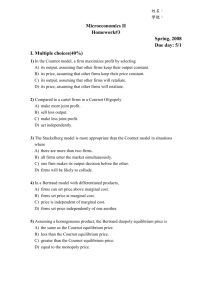

18. Oligopoly

advertisement

18. Oligopoly

Varian, Chapter 27

Two firms, two issues

• Concentrate on duopoly – easy notation

• Two issues:

1. What are firms’ choices?

– Choose a quantity/quality of output; or

– Choose a price

2. What is the timing of firms’ actions?

– Simultaneous decisions; or

– Sequential decisions

Four interactions

Timing

Simultaneous Sequential

Strategy Prices

Quantities

Bertrand

Stackelberg-p

Cournot

Stackelberg-q

We’ll do these two

Costs and profits

• Two firms, 1 and 2

• Single good, outputs y1 and y2

• Cost for firm i is

c(yi)

Market price depends

on total output, but not

• Inverse demand function is

on which firm makes it

p(y1+y2)

• If outputs are y1 and y2, profits are

p1(y1,y2) = p(y1+y2) y1 - c(y1)

p2(y1,y2) = p(y1+y2) y2 - c(y2)

Quantity leadership: Stackelberg

• Firm 1 goes first; firm 2 follows

• The follower’s problem: Given y1, choose

y2 to

max p2(y1,y2) = [p(y1+y2) y2] - c(y2)

Revenue

Costs

• Firm 2’s output satisfies

p(y1+y2) + p’(y1+y2) y2 = c’(y2)

Marginal revenue

Marginal cost

Firm 2’s reaction function

• Firm 2’s profit-maximizing output depends

on firm 1’s choice

• That is,

y2 = f2(y1)

for some function f2(.)

• f2(.) is called firm 2’s reaction function

Example: linear demand and zero

costs

• Suppose the inverse demand function is

p(y1+y2) = A – B(y1+y2)

• Firm 2’s profit is

p2(y1,y2) = (A – B(y1+y2) ) y2

= (A - By1) y2 - B y22

• Firm 2’s best choice of output is

y2 = (A – By1)/2B = f2(y1)

Graphical treatment of linear case

y2

Iso-profit lines for firm 2

Profit

increasing

Firm 2’s reaction function

y2 = f2(y1) = (A – By1)/2B

y1

The leader’s problem

• Firm 1 anticipates firm 2’s reaction to its

output choice

• So it chooses y1 to

max p1(y1,y2) = [p(y1+y2) y1] - c(y1)

or

max [p(y1+ f2(y1)) y1] - c(y1)

Linear demand, zero costs

• We know

f2(y1) = (A – By1)/2B

• So

p1 = (A-B(y1+f2(y1)) y1

= {A-By1 – B [(A – By1)/2B ]} y1

= (A/2) y1 - (B/2) y12

• Best choice of y1:

y1 = A/(2B)

Stackelberg equilibrium

y2

Firm 2’s reaction function

y2 = f2(y1) = (A – By1)/2B

Stackelberg equilibrium

Profit

increasing

Iso-profit lines for firm 1

y1

Stackelberg outcome

• Firm outputs

y1 = A/(2B)

y2 = f2(y1) = (A – By1)/(2B) = A/(4B)

• Total industry output

YS = y1 + y2 = (3A)/(4B)

• Pareto efficient output

YP = A/B

Why?

Pareto efficiency

y2

Is the Stackelberg equilibrium

Pareto efficient from the

perspective of the two firms?

Stackelberg equilibrium

2’s Profit

increasing

Room for a

Pareto improvement

1’s Profit

increasing

y1

Cournot competition

• Now both firms choose output

simultaneously

• We assume their choices constitute a

Nash equilibrium

• Whatever 1’s output, y1 , firm 2 must do

Firm 2’s reaction

the best it can:

function

y2 = f2(y1)

• Whatever 2’s output, y2 , firm 1 must do

the best it can:

Firm 1’s reaction

y1 = f1(y2)

function

Cournot equilibrium

y2

y1 = f1(y2)

Cournot equilibrium

2’s Profit

increasing

y2 = f2(y1)

1’s Profit

increasing

y1

Linear demand, zero costs

• 2’ reaction function is

y2 = f2(y1) = (A – By1)/2B

• 1’ reaction function is

y1 = f1(y2) = (A – By2)/2B

• Solve these two equations for y1 and y2 :

y1 = y2 = A/3B

• Industry output

YC = y1+y2 = (2A)/(3B)

Pareto efficiency

y2

Is the Cournot equilibrium

y1 = f1(y2) Pareto efficient from the

perspective of the two firms?

Still room for a

Pareto improvement

Cournot equilibrium

y2 = f2(y1)

y1

Maximizing joint profits

• Suppose the firms cooperatively choose

outputs, y1 and y2

• When costs are zero, they choose

aggregate output Y = y1 + y2 like a single

monopolist:

YM = A/(2B)

• Note that

YM < YC < YS < YP

A/(2B)

A/B

(2A)/(3B)

(3A)/(4B)

Comparing output levels

y2

y1 = f1(y2)

YP

YS

YC

45o

Pareto efficient from

firms’ and consumers’

perspective

YM

y2 = f2(y1)

Pareto efficient from

firms’ perspective

y1

Externalities in competition

• Firms produce too much when they

compete

• Where does the inefficiency come from?

– Each firm ignores the effect on the other’s

profit when it expands output

– i.e., there is a negative externality

– Compared to monopoly, oligopoly pushes

result closer to perfectly competitive outcome

Sustaining a cartel

• Beat-any-price clauses

– It sounds very competitive

– ….but maybe each firm is using consumers to

check that other firms are not “cheating”

• VERs – voluntary export restraints in

Japan

– US negotiated with Japan for Japanese firms

to reduce sales in US

– Benefited US car makers

– …..but not US car consumers