by the two fertilizer companies, FFC & FFBL will yield fruits in future. (1) Dividends are expected to flow from CY09 as the production is expected to commence in CY08. (2) Availability of phosphoric acid at a cheaper price which is a major raw-material for manufacturing DAP FFC and FFBL are expected to maintain high payout ratio despite investment in several projects which provides a safety cushion to the investors in a volatile market We are initiating coverage on Fauji Fertilizer Company Ltd (FFC) and Fauji Fertilizer Bin Qasim Ltd (FFBL). FFC with an estimated 6-year (CY06-12E) earnings CAGR of 7.1% and trading at CY08E PER of 11.9x provides an upside of 23.5% to our 12 month target price of PKR 154 per share. FFBL with an estimated 6-year (CY06-12E) earnings CAGR of 13.8% and trading at CY08E PER of 10.3x offers 18.9% upside to our 12 month target price of PKR 55 per share 1,014.2 Daily traded volume - 12mth (mn) 1.4 Current price 124.7 Target price (PKR) 154.0 FFBL O/S shares (mn) 934 Market Capitalization (USD mn) 712.3 Daily traded volume - 12mth (mn) 11.2 Current price 46.3 Target price (PKR) 55.0 (%) FFBL FFC Index 80 40 0 -40 Oct-06 Jan-07 Apr-07 Jul-07 Oct-07 Performance 1M 3M 12M Absolute FFC (%) 8.4 0.5 6.6 Absolute FFBL (%) 4.4 2.1 59.8 Rel (KSE 100) FFC (%) 1.1 (3.7) (19.8) Rel (KSE 100) FFBL (%) (2.8) (2.1) 33.3 Umar Nauman umar.nauman@fortunesecurities.com (+92 21) 5309101-09 Ext. 141 Fortune Securities Limited Head Office 3rd Floor, Razi Tower, BC-13, Block No. 9, KDA Scheme No. 5 Clifton, Karachi Phone: (92 21) 5309101-09 Fax: (92 21) 5309155 u Retail Broking Room # 104, 1st Floor Business & Finance Centre I.I Chundrigar Road, Karachi Phone: (92 21) 2466946-51 Fax: (92 21) 2437726 Fortune Securities Limited | Equity Research Fauji Fertilizers Contents 1 Investment Summary 2 Overview of the Economy 3 Budget FY08 Impact 7 Demand v/s Supply 8 Pricing 9 Comparative Valuation 11 Fauji Fertilizer Company Ltd. (FFC) 13 Investment Proposal 14 Valuation 18 Company Overview 27 Financial Statements 28 Fauji Fertilizer Bin Qasim Ltd. (FFBL) 31 Investment Proposal 32 Valuation 35 Company Overview 40 Financial Statements 41 Fortune Securities Limited | Equity Research Fauji Fertilizers Investment Summary Pakistan is an agricultural country, with agricultural income forming 20.1% of total GDP in FY07. The agricultural sector provides food, feed and raw materials to various other industries operational in the country while it employs more than 41% of the country's total labor force and supports almost the entire rural population which makes up almost 66% of the total country’s population. Agri-earnings form about 35-40% of the national income and approximately 60% of total export income which is derived from raw and processed agricultural commodities. Hence, due to its critical position in the economic setup, any positive or negative alterations in the industry initiates a domino-effect on the rest of the financial system of the country. Consequently, the farming industry has received maximum attention and benefits from the Government in recent years. This has been in the form of credit disbursements to farmers at lower rates, subsidized prices of fertilizer and high acreage seeds, reduced electricity charges for tubewells and launching of various training and education programs in order to bring about higher quality output and improved yield. Pakistan’s economy has depicted tremendous development in recent years averaging close to 7.5% in the last 4 years, outshining its peers in the Asian region and fast appearing as one of the emerging economies in the world. This growth has been amply reflected in the fertilizer industry of the country, with agricultural production increasing by 4% on average in the last 5 years. Urea and DAP offtake have registered 5 year CAGRs of 6% and 5% respectively while prices of the two commodities have displayed CAGRs of 6% and 11% during the same period. We predict Pakistan’s economic growth to sustain its current levels and estimate GDP increase to register around 6.5% for FY08 over 6% in the medium term. With the country going through such a strong expansion phase the fertilizer industry is all to set to reap benefits from it. Currently nine fertilizer producing plants are operating in Pakistan with a total installed capacity of 4.35mntpa. Current shortage in the industry on the back of rising demand, is met through imports. We expect the consumption of fertilizers to rise by an average of 3-4% per annum, creating room for the existing manufacturers to take advantage. Supply on the other hand is likely to rise given the expansionary projects currently in the pipeline. Urea shortage is expected to shrink significantly in 2010 after the 1.3mntpa expansion of Engro becomes operational. FFC and FFBL with a collective market share of 62% of the total urea demand, have an opportunity to capitalize on the current market situation through capacity enhancement and expansions. FFBL holds 31% market share of DAP, which we expect will increase to 35-40% after the completion of BMR of DAP plant. The two players will benefit from the rising prices of urea and DAP, which we expect to increase by a 6-year (CY06-12E) CAGR of 5.5% and 6.2% respectively. The demand over the next 3 years is expected to keep fertilizer prices and consequently manufacturers’ margins firm before Engro’s expanded capacity becomes available (expected by 2010), reducing the demandsupply gap in the country. 2 Fortune Securities Limited | Equity Research