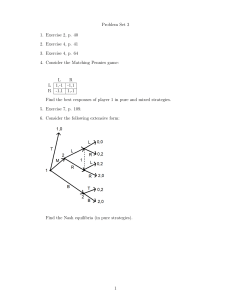

solution (thanks to Kelby)

advertisement

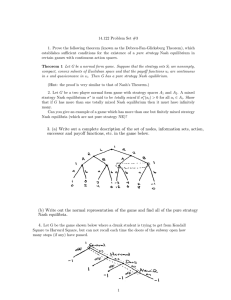

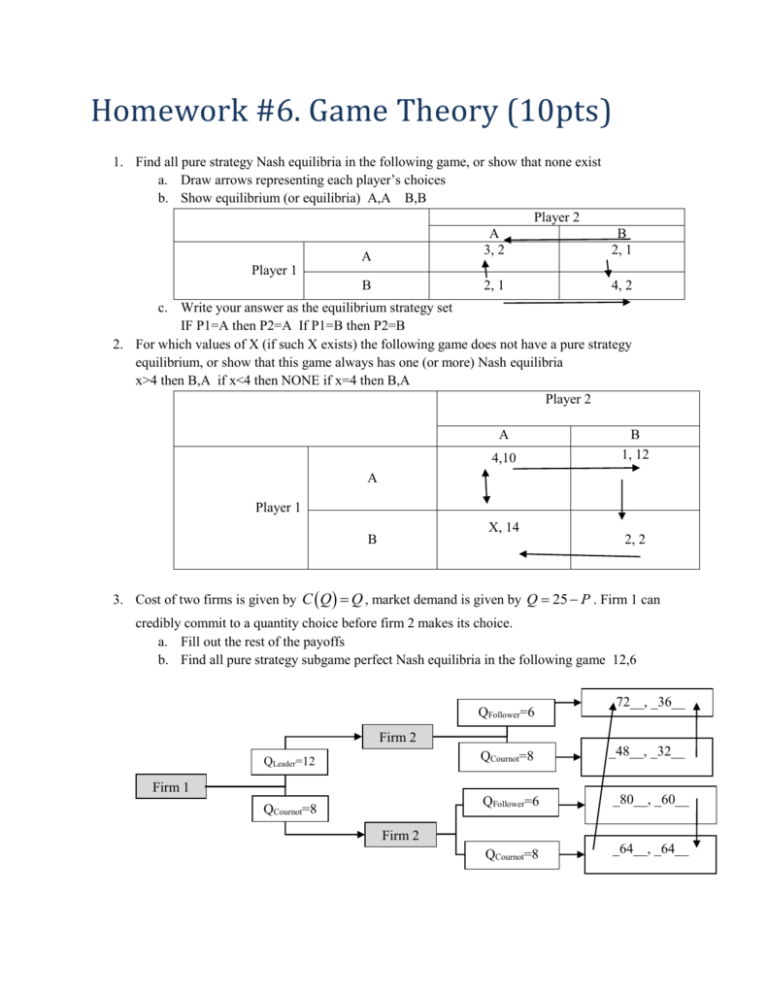

Homework #6. Game Theory (10pts) 1. Find all pure strategy Nash equilibria in the following game, or show that none exist a. Draw arrows representing each player’s choices b. Show equilibrium (or equilibria) A,A B,B Player 2 A B 3, 2 2, 1 A Player 1 B 2, 1 4, 2 c. Write your answer as the equilibrium strategy set IF P1=A then P2=A If P1=B then P2=B 2. For which values of X (if such X exists) the following game does not have a pure strategy equilibrium, or show that this game always has one (or more) Nash equilibria x>4 then B,A if x<4 then NONE if x=4 then B,A Player 2 A 4,10 B 1, 12 A Player 1 X, 14 B 2, 2 3. Cost of two firms is given by C Q Q , market demand is given by Q 25 P . Firm 1 can credibly commit to a quantity choice before firm 2 makes its choice. a. Fill out the rest of the payoffs b. Find all pure strategy subgame perfect Nash equilibria in the following game 12,6 QFollower=6 _72__, _36__ Firm 2 QLeader=12 QCournot=8 _48__, _32__ QFollower=6 _80__, _60__ QCournot=8 _64__, _64__ Firm 1 QCournot=8 Firm 2 4. Starting with the setup of the previous problem now assume that there is a fixed cost of 30 in the production function and the leader can attempt to prevent entry by limit pricing. a. Fill out the payoff matrix b. Find all pure strategy subgame perfect Nash equilibria in the following game 14,0 and 14,0 in subgame _42__, _6__ Enter, QFollower=6 Firm 2 QLeader=12 Not enter, Q=0 __114___, 0 Enter, Q=_5_ __40__,__-5___ Not enter, Q=0 __110____, 0 Firm 1 QLimit=14 Firm 2 Notice that when the follower does not enter and the leader produces either 12 or 14, the market price will be determined by the inverse demand as 25-12=13 or 25-14=11. Leader’s profits will be determined correspondingly as (13-1)12-30=114 and (11-1)14-30=110 5. Solve problem 3 at the end of chapter 6 (solved in the book) 6. Solve problem 4 at the end of chapter 6. This problem is optional but a good attempt is required. This problem demonstrates how the nature of the competition affects how firms react to changes in prices. You may use formulas from the appendix to find the answer. There are two ways to answer this question. Let me show you how to do the increase in price for Cournot competition. From the equation 6A.7. p on p is a nm a n m so the effect of 10% increase in m n 1 n 1 n 1 n .1m . In the case of duopoly n 2 and the price will increase by 2/3 of the increase in the n 1 marginal cost. Using equations for quantity and price of Stackelberg from the appendix of chapter 6 you will be able to find the changes for the remaining price and quantity. Another way would be to set up a very simple and familiar Cournot competition model, change marginal cost by 10% and see what happens to the price. Say demand is Q 25 P; P 25 Q and the marginal cost is 1. The price in Cournot duopoly is 9. Now if the marginal cost increases to 1.1 (a 10% increase) Q 25 1.1 QB 11.95 B . Using the familiar trick QA QB we 2 2 2 can solve for quantity QA QB 11.95*2 / 3 7.96667 so the total quantity is twice of that of each the reaction functions become: QA 2 3 firm’s and the price from the inverse demand is therefore P 25 2* 11.95* 9.06667 . In other words, a 0.1 increase in the marginal cost caused a 0.06667 increase in the price. Notice that the answer is the same whether you use the is 2/3 7. Solve problem 7 at the end of chapter 6 Substitute numbers into the formula for elasticity to find the elasticity. Cartel would price at the monopoly price which is always in the elastic part of the demand.