PPT - WWZ

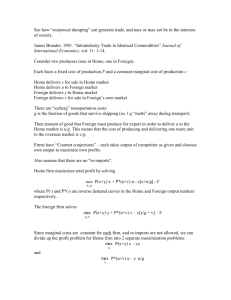

advertisement

Strategic Pricing: Theory, Practice and Policy Professor John W. Mayo mayoj@georgetown.edu Prices, Industry Supply & Demand, and the Role of Industrial Organization CS = Consumer Surplus $ mc S ac D Pricing above competitive levels imposes economic welfare losses Monopoly and Competition $ mc ac cs D mr Prices are higher under Monopoly than competition The Role of Market Structure in Pricing • Suppose that: • Market Demand Q=1000-1000P • MC = $.28 • How do optimal prices compare depending on Market Structure and the nature of competition? Perfect Competition Industry Regardless of Market demand Price is driven by the equality Of price and marginal cost MC P=.28 D 720 Q Monopoly Firm π = PQ - .28Q π = [1 – (1/1000Q)]Q -.28Q π = Q - .001Q2 -.28Q So, taking the first derivative And setting equal to 0: P=.64 MC P=.28 Dπ/dQ = 1 - .002Q - .28 =0 D mr 360 720 Q = 360 Q Plugging into the demand function P= .64. The Role of Industrial Organization on Pricing • Competition v. Monopoly • Strategic Interactions Among Competitors • Oligopoly • Few competitors • Barriers to entry • Possible reactions to price/output changes: • Competitors match price decreases, but not price increases • Model: Sweezy oligopoly • Price is determined by market output. Each competitors set output to maximize profit given the output of rivals • Model: Cournot Oligopoly • Firms constantly seek to undercut competitors’ prices • Model: Bertrand oligopoly • Price leadership (One or more firm calls out price and others follow) • Model: Dominant Firm-Competitive fringe • Models most typically rely upon Nash equilibrium concept • Each firm is optimizing given the behavior of its rivals Sweezy Oligopoly P Suppose price is initially at P0. If competitors follow price decreases, but not increases, then a kinked demand results P0 mr2 D2 D1 mr1 Q Sweezy Oligopoly P Implications: prices are non-responsive to changes in mc over a range – consider mc1 and mc2 mc1 mc2 mr2 D2 D1 mr1 Q Nash equilibrium In a Nash equilibrium, each firm is optimizing, given the behavior of other firms John Nash 1994 Nobel Laureate Cournot Oligopoly • Price is determined by total market output (relative to demand) • So my strategy must account for the output of rivals • If duopoly: • Q1* =r1(Q2) and Q2* = r2(Q1) Cournot Model: Nash equilibrium as number of firms changes Assume mc=0 $ With an initial equilibrium of Qm,Pm, consider the output of a second firm. The second firm takes the output of Firm 1 as given, then optimizes on the Residual demand curve (the lower Half of the original demand) Pm The result is P2. P2 What is Firm 1’s reaction? D1 Qm mr1 mr2 Qc Q Cournot Model: Nash equilibrium as number of firms changes The result is P2. What is Firm 1’s reaction? Firm 1, then takes the output of firm 2 as given and reduces its output. Why? Because firm 2 has taken ¼ of market. Pm P2 D1 mr1 mr2 Cournot Quantity Adjustments Reaction Functions In Cournot, each firm seeks to maximize profit given the output of its rival. So, we can examine how firm 1’s output changes as firm 2 has different outputs. Denote Q1*(Q2) Q1 Note that in our previous example, increases in Q2 were met with reductions in Q1 Q2*(Q1) Similarly, for Q2*(Q1) Cournot- Nash equilibrium Q1*(Q2) Q2 Cournot: A linear demand example Suppose that market demand is P= 30-Q and MC1=MC2 = 0. What is firm 1’s reaction function? Revenue for firm 1 = PQ1 = (30-Q)Q1 = (30 – Q1- Q2)Q1 = 30Q1 – Q12 – Q1Q2 Thus, MR = 30-2Q1-Q2 Set MR=MC and solve for Q1: Q1 = 15 - 1/2Q2 Similarly, Q2 = 15-1/2Q1 Cournot: linear demand (cont.) Solving the reaction functions simultaneously: Q1 Q1 = 15 - 1/2Q2 Q2 = 15 - 1/2Q1 How does this compare with a Competitive equilibrium for the firms? How does this compare with the case of Collusion? 10 10 Q2 Stackelberg • Consider that firms compete in quantities, but now… • Suppose that instead of firms choosing outputs simultaneously, one firm is the leader and output is sequential Stackelberg If firm 1 goes first, then it will maximize profit given the reaction function of firm 2 Recall that in our example Rev1 = PQ1 = 30Q1 – Q12 –Q1Q2 But firm 1 knows how firm 2 will react to its output, so substituting in the reaction function from 2, we get Rev1 = 15Q1 -1/2Q12, so MR = 15 –Q1, so Q1* = 15, Q2* = 7.5. Why is the equilibrium different from simultaneous Cournot? Bertrand Oligopoly • Homogeneous • Differentiated Dynamic Pricing Considerations • Cournot and Bertrand are static • What if playing (in competition with) a rival repeatedly? Pricing: Dynamic considerations • Suppose rivals announce intention to raise price • If cooperate, then your profits are $10 per period, forever. • If “cheat”, then profits increase (say to $50) this period with zero thereafter. Pricing: Dynamic considerations • Look at NPV of cooperative behavior compared to NPV of non-cooperative behavior • Assume infinitely repeated • NPV = p0 + S p’t * (1/(1+r))t = [(1 + r)/r]p0 • NPVCO = 10 + S 10 * (1/(1+r))t = 10 + 10*1/r • NPVNC = 50 + S 0 * (1/(1+r))t = 50 • NPVCO > NPVNC if r < .25 • In this example, if very impatient, cheat. Otherwise cooperate with price increase. • Pricing strategy will depend upon discount rates and the relative payoff from defection IF competing in long-run • Folk Theorem – says that with a low discount rate, any price between MC and PM can be equilibrium • Engendering cooperation • Focal prices [Knittle and Stango (AER 2003)] • Standardize timing of price changes • Pre-announcement of price changes (upward) • Trigger Strategies (tit-for-tat; grim trigger) • Most Favored Customer Clause • Match rivals’ price (create “whistle blowing” consumers) • “Giant now honoring Safeway coupons” Price Ceilings as Focal Points • Knittle and Stango study the credit card market • 1450 bank-issued cards • 90 % of states in late 70s/early 80s had interest rate ceilings (18% was most common) • Find tacit collusion consistent with price ceilings serving as focal points • Tacit collusion is more likely when: • (a) concentration is higher • (b) costs are higher • (c ) firms are larger • (d) but lower when demand is high