Fauji Fertilizer Company Limited (FFC) was incorporated in 1978 as

advertisement

Breif Recording of Fauji Fertilizer Company Limited (FFC)

Fauji Fertilizer Company Limited (FFC) was incorporated in 1978 as a private limited company in order to meet domestic

demand for fertilizer through local production. This was a joint venture between Fauji Foundation and Denmark-based Haldor

Topsoe A/S.

With an initial share capital of Rs.813.9 million and an annual production capacity of 570,000 tons, the Company commenced

operations with the production of urea, in 1982. Under the 'de-bottlenecking programme' (DBN), the plant's capacity was later

increased to 695,000 tons per year.

In 1993, the Company established a second plant with an annual capacity of 635,000 tons, effectively almost doubling the

Company's productive capacity.

FFC also participated as a major shareholder in the establishment of a new urea/di-ammonium phosphate (DAP) production

facility, along with other national and international institutions. The new facility was formulated as a separate company named

FFC-Jordan Fertilizer Company Limited; which was later renamed Fauji Fertilizer Bin Qasim Limited (FFBL).

The FFBL plant had an annual capacity of 551,000 tons of urea and 445,500 tons of DAP when it commenced commercial

production on January 1, 2000. However, subsequent revamping of this plant has increased DAP production capacity to 670,000

tons per year.

In 2002, FFC acquired a urea plant situated in Mirpur Mathelo, district Ghotki. This plant had been formerly operated by PakSaudi Fertilizers Limited (PSFL) and was purchased from National Fertilizer Corporation (NFC) for a historic sum of Rs.8,151

million - the largest industrial sector transaction in the country at that time. The annual production capacity of this plant was

increased from 574,000 tons to 718,000 tons in 2009.

In 2004, FFC acquired 12.5 percent equity in Pakistan Maroc Phosphore, Morocco by investing Rs.706 million. Moreover, the

Company performed the de-bottlenecking of plant III for enhancement of capacity to 125 percent of design in 2008.

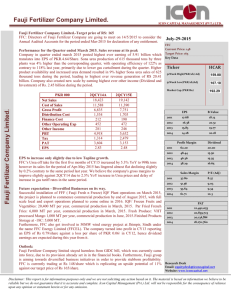

Financial highlights

FFC being the market leader in urea industry derives its financial success from its strong sales network and a well-established

brand name. 2011 was a robust year for FFC in terms of revenues growth as the sales grew by a healthy 23 percent over the

previous year.

The volumetric sales were 6 percent lower in comparison to the previous year, due to extended feedstock gas curtailment and a

slowdown in urea off-take, but the massive price increase more than offset the volumetric sales loss, as the 29 percent year-onyear

rise

in

urea

prices

helped

the

Company

maintain

a

strong

sales

growth.

The gross profits in 2011 swelled by a good 76 percent year-on-year and the gross margins stood at a stupendous 62 percent

versus 41.4 percent in 2010. The massive surge in gross margins was primarily due to an abnormal price hike, and since FFC

was not at the receiving end of major gas supply disruptions by virtue of being at the Mari gas network, it benefited more from

the urea price increase than other players in the industry which found it hard to sustain their primary contribution margins.

Moreover, FFC's improved plant efficiency as a result of de-bootlicking also played its part in achieving a healthier gross margin

in 2011.

The Company has historically had a rich cash cycle and 2011 was no different. FFC's stupendous current and quick ratio are a

testimony to the notion that it finds no difficulty in managing its working capital requirements, which is why the finance costs

have historically never been a great portion of the profit and loss account, providing ample support to the bottom line.

Another important contributor to the bottom line is other income, which has historically provided strong support to the profits.

2011 was an outstanding financial year in this regard as FFC's pre-tax profits had a contribution of nearly 20 percent from the

other

income,

versus

a

modest

7

percent

average

in

the

previous

three

years.

FFC's smart investment in its subsidiary, Fauji Fertilizer Bin Qasim (FFBL) paid good dividends in 2011 as the dividend income

contribution from FFBL surged alone by 89 percent year-on-year. Furthermore, the company's cash rich balance sheet and smart

cash management also enabled it earn sizeable return on cash and other investment, which fattened the bottom line.

Such phenomenal was 2011 for FFC that it ended up paying taxes nearly as much as what it earned in profits a year ago. FFC's

profitability, leverage, operational ratios all surpass those of the industry, by a good margin which showcases the company's

immense strength and resilience even in tough times.

FFC continued its policy of distributing high dividend payout and delighted the shareholders with bonus issues. The Company has

a tradition of sharing the profits with the shareholders and has kept nearly a 100 percent payout ratio in the past many years.

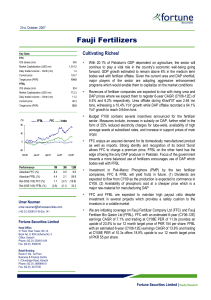

Going Forward

FFC has not faced a major challenge thus far in the past decade or so, but 2012 has already posed one. The market leader has

been forced to reduce its urea price by Rs.140/bag as the industry off-take hit snags in April due to the oversupply of urea as

the urea inventory in the country is at record high levels. The availability of cheap imported urea has resulted in considerably

lower off-take for the local players, which is why they were left with no option but to reduce their selling price.

It is highly unlikely that FFC reports the kind of profit margins it did in 2011 as the feedstock gas price has increased threefold in

1

{Published in Business Recorder on 17 May, 2012

comparison to the previous year and the margins are likely to take a sizeable blow. That said FFC would still reap decent enough

margins, which will be much better than those of its peers as it is placed in the Ari network and gas availability is much better

than the other networks. Moreover, the Company's efficient plants and strong distribution network will also keep the company

afloat.

2

{Published in Business Recorder on 17 May, 2012