Vertical Arrangements, Market Structure, and Competition

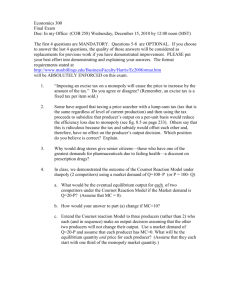

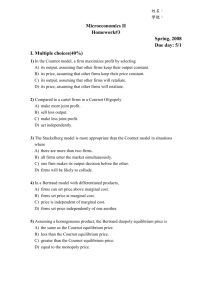

advertisement