Banks extend PKR138.45bn to exporters under

elixir securities

a dawood group company

October 29, 2010

T HE B ELL

P AKISTAN R ESEARCH

Chemicals

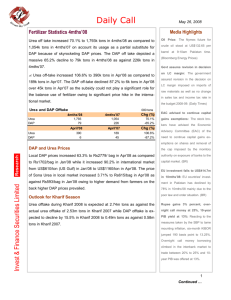

September-10 Fertilizer Offtake: 36% YoY jump in DAP… not over yet!

DAP offtake up 36% YoY; Urea sales plunge 25% YoY: During the month of September, in line with our expectation, offtake of DAP jumped 36% YoY to 256k tons primarily on the back of accumulation for the ongoing Rabi sowing season. Simultaneously, Urea sales witnessed a decline of 25% YoY to 324k tons.

9MCY10 – DAP & Urea sales down 38% YoY & 9.6% YoY respectively: During the 9-month period, both Urea and DAP witnessed a decline to 4,191k tons (-9.6% YoY) and 675k tons (-

38% YoY) respectively. The suppressed demand was mainly due to uncertainties regarding soil condition for the upcoming Rabi season.

Positive stance - It’s not over yet! We anticipate full year Urea and DAP offtake at the level of

5.7mn tons (-11% YoY) and 1.3mn tons (-20% YoY) respectively, implying 4Q Urea/DAP offtake of 1,580k tons/ 670k tons respectively, down 14%/ up 12% YoY. Moreover, strong margins will result in healthy profitability growth for the manufacturers during the fourth quarter

(4QCY10E EPS of FFC/FFBL estimated at PKR4.09/ PKR1.71).

DAP offtake the main highlight of the month (+36% YoY)

DAP remained the main highlight of the month witnessing a sharp recovery in offtake with

36% YoY growth to 256k tons during September 2010 as farmers stepped up purchases for the

Rabi season. However, for Urea, offtake was down 25% YoY to 324k tons. During the 9-month period, both Urea’s and DAP’s cumulative sales registered negative growth to 4,191k tons (-

9.6% YoY) and 675k tons (-38% YoY) respectively, primarily attributable to lower sales in anticipation of poor soil condition post flood during the previous months.

Overall Fertilizer Offtake (kT)

Urea

DAP

Sept'10

324

256

Sept'09

429

189

YoY

-24.5%

35.7%

9MCY10

4,191

675

9MCY09

4,636

1,095

YoY

-9.6%

-38.3%

Company-Wise Offtake (kT)

Urea

FFC

FFBL

Sept'10

113

38

Sept'09

199

50

YoY

-43.1%

-22.9%

9MCY10

1,646

373

9MCY09

1,859

441

YoY

-11.4%

-15.5%

Umar Nauman AC umarnauman@elixirsec.com

(+92-21) 3569 4679

Engro

DAP

FFBL

Avg Fertilizer Retail Prices (PKR per bag)

Urea Sona (FFC)

DAP

NP

SOP

Source: NFDC

45

124

74

50

-39.5%

148.3%

645

320

Sept'10

851

2,628

1,718

2,420

670

537

Aug'10

862

2,597

1,727

2,396

-3.7%

-40.4%

MoM

-1.3%

1.2%

-0.5%

1.0%

Please refer to the last page for Analyst Certification and other important disclosures.

THE BELL

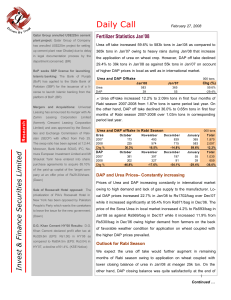

More to come during 4QCY10

With wheat sowing season starting in Oct-Nov, overall fertilizer dispatches (both Urea and DAP) will likely post significant growth during

4QCY10 with uncertainties regarding soil conditions tapering off. Moreover, sowing of Canola in flood affected areas is expected to improve the soil quality for the wheat sowing in Rabi season, which could lead to fast recovery in offtake. We expect 4QCY10 Urea and

DAP sales at 1,580k tons/ 670k tons respectively, taking CY10 offtake to 5,770k tons/ 1,345k tons down 11%/ 20% on YoY basis.

Monthly Urea Offtake (CY10) kT

800

700

600

500

400

300

200

100

-

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

*green bars show forecasted numbers

Source: NFDC

Monthly DAP Offtake (CY10) kT

350

300

250

200

150

100

50

-

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

*green bars show forecasted numbers

Source: NFDC

Demand recovery combined with strong margins to bode well for manufacturers

Strong demand recovery likely during 4QCY10, coupled with strong industry margins, we believe the sector will enjoy healthy earnings growth during the last quarter (4QCY10E EPS of FFC/FFBL estimated at PKR4.09/ PKR1.71). Hence, we recommend accumulation at current levels with our June’11 PT for FFC and FFBL at PKR123/share and PKR39/share respectively.

Economic & Political News

Research, (+92-21) 3569 4676

Forex reserves dip to USD16.88bn

Pakistan’s foreign exchange reserves slipped to USD16.88bn on regular debt payments by the week ended on October 22, the central bank said. The foreign exchange reserves held by the State Bank of Pakistan (SBP) declined to USD13.09bn while those held by other commercial banks came down to USD3.79bn, it said.

2

ELIXIR SECURITIES April 15, 2020

3

THE BELL

Analyst Certification

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice.

Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.)

Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities

Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

© Copyright 2010, Elixir Securities Pakistan (Pvt.) Ltd. All rights reserved. This report or any portion hereof may not be reproduced,

distributed, published or sent to a third party without prior consent of Elixir Securities Pakistan (Pvt.) Ltd.