Hence equation 5 becomes

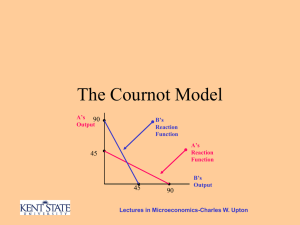

advertisement

The First Order Profit Maximising Condition Reformatted Profit function of firm i: i R(Qi ) C (Qi ) 1. where, R(Qi) is the revenue function and C(Qi) is the cost function of firm i. For profit maximisation the derivative of profit is zero, which amounts to saying that the derivative of revenue is equal to the derivative of cost: MRi MC i 2. where MRi is the marginal revenue and MCi the marginal cost. Revenue is R=pQi, where p f (Q ) , where Q is the sum of all individual outputs of the n firms in the industry ( Q i 1 Qi ). n Marginal revenue, the derivative with respect to the firm’s output level, Qi , is then n p p Q p Qi j i Q j MRi p Qi p Qi p Qi Q Qi Q Qi Qi MRi = p p Qi (1 i ) Q Qi 3. j i Q j n where i is the conjectural variation term, i.e. the firm’s conjecture as to Qi its rivals’ response to a change in its own output. If we both multiply and divide p equation 3 by then this becomes: Q 1 i MRi p1 S i 4. indl1.doc Q Q p , and S i i is the market share of firm i. Substituting 4 into 2 Q p Q gives the profit maximising condition taken orthodox microeconomic theory reformatted to with referenced to the structure-conduct-performance framework: where, 1 i MRi p1 S i MC i 5. Alternative market structures Perfect competition Q 0 1 i 0 i 1 Qi Hence equation 5 becomes MRi p MCi 6. Monopoly Q Qi Q Qi 1 Qi Qi Hence equation 5 becomes 1 MR p1 MC 7. Joint Profit maximisation Firms seek to maintain market share following the rule: Q j Qi j i Q j n i Qi Qj Qi n j i Qi i 1,2,..., n Qj Q Qi Q 1 Qi Qi indl1.doc 1 i Q 1 Qi S i Hence equation 5 becomes 1 MRi p1 MC i 8. Cournot Each firm is assuming that its rivals output will not change in response to a change in his own output, hence: j i Q j n i 0 Qi Hence equation 5 becomes S MRi p1 i MC i 9. The Cournot Model: An Example Set n=2, MCi=c and p=a-bQ, b> 0 and i=0. Profits are equal to i a bQ Qi cQi and since 1 a bQ , the profit maximising condition 9 becomes: b Q a bQ 1 Qi b Q Q c a bQ a bQ bQi c a 2bQi b j i Q j c n a c j i Q j Qi 2b 2 n for i=1,2. Writing the two equations explicitly indl1.doc Q2 a c 2 2b Q1 ac Q2 2 2b Q1 Solving the system of the two equations we get: Q1* Q2* In the case of monopoly, since a c C 2(a c) C a 2c ,Q ,p 3b 3b 3 1 bQ , Qi=Q, equation 7 becomes: a bQ a 2bQ c Q M ac M ac ,p 2b 2 In the case of perfect competition, since p=c a-bQ=c, and therefore: a bQ c Q PC a c PC ,p c b Stackelberg’s Model Instead of simultaneity in the firms’ action as in the Cournot model, here the follower (say, firm 2) moves second playing Cournot: Q2 a c Q1 2b 2 while the leader, (say, firm 1) will maximise its profits by taking into account the follower’s reaction function as he knows that the latter will act as a Cournot firm, (correctly) treating the leader’s output as fixed. Hence equation 1 becomes: Q ac 1 pQ1 cQ1 Q1 a bQ1 Q2 cQ1 a bQ1 b b 1 c Q1 2b 2 Q ac 1 b 1 Q1 2 2 Consequently, indl1.doc d 1 a c Q1 a c F a c Q1L a c L 2b 0 Q1 , Q2 , dQ1 2 2 2b 2b 2 4b Q S Q1 Q2 3(a c) S 3(a c) a 3c , p a b 4b 4b 4 In other words, there is a first mover advantage as the leader produces more relative to the Cournot model, at the expense of the follower who know produces less, while the total output (price) is greater (lower) than the total output (price) in the Cournot model. indl1.doc