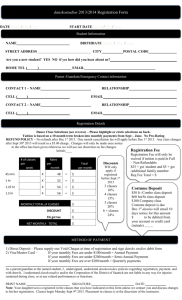

Business Checking

advertisement

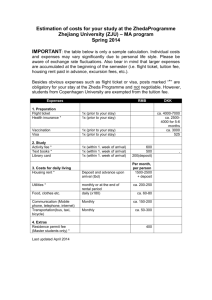

Service Fees &Misc.Charges Business ChecDig Base Fee(monthly) $20.00 Additional Stab!n 1ents (ead'l) 2.00 Coin (per roiQ o.os Collection items (lnmming &Outgoing) 15.00 Currency(per$1,000) 030 Deposit Items Ondividual aedit items) o.oa Deposits (per depasft slip or ACH Item} 0.30 Debits (c:heclcsordebit card transactions} o.20 Retumed Deposit item (Charge backll:em) 5.00 WnTransfers (lnmming) NIC WireTransfers (Outgoing-Domeslic) :zo.oo International Wft (h:orYWig} NIC International wn COUigomg) 60.00 FDICinsurance(monthly) 0.10/$1,000 1%or$5min On6ne Bil Pay O.SOeach Other Business Services: cash Sweep ChecDigAcmunt Business Loans FREE E-Stal& 1iliHits FREEVISA Check Business Debit Cards FREE Direct Deposit Servia! Merdlantcard Protessing Remote Deposit capture Servb (for qualifying businesses) See our website for more infonnation. PEOPLES BANK www.peoplesbaaktellas.COIII Peoples Bank is a strong, locally owned community bank, established in 1968. Our decision-makers are here. This allows us to make fast decisions along with our friendly service to help make your business profitable and successful. Contact any of our banking locations to discuss any business need and ask questions about any of our quality business services. Definitions of Terms Average Collected Balance Average ledger balance less float. (Float is time required for items deposited in your account to be paid.) We do give you immediate credit even though actual funding to the bank may require up to three or more days. Charge Back on Deposited Items Items deposited to your account that are returned due to insufficient funds, closed accounts. etc. Credit Allowance on Investable Funds Your investable balance is multiplied by the average Fed Funds rate for that month. Credit allowance on investable funds is calculated each month and varies according to Fed Funds rate= Earnings Credit Rate Deposit Items All checks or items processed into your account. Base Fee The monthly account maintenance charge for generating your monthly statement and general operating cost of handling the account. Code Descriptions 1-Average Ledger Balance: The average daily ledger balance of the Demand Deposit Account. 2-Average Float: The average daily deposit float for the Demand Deposit Account. Float is the time required for items deposited in your account to be paid. (We do allow you immediate credit even though actual funding may require up to three days or more.) 3-Average Collected Balance: Average Ledger Balance less Average Float. 4-Services Rendered: A deKription of all the Bank services rendered during the statement period. No Fee Example - BualnaH Account Primary Account 5555555 Paopl" Bank Cuetomar 11111 Main street Lubbock, Texae 78999 September 1, 2011 ACCOUNT ANALYSIS STATEMENT...................................................... Average Ledger Balance $50,000.00 [j] Less Average Float (Uncollected Funds) (1,500.00) [II Average Collected Balance $48,500.00 [j] SERVICES RENDEREDW VOLUME []] PRICE [i] Base Fee - Monthly 1 7 Cradit Faa 42 Regular Debits Item Faa 20 FDIC Insurance per$1000 20.00 TOTAL [I] 20.00 2.10 8.40 1.20 0.50 32.20 00 39,176.67 [[] 9,323.33 [j]] 0.30 0.20 0.06 0.10 Total Balance Required for Services Balance Available for Other Services RECAP OF ACCOUNT ANALYSIS........................................................ . 5-Volume: The total number of units of each Bank service used by the account during the statement period. 6-Price: The per unit charge for each service. 7-Total: Volume of each service multiplied by the price per unit for that service. 8-Total Calculated Charges: The total of all charges for services during the statement period. 9-Total Balance Required for Services: The average daily balance that would have to be maintained in the account to offset the cost of all Bank services rendered during the statement period. Investable Funds Average collected daily balance minus reserve requirement. We invest these funds nightly and give you credit on your investable balance, which is netted against your monthly service fees. 10--Balance Available for Other Services: The Average Collected Balance less Balance Required for Services: (a) if positive, these are balances that exceed the Balance Required for Services; (b) if zero, the Balance Required for Services exceeds your Average Collected Balance and your balances are deficient to cover services rendered. Credit Fee Cost of processing all items listed on a single deposit slip. 11--Reserve Amount: The total amount of required reserves for the account. Regular Debits Cost of processing checks, debits, or items written on your account: checks, debits, drafts, inter-bank debits, etc. 12--lnvestable Balance: Average collected Balance less Reserve amount. This is the amount of balances available to cover services rendered on the account. Reserve Requirement Banking law requires a percentage of your deposits to be held in reserve at a Correspondent Bank or the Federal Reserve. 13--Net Credit for Balances: Investable Balance multiplied by the Earnings Credit Rate. Reserve Amount at1 0% (Collected) Investable Balance (Collected) Credit for Balances at 1.0% ~ Lass lntarast Earned: nona Nat Credit for Balances Less Charges for Services (4,850.00) IITl 43,650.00 [12J 36.36 0.00 36.38 ~ (32.20) 4.18 [1j] 0.00 Nat Results of Analysis Final Service Charge Fee Incurred Example - BualnaH Account Paopln Bank Cuetornar 11111 Main street Lubbock, Texae 79SMKI Primary Account 5555555 September 1, 2011 ACCOUNT ANALYSIS STATEMENT............................................. ......... $30,000.00 [j] Average Ledger Balance Less Average Float (Uncollected Funds) (1,500.00) [j] Average Collected Balance $28,500.00 [I] SERVICES RENDEREDW VOLUME []] PRICEI&J Base Fee - Monthly Cradit Faa 7 Regular Debits 42 Local Item Fee 20 per$1000 FDIC Insurance Total Balance Raqulrad for Services Balance Available for Other Services 20.00 TOTAL [I] 20.00 2.10 8.40 0.30 0.20 0.06 1.20 0.30 0.10 32.00 00 38,933.33 [[] (1 0,433.33) [j]] RECAP OF ACCOUNT ANALYSIS.............................. ..................... ...... 14--Final Service Charge: The fee required to cover services rendered which were not offset with balances. Reserve Amount at1 0% (Collected) Investable Balance (Collected) Credit for Balances at 1.0% [J]] Less Interest Earned: none Net Credit for Balances Less Charges for Services Net Results of Analysis Final Service Charge (2,850.00) 25,650.00 IITl I12J 21.38 0.00 21.38 ~ (32.00) (10.62) [1j] (10.82)