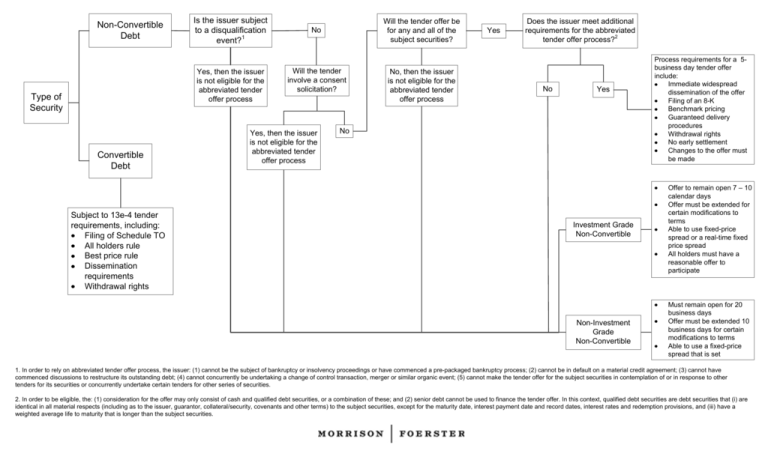

Debt Tenders and Exchanges—A Decision Tree

advertisement

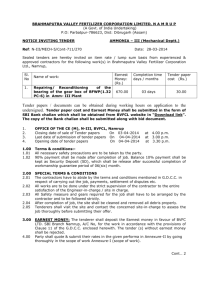

Non-Convertible Debt Is the issuer subject to a disqualification event?1 Yes, then the issuer is not eligible for the abbreviated tender offer process Type of Security Convertible Debt Subject to 13e-4 tender requirements, including: Filing of Schedule TO All holders rule Best price rule Dissemination requirements Withdrawal rights Will the tender offer be for any and all of the subject securities? No Will the tender involve a consent solicitation? Yes, then the issuer is not eligible for the abbreviated tender offer process No, then the issuer is not eligible for the abbreviated tender offer process Yes Does the issuer meet additional requirements for the abbreviated tender offer process?2 No Yes No Process requirements for a 5business day tender offer include: Immediate widespread dissemination of the offer Filing of an 8-K Benchmark pricing Guaranteed delivery procedures Withdrawal rights No early settlement Changes to the offer must be made Investment Grade Non-Convertible Offer to remain open 7 – 10 calendar days Offer must be extended for certain modifications to terms Able to use fixed-price spread or a real-time fixed price spread All holders must have a reasonable offer to participate Non-Investment Grade Non-Convertible Must remain open for 20 business days Offer must be extended 10 business days for certain modifications to terms Able to use a fixed-price spread that is set 1. In order to rely on abbreviated tender offer process, the issuer: (1) cannot be the subject of bankruptcy or insolvency proceedings or have commenced a pre-packaged bankruptcy process; (2) cannot be in default on a material credit agreement; (3) cannot have commenced discussions to restructure its outstanding debt; (4) cannot concurrently be undertaking a change of control transaction, merger or similar organic event; (5) cannot make the tender offer for the subject securities in contemplation of or in response to other tenders for its securities or concurrently undertake certain tenders for other series of securities. 2. In order to be eligible, the: (1) consideration for the offer may only consist of cash and qualified debt securities, or a combination of these; and (2) senior debt cannot be used to finance the tender offer. In this context, qualified debt securities are debt securities that (i) are identical in all material respects (including as to the issuer, guarantor, collateral/security, covenants and other terms) to the subject securities, except for the maturity date, interest payment date and record dates, interest rates and redemption provisions, and (iii) have a weighted average life to maturity that is longer than the subject securities.