Nick Calhoun Darius Douglas Brittany Douglas

advertisement

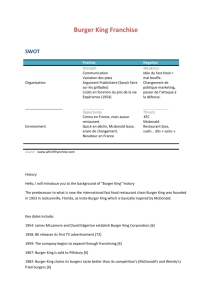

Three Year Strategic Plan for 20132015 NICK CALHOUN DARIUS DOUGLAS BRITTANY DOUGLAS PRESENTATION OUTLINE I. Introduction of McDonald’s i. Company Overview ii. Mission Statement a) b) IV. McDonald’s Burger King Vision Statement Internal Assessment I. Company Values II. Financial Ratios III. Organizational Chart iii. II. I. II. IV. Current Chart Revised Chart Marketing Strategy I. II. Current Revised Strengths/Weakness VI. IFE External Assessment I. Competitor Analysis V. III. I. V. CPM VI. Strategic Formulation I. SWOT Matrix II. Space III. BCG IV. Grand Strategy Matrix V. QSPM VI. Recommendations Strategy Implementation I. Strategy Timeline II. EPS III. Predicted Financial Statements IV. Financial Ratios Conclusion VISION STATEMENT Our goal is becoming customers favorite way and place to eat and drink by serving core favorites such as the world famous French Fries, Big Mac, Quarter Pounder and Chicken McNuggets. COMPANY OVERVIEW McDonald’s began it’s operation in 1948 In 1963 the 500th restaurant was opened • Currently • By 1965 the stock offering was $22.50 per shar Current 33,000 locations world wide stock price is $87.97 McDonald’s now operates in 119 countries Current Chief Executive Officer is Don Thompson MCDONALD’S MISSION STATEMENT McDonald's brand mission is to be our customers' favorite place and way to eat. Our worldwide operations are aligned around a global strategy called the Plan to Win, which center on an exceptional customer experience – People, Products, Place, Price and Promotion. We are committed to continuously improving our operations and enhancing our customers' experience MCDONALD’S MISSION STATEMENT ANALYSIS Mission Statement only includes the following components: Market Concern for survival, growth, and profitability Philosophies Mission statement are missing the following components: Specific Customers Specific products or services Technologies Self-Concept Concern for public image Concern for employees Statement endorses the concept of the four p’s Product Place Price Promotion BURGER KING MISSION STATEMENT Every day, more than 11 million guests visit BURGER KING® restaurants around the world. And they do so because our restaurants are known for serving highquality, great-tasting, and affordable food. Founded in 1954, BURGER KING® is the second largest fast food hamburger chain in the world. The original HOME OF THE WHOPPER®, our commitment to premium ingredients, signature recipes, and family-friendly dining experiences is what has defined our brand for more than 50 successful years. BURGER KING MISSION STATEMENT ANALYSIS Does not show any type of technological advances which could appeal to a younger generation No self concept and social responsibility to go that extra mile Although they are the 2nd largest hamburger fast-food chain in the world, this should not be indicated because it shows they are not the best COMPANY VALUES We place the customer experience at the core of all we do. We are committed to our people We believe in the McDonald’s System We operate our business ethically We grow our business profitably. We strive continually to improve FINANCIAL RATIO ANALYSIS Ratios McDonalds Industry Price/Earnings 16.45 21.20 Quick Ratio 1.00 0.70 1.2 0.48 0.97 18.1% 16.5% 44.8% 30.3% 20.5% 21.6 133.6 1.00 0.95 1.03 8.20% 10.70% 36.70% 25.69% 15.10% 34.20 47.00 0.8 1.20 Current Ratio Long Term debt/ Equity Total Debt/ Equity Net Profit Margin Return on Assets Gross Margin Return on Equity Return on Capital Receivable Turnover Inventory Turnover Asset Turnover ORGANIZATIONAL CHART (CURRENT) President and Ceo CBO Executive VP and CFO Executive VP HRM Social Media VP Controller VP CDO COO President Central Division President East Division President USA VP COO McDonald’s USA Executive Vice President, General Counsel and Secretary President West Division Corporate Vice President Supply Chain and Franchising President Asia, Pacific, Middle East, Africa President Europe PROBLEMS WITH ORGANIZATIONAL CHART Double titles of Top executives; such as CEO and President Some of the titles are obscure, such as “President USA” and “Executive Vice President HRM” President title of Asia, Pacific, Africa, and Middle East should be broken up into two presidential positions for more effective leadership and region concentration No research and development business unit Unnecessary positions such as “CDO (Chief Diversity Officer)” and “Social Media”. Chart shows two COO’s, one for the overall company and one for McDonald’s USA REVISED ORGANIZATIONAL CHART TOP LEVEL MANAGEMENT TITLES CEO- Chief Executive Officer COO- Chief Operating Officer CBO- Chief Brand Officer CFO- Chief Financial Officer General Counsel and Secretary CROO- Chief Restaurant Operations Officer HRM- Human Resource Manager Supply Chain Development and Franchising Research and Development ORGANIZATIONAL CHART IMPROVEMENTS Eliminates double titles Addition of a Research and Development Function Shows all divisional presidents reporting to the COO Eliminates the extra COO for McDonald's USA and other unnecessary positions President over Asia, Pacific, Middle East, and Africa is broken up into two positions: President Asia and Pacific President Middle East and Africa PRESENT MARKETING A restaurant that offers a consistent value menu. Using a worldwide market and adapt to the needs of their many locations. President figures in USA, Asia, Europe, Pacific, Middle East, Africa, and even Latin America Advertising Channels: Internet Radio Television Direct mail Billboards -Current Target Market- Families in all cultures MARKETING POSITIONING MAP MARKETING POSITIONING MAP NEW MARKETING STRATEGIES -Advertise more on social media sites such as Instagram and also on mobile apps such as Pandora. -Offer more weekly giveaways such as $1000 for one lucky contestant or a $100 McDonald’s gift card. -Correlate McDonald’s with both basketball AND football. -Offer different side items for individuals who do not have a desire for french fries. Wendy’s for example offers a variety of side items which can cater to everyone’s needs. -Invest more in African countries such as Guana. It is one of the more profitable countries in the continent UPDATED MARKETING SLOGAN PROGRESSION PLAN An official progression plan is needed in order to maintain the success of McDonald’s as the #1 fast-food restaurant in the world and stay current with an ever-growing world population. We suggest that each top level manager meet with one another four times out of the year due to some of them being fairly new to their positions. CEO Don Thompson should use an experienced advisor for his first 2 years in order to ensure accurate running of the company and command of subordinates. MCDONALD’S BURGER KING Co unties with Burger King Co untries without Burger King MAP OF STORE LOCATION HOW MUCH IS MCDONALD’S WORTH? Method 1: Stock Holders' Equity (in millions) (2011) Common Stock Additional Paid-In Capital Retained Earnings Goodwill & Intangibles 16.6 5487 36710 -2653 Net Worth 39560.6 Method 2: Net Profits 2007 2008 2009 2010 2011 7905 8639 8792 9637 10690 5-Year AVG 9132.6 Method 3: Price-Earnings Ratio PE Ratio AVG Net Inc 5-Years 16.09 9132.6M Worth 146943.5 Method 4: Outstanding Shares # of Outstanding Shares MKT Price per Share AVG of 4 Methods 157M $93.20 14632.4 52567.28 ~52 Billion WEBSITE WEBSITE MCDONALD’S WEBSITE ANALYSIS Homepage shows current promotion o Categories are clearly listed on the left side of the website The topic food is at the top showing that it is their main priority o o “Monopoly Game” The food section of the website list all of the various items McDonalds has to offer It provides nutritional information The website is clear and concise with only the important pieces of information Website is more interactive in comparison to competitor The background of the website does not possess much detail that may attract a customer Not a clear link to McDonald’s Company website BURGER KING HOMEPAGE BURGER KING WEBSITE ANALYSIS Menu options are listed at the top of the website Offer social network options Twitter Facebook Offers an option to help find customers the closest restaurant Company Information is accessible from main page Option for careers is not easily found on the website Offers a mobile website and application STRENGTHS Operates in 33,000 locations Has reduced sodium by 10% in various chicken items on the menu Restaurants have increased the amount of cardboard recycled by 20% On average 15.8 menu items per market share include a 1/2 serving of fruit Created a new division line of product such as McCafe Serves over 47 million customers daily Created a partnership with the Olympics Sales have increased by 2.94 billion dollars in 2012 WEAKNESS Turnover rate for employees is 44% Quality control throughout the different franchise Top level management is new to the company Only operates in three countries in the continent of Africa Difficult to become a franchisee Very little training is offered to employees Website only shows top level management but not the organizational chart STRENGTHS (IFEM) WEAKNESSES (IFEM) COMPETITIVE PROFILE MATRIX McDona lds Cri teri a Bra nd Name Wei ght Burger Ki ng Wei ghted Score Ra ting Wi eght Wei ghted Score Ra ting Wendy's Wei ght Wei ghted Score Ra ting 0.25 4 1 0.2 3 0.75 0.18 2 0.5 0.2 2 0.4 0.19 3 0.6 0.21 4 0.8 Pri ce 0.08 4 0.32 0.09 3 0.24 0.11 2 0.16 Advertising 0.05 4 0.2 0.06 3 0.15 0.09 2 0.1 0.2 2 0.4 0.25 4 0.8 0.23 3 0.6 # of Loca tions 0.15 4 0.6 0.06 2 0.3 0.1 3 0.45 Va ri ety of Menu i tems 0.07 2 0.14 0.15 4 0.6 0.08 3 0.24 2.92 1 2.84 1 Product Qua lity Cus tomer Service Total 1 2.61 OPPORTUNITIES 3% in worldwide population Fast food industry growth by 5% 25% of consumers eat fast food everyday Not as many grocery stores in urban areas Release of new Disney movies Unemployment rates falls to 6% THREATS Multiple stores in a geographic area Society views on fast food Fast Food restaurants are required to show nutritional information. Imitated by competitors Sales at local grocery stores Unemployment rate rises to 9.9% EFE MATRIX Opportunities 3% increase in worldwide population Fast-food industry growth by 5% Increase in the number of franchisees Release of new Disney movies could create new marketing opportunities 25% of consumers eat fast-food everyday Urban areas struggle to get grocery stores Economic growth of 5% in Guana, Kenya, and Angola Invest more in northwest areas that lack a restaurant Calorie count on menu allows more nutritional info The multitasking of Generation Y allows for more fast food sales. Wieght Wieghted Score Rating 0.09 0.05 0.09 3 4 3 0.27 0.2 0.27 0.05 0.09 0.02 0.01 0.02 0.06 3 2 3 1 3 4 0.15 0.18 0.06 0.01 0.06 0.24 0.01 2 0.02 0.04 0.06 0.07 0.07 0.03 0.06 0.05 0.05 0.02 0.06 2 3 1 4 2 1 4 3 1 4 0.08 0.18 0.07 0.28 0.06 0.06 0.2 0.15 0.02 0.24 Threats 11. Multiple stores in one geogrphic area 12. Society's view on fast food 13. Being imitated by compettitors 14. Displaying Nutritional data 15. Competitors have more side items for meals 16. Gas prices up 14% 17. Society's perception of fast food 18.Competitors offer online ordering 19. Family sized meals 20. Sales at local grocery stores Total 1 2.07 STRATEGIC DIRECTION The strength of the alignment among the Company, its franchisees and suppliers (collectively referred to as the System) has been key to McDonald’s success. This business model enables McDonald’s to deliver consistent, locallyrelevant restaurant experiences to customers and be an integral part of the communities we serve. In addition, it facilitates our ability to identify, implement and scale innovative ideas that meet customers’ changing needs and preferences. McDonald’s customer-focused Plan to Win provides a common framework for our global business yet allows for local adaptation. Through the execution of initiatives surrounding the five elements of our Plan to Win – People, Products, Place, Price and Promotion – we have enhanced the restaurant experience for customers worldwide and grown comparable sales and customer visits in each of the last eight years. This Plan, combined with financial discipline, has delivered strong results for our shareholders. SWOT MATRIX SO Strategies Offer more franchises in states with the least number Provide healthier meal combinations ST Strategies Offer family sized meal that have four servinngs Increase dividends by 5% Create an iPhone app that shows store with shortest lines Ceate more side items and desserts Offer jobs to teenagers Aquire smaller fast food chains Increase advertising spending by 15% Offer table service to customers that dine-in SWOT MATRIX (CONTINUED) WO Strategies WT Strategies Increase MCD stock trade volume Build more stores in African Countries Incrase treasury stock Offer servings that are beloew 400 calories Create more McCafe products Create a new and imroved organiztional chart Hire more experienced leaders for top management Make the company's website more interactive Buy fruits and vegetables locally if they are availabe Offer catering at major events SPACE MATRIX FS Conservative Aggressive 6 5 4 3 2 1 CA -6 -5 -4 -3 -2 -1 1 2 3 4 -1 -2 X Plot 2.8 -3 -4 -5 Y Plot 2.2 -6 Defensive ES Competitive 5 6 IS SPACE MATRIX DATA Financial Position (FP) Return on Investments Brand Name Earnings Per Share Net Income Working Capital 6 7 4 6 3 Environmental Position (EP) Technological Changes Demand Variability Competitive Pressure Barriers of entry into market Rate of Inflation -2 -1 -3 -6 -3 Financial Position Avg. 5.2 Environmental Position Avg. -3 Competitive Position (CP) Product Quality Customer Loyalty Technology know-how Product Life Cycles Market Share -4 -1 -3 -2 -2 Industry Potential (GP) Profit Potential Financial Stability Resource Utilization Extent Leveraged Ease of entry 7 7 4 5 3 Competitive Position Avg. -2.4 Growth Potential Avg. 5.2 BCG DATA TABLE BCG MATRIX GRAND STRATEGY MATRIX Rapid Market Growth Weak Competitive Advantage Strong Competitive Position Slow Market Growth Saturated Market Moderate Integration Stronger than Competitors Slow Company Growth QSPM (CONTINUED) QSPM (CONTINUED) QSPM (CONTINUED) RECOMMENDATIONS STRATEGICAL TIMELINE EPIS/EPS ANALYSIS Common Stock Financing Recession Normal Boom $EBIT 900,000,000 450,000,000 900,000,000 $Interest 0 0 0 $EBT 900,000,000 450,000,000 900,000,000 $Taxes 360,000,000 180,000,000 360,000,000 $EAT 540,000,000 270,000,000 540,000,000 #Shares 1044.9 1044.9 1044.9 $ EPS 5.17 2.58 5.17 Debt Financing Recession Normal Boom 900,000,000 450,000,000 900,000,000 65,000,000 65,000,000 65,000,000 965,000,000 385,000,000 835,000,000 289,500,000 115,500,000 250,500,000 675,500,000 269,500,000 584,500,000 1008.63 1008.63 1008.63 6.7 2.63 5.8 70% Stock - 30% Debt Recession Normal Boom $EBIT 900,000,000 450,000,000 900,000,000 $Interest 19,500,000 19,500,000 19,500,000 $EBT 919,500,000 430,500,000 880,500,000 $Taxes 275,850,000 129,150,000 264,150,000 $EAT 643,650,000 301,350,000 616,350,000 #Shares 929.4 929.4 929.4 $ EPS 6.92 3.24 6.63 70% Debt - 30% Stock Recession Normal Boom 900,000,000 450,000,000 900,000,000 45,500,000 45,500,000 45,500,000 945,500,000 404,500,000 854,500,000 283,650,000 121,350,000 256,350,000 661,850,000 283,150,000 598,150,000 971.58 971.58 971.58 6.81 2.91 6.16 BALANCE SHEET Assets Cash/Short Term Investments Accounts Receivables/Net Inventory Prepaid Expenses Total Current Assets 2013 2,532.10 1,576.70 125.4 634.5 4,868.70 2014 2,943.00 1,689.90 144.2 693.1 5,470.20 2015 3,398.80 1,912.20 151.9 621.4 6,084.30 23,153.70 2,898.20 1,795.80 1,783.40 34,499.80 24,599.80 2,767.30 1,612.10 1,751.90 36,201.30 25,971.30 2,690.50 1,749.20 1,789.20 38,284.50 987.1 2,165.70 122.6 299.3 3574.7 1,097.60 1,930.10 287.4 347.9 3,663.00 1,235.40 2,276.50 398.1 287.2 4,197.20 Total Long Term Debt Deferred Income Tax Other Liabilities Total Liabilities 12,961.30 1,387.20 1,745.10 19668.3 14111.7 1,412.80 1,805.90 20,993.40 15165.9 1,469.10 1,937.70 22,769.90 Equity Preferred Stock Common Stock Additional Paid-in Capital Retained Earnings Treasury Stock-Common Other Equity Total Equity 0 16.6 6,711.50 37,224.80 -29,843 519.5 14629.9 0 16.6 7,054.10 39,791.60 -32643.9 743 14,961.40 0 16.6 8,248.80 42,862.70 -35780.7 613.8 15,961.20 34298.2 35,954.80 38,731.10 Prop., Plant, Equip. Good Will Long Term Investments Other Assets Total Assets Liability and Shareholders' Equity Accounts Payable Accrued Expenses Debt/Capital Leases Other Liabilities Total Current Liabilities Total Liabilities and Equity Total Revenue 23,788.0 26,589.6 2013 C ost of Revenue, Total 2014 27,173.7 2015 INCOME STATEMENT 14,549.1 14,068.3 12,745.9 Gross Profit 9,238.9 12,521.3 14,427.8 Selling/General/Administrative Expenses, Total 2,182.7 2,054.3 1,995.2 Research & Development 0.0 0.0 0.0 Depreciation/Amortization 0.0 0.0 0.0 Interest Expense (Income), Net Operating 0.0 0.0 0.0 Unusual Expense (Income) -10.8 -101.6 77.4 Other Operating Expenses, Total 0.0 Operating Income 0.0 0.0 10,467.0 12,432.6 7,056.2 Interest Income (Expense), Net Non-Operating 0.0 0.0 0.0 Gain (Loss) on Sale of Assets 0.0 0.0 0.0 -32.5 -41.2 -17.6 Income Before Tax 6,761.2 10,085.3 11,987.0 Income Tax - Total 1,978.1 2,122.0 2,343.0 Income After Tax 5,783.1 7,963.3 9,644.0 M inority Interest 0.0 0.0 0.0 Equity In Affiliates 0.0 0.0 0.0 U.S. GAAP Adjustment 0.0 0.0 0.0 5,783.1 7,963.3 9,644.0 0.0 0.0 0.0 5,783.1 7,963.3 9,644.0 Other, N et N et Income Before Extra. Items Total Extraordinary Items N et Income PROJECTED FINANCIAL RATIOS