GAME THEORY

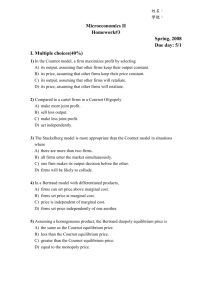

advertisement

OLIGOPOLY

Cournot Game

In a Cournot game, each firm chooses its output level

taking as given all other firms’ output levels.

Model with 2 firms

- 2 firms, index by i = 1, 2, producing homogenous good

with output y1 and y2 and cost c1(y1) and c2(y2)

- Aggregate output Y = y1 + y2

- Inverse demand p(Y) = p(y1 + y2)

Firm i's maximization problem is

Max Пi(yi, yj) = p(yi + yj) yi – ci(yi)

i = 1, 2, i ≠ j

yi

Firm i's profit depends on the amount of output chosen by j.

Hence, firm i must forecast firm j's output decision.

A (pure-strategy) Cournot Nash equilibrium

is a set of output (y1*, y2*) in which each firm is choosing

its profit maximizing output level given its beliefs about the

other firm’s choice and the beliefs are correct.

Assuming interior optimum, y1 > 0 and y2 > 0

Solution to firm i's maximization

F.O.C.:

S.O.C.:

(

∂

Π i yi , y j

∂

yi

(

∂

Π i2 yi , y j

∂

y 2i

)

)

= 0

i = 1, 2, i ≠ j

≤0

i = 1, 2, i ≠ j

From F.O.C.s, we get each firm reaction curve (best response

function). Reaction curve gives firm i's optimal output as a

function of its beliefs firm j's output choice.

Denote the reaction curve of firm i by fi (yj),

from F.O.C., we write

(

∂

Π i f i ( y j ), y j

∂

yi

)

≡0

To see how i changes its optimal output level as its belief

about firm j's output changes, differentiate the above w.r.t. to

yj

(

∂

Π 2i yi , y j

∂

y 2i

)

f i′

(yj) +

(

(

∂

Π 2i yi , y j

∂

yi ∂

yj

Π 2i yi , y j

f i′

(yj) =

(

)

=0

)

Π 2i yi , y j

yi ∂y j

)

y 2i

Denominator is negative due to S.O.C.

Numerator is negative if inverse demand curve is downward

(Y ) + p′

(Y ) yi < 0

sloping and not too convex such that p′

(yj) < 0

→ fi′

If the reaction curves are downward sloping, players’

strategies are said to be strategic substitutes.

If the reaction curves are upward sloping, players’

strategies are said to be strategic complements.

System of differential equations

dy1

= g1 ( y1 , y 2 )

dt

dy2

= g 2 ( y1 , y 2 )

dt

has a stable equilibrium if

∂

g1

∂

y1

∂

g2

∂

y1

∂

g1

∂

y2

∂

g2 > 0

∂

y2

and

∂

g1

∂

g2

+

< 0

∂

y1

∂

y2

Suppose the firms adjust their outputs in the direction of

increasing profits

dy1

∂

Π1 ( y1 , y 2 )

= α1[

]

dt

∂

y1

dy2

∂

Π 2 ( y1 , y 2 )

= α2[

]

dt

∂

y2

Then the equilibrium is stable if

Comparative Statics

We want to see how optimal choice (say of firm 1) is

affected if some parameter changes.

Suppose that a is a parameter that shifts П1

∂

Π1 ( y1 ( a ), y 2 ( a ), a )

≡0

∂

y1

∂

Π 2 ( y1 ( a ), y 2 ( a ))

≡0

∂

y2

by F.O.C.s

Differentiating with respect to a and using the Cramer’s rule

∂

y1

to solve for ∂

, we get

a

Several Firms

Suppose there are N firms

p(Y ) + p′

(Y ) yi = ci′

( yi )

i = 1, 2,…., N

N

where Y = ∑yi

i =1

We can write

p(Y )[1 + p′

(Y )

Y

si ] = ci′

( yi )

p

i = 1, 2,…., N

si

p(Y )[1 + ] = ci′

( yi )

i = 1, 2,…., N

ε

where si = yi/Y and ε = elasticity of market demand.

Cournot model is in between monopoly and competitive

models.

if si = 1 → monopoly

if si → 0 → competitive firms with infinitesimal market share.

Adding up all N equations, we have

N

Np(Y ) + p′

(Y )Y =

Σ ci′

( yi )

i =1

Aggregate industry output Y only depends on the sum of the

marginal costs, not on their distribution across firms.

If all firms have the same constant MC = c then the

equilibrium is symmetric si = 1/N and

1

p(Y )[1 +

] = c as N → ∞, price approaches marginal cost

Nε

Welfare

Assuming a symmetric equilibrium, Cournot induxtry

maximizes the weighted sum of consumers’ surplus and

industry profit as given by

(N-1)[U(Y) – cY] + [p(Y) – c]Y

To see this, differentiate the above with respect to Y and set

equal to 0

(Y ) – c] + p′

(Y ) Y + p(Y) – c = 0

(N-1)[ U ′

Note that U(Y) =

Y

∫

0p(x)dx

U′

(Y ) = p(Y)

Using this fact and rearrange the equation yeilds

1

p(Y )[1 +

]=c

Nε

This is the profit maximizing condition in a symmetric

Cournot equilibrium.

As N → ∞, more weight is put on the social objective of

utility minus costs, as compared to private objective of profits.

Alternatively, to maximize social objective

Wsocial(Y) = U(Y) – cY

(Y ) = p(Y) = c

F.O.C.: U ′

1

p

(

Y

)[

1

+

] = c,

However, Cournot optimization

Nε

as N → ∞, social objective is maximized.

Bertrand Game

In a Bertrand game, each firm chooses its price level taking as

given all other firms’ price levels.

Model with 2 firms

- 2 firms, index by i = 1, 2, with a constant unit cost of c1 and c2

- Products are homogeneous and the demand for firm i is

di(pi, pj) =

{

D( pi )

D( pi ) / 2

0

if pi < p j

if pi = p j

if pi > p j

where D(p) is the market demand curve

Case 1): If c1 = c2 = c, a Bertrand Nash equilibrium is

p1 = p2 = c and each firm gets half of the markets

Proof.: If p1 > c, firm 2 can set p2 = p1 – ε and get the entire

market, earning (almost) entire profit

But if p2 > c, this cannot be an equilibrium because

firm 1 will have incentive to undercut price further

Case 2): If c2 > c1, a Bertrand Nash equilibrium has

firm 1 sets p1 = c2 and gets the entire market and

firm 2 sets p2 ≥ c2 and produces zero.

Proof.:

With only 2 firms, we get the result of firms setting price =

MC, or the firm that is in operation sets its price = marginal

cost of firm with higher cost.

Differentiated Products

Inverse demand functions

of two goods that are not perfect substitutes

p1 = α1 – β1y1 – γy2

p2 = α2 – β2y2 – γy1

Measure of product differentiation γ2/ β1β2

Cournot Competition for firm i

Max [αi – βiyi – γyj] yi

yi

Direct Demand functions

y1 = a1 – b1p1 + cp2

y2 = a2 – b2p2 + cp1

Bertrand Competition for firm i

Max [ai – bipi + cpj] pi

pi

Outputs of firms are strategic substitutes

→ increasing yj makes it less profitable for firm i to

increase its output

Prices are strategic complements

→ an increase in pj makes it more profitable for firm i to

increase its price.

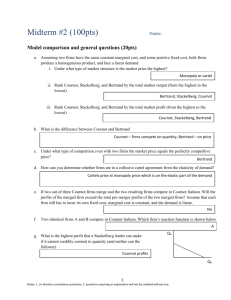

Quantity Leaership (Stackelberg Model)

- A sequential game with 2 stages

- First stage: Leader moves by choosing its output level

- Second stage: Follower chooses its output level after

observing the leader’s output.

Stackelberg with homogeneous products (perfect

substitutes)

Let leader = firm 1, follower = firm 2

Second stage

Firm 2 chooses y2 given y1

This is essentially reaction curve of firm 2, f2(y1) in Cournot game

First stage

Firm 1 maximizes

Revealed Preference:

The profit of the leader in Stackelberg equilibrium will usually

be higher than his profit in Cournot equilibrium.

Leadership Preferred:

A firm always weakly prefers to be a leader.

Proof.

This can be shown using the fact that with homogeneous products

i) П1(y1, y2) is a strictly decreasing function of y2 and vice versa

ii) The reaction curves f1(y2) and f2(y1) are strictly decreasing

functions

Price Leadership

- Heterogeneous products

- Demand for output of firm i = xi(p1, p2)

- 2 firms, leader = firm 1, follower = firm 2

Second stage

Firm 2 max

First stage

Firm 1 max

If goods are substitutes with high degree of substitution, we

may expect reaction curves to be upward sloping.

Following Preferred

If both firms have identical cost and demand functions and if

reaction curves are upward sloping.

→ each firm prefers to be the follower to being the leader

Intuition: Leader has to support high price by producing low

output whereas follower can set price equal to leader’s price (or

undercut leader’s price a little) and produce as much as it wants.

Capacity Constraint Game

- 1st period, each firm chooses its production capacity yi

- 2nd period, they play Bertrand game

The outcome of this game is typically a Cournot equilibrium

- The price charged at 2nd period is p(y1 + y2) which is just the

inverse demand at capacity

- Choosing capacity at 1st period is then just a Cournot game.

Conjectural Variations

If firm 1 makes a conjecture about firm 2 responds to its

choice of output, denote it by y 2v ( y1 ) and let

v12

∂

y 2v ( y1 )

=

∂

y1

v

Firm 1 max p(y1 + y 2 ( y1 ) ) y1 – c1(y1)

F.O.C.:

i) If v12 = 0

→ Cournot model, each firm believes that

the other firm’s choice is independent from its own

ii) If v12 = -1

→ Competitive model

( y1 ) = slope of reaction function → Stackelberg

iii) If v12 = f 2′

iv) If v12 = y2/y1 → Cartel

Criticism:

It is a static model but is should be a dynamic model as it is

modelling how other firms should respond.

Collusion

If firms act as cartel, they maximize the sum of profits by

choosing y1, y2,….,yN simultaneously

N

max

y1, y2,..,yN

p(Y)Y –

Σ ci ( yi )

i =1

F.O.C.:

However, the solution is not stable, there is incentive to cheat

If firm 1 maximizes its own profit at cartel’s solution Y*

If firm 1 believes that other will employ cartel output, then it

would benefit to increase its own output.

If it does not believe that other firms will set cartel output,

generally, not optimal for it to maintain cartel output either.

To make cartel possible, often use effective punishment to

deter cheating.

Repeated Oligopoly Games

Example: Punishment Strategy

- chooses cartel output as long as no one cheats

- if someone cheats, chooses Cournot output in all future

periods

Let

∏ *i be one-period profit of firm i from cartel outcome

∏ Ci be one-period profit of firm i from Cournot outcome

∏ iD be one-period profit of firm i from deviation (cheating)

Infinitely Repeated Games

Note:

i) cooperation is not part of SPE in finitely repeated game.

ii) Abreu (1986) shows that one-period punishment will

typically be sufficient to support cartel output.

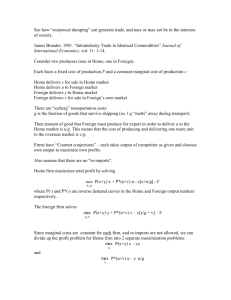

Limit Pricing

Limit pricing = pricing to prevent entry

Example: Perfect knowledge

- 2 firms, incumbent and a potential entrant

- 2 periods:

1st period, incumbent sets price and quantity (observed by

entrant)

2nd period, if entry occurs, they play duopoly game, if

there is no entry, the incumbent will charge monopolist price.

Solution

If duopoly profit for entrant > 0, will enter regardless of

what incumbent does previously.

Hence, incumbent should choose monopolist price in 1st

the period.

This is because the first period price conveys no

information.

Example: Imperfect Information

- uncertainty about incumbent’s cost (entrant does not know if

the incumbent has low or high cost)

Incumbent can reveal that it is a low cost by set low enough

price at first period such that a high-cost incumbent will have

no incentive to do so.